The £397m Baronsmead venture capital trusts (VCTs) have launched a fundraising as investors have ploughed more than half a billion pounds into the tax-efficient vehicles, according to Wealth Club.

Seeking £40m in new capital, applications opened today with the potential for a £10m overallotment facility if required. Investors will need a minimum £5,000 to invest in the portfolio, which aims to deliver a dividend of 7% – a policy it has achieved in each of the past five financial years.

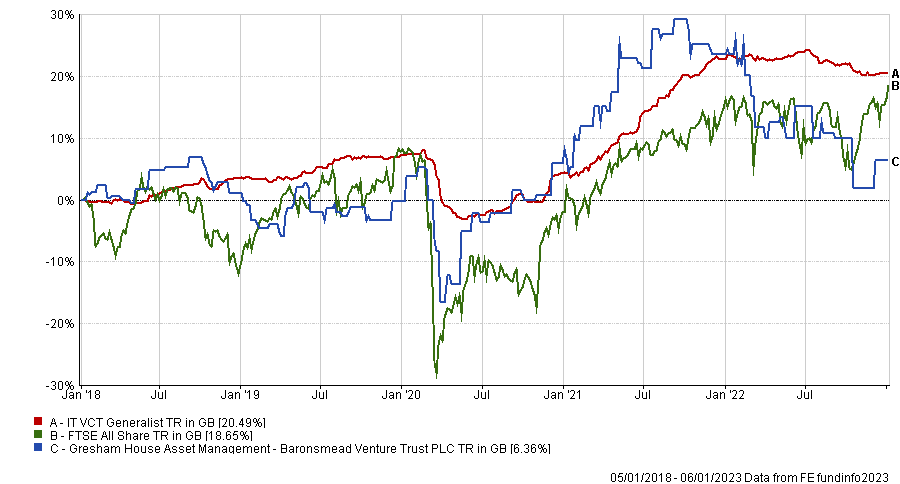

Over this time, the technology-biased trust run by Ken Wotton and his team at Gresham House has returned 6.4%, around a third of the FTSE All Share benchmark index, although investors that bought new share will have benefited from tax savings.

VCTs offer up to 30% income tax relief on the amount invested up to £200,000, which can be offset during the tax year that shares are bought. Any dividends or capital growth on the investment are also tax free.

Total return of trust vs sector and benchmark over 5yrs

Source: FE Analytics

Around 41% is invested AIM-quoted companies and 29% in unquoted companies, with the remaining 30% split across three equity funds: LF Gresham House UK Micro Cap, LF Gresham House Multi Cap Income, and LF Gresham House UK Smaller Companies.

Popular trusts Northern and Unicorn are also expected to launch their fundraisings this month, with Alex Davies, founder of Wealth Club, noting that all three are expected to be popular and sell out quickly as investors look to shield money from the tax man.

“The VCT season is now picking up pace as we head into the busiest final three months of the tax year, it is set to become one of the biggest on record, and may even reach the heights of last tax year”, he said.

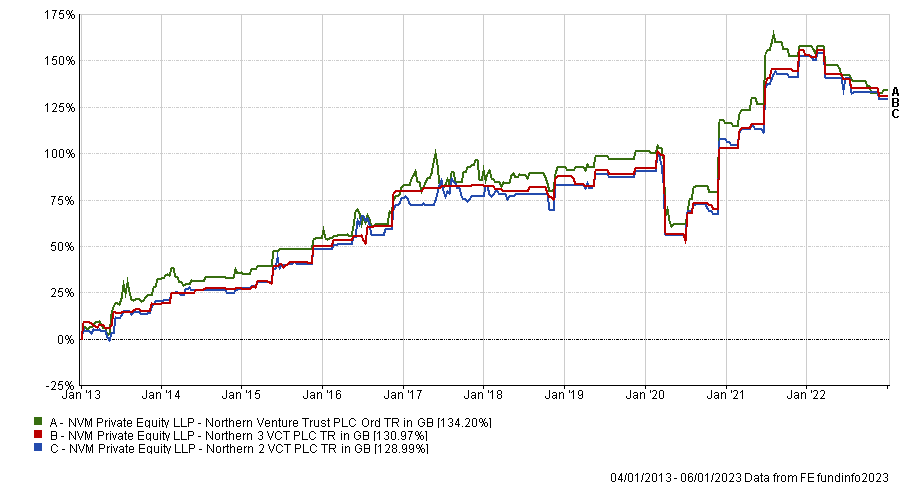

“Northern and Baronsmead VCTs in particular have a legion of loyal investors and their offers are likely to sell out very quickly, but this is unsurprising when you consider how well they have rewarded investors over the years.”

Total return of Northern VCTs over 10yrs

Source: FE Analytics

Applications for the Northern trusts will open this month, although the exact date is yet to be confirmed. The three VCTs will aim to raise £18m, less than half the £40m they achieved last year, which Davies said could mean some investors miss out on the opportunity to buy.

Unicorn VCT meanwhile is to raise £15m this month. The largest VCT focusing solely on AIM companies, the £221m portfolio has been a strong performer over the past decade, as the below chart shows.

Total return of fund vs sector over 10yrs

Source: FE Analytics

Venture capital trusts have become more popular with investors as pensions freezes mean millions of higher earners could breach the upper limit, while a reduction in the dividend allowance in the most recent Autumn Statement means the tax-free nature of the income is also likely to draw more investors in.

“Whilst the economic backdrop has changed dramatically over the past few years, the reasons why investors have been turning to VCTs haven’t,” said Davies.

“But it is not just about the tax relief. Investors are increasingly realising that growth and innovation are not likely to come from the large corporates you find on the main stock market, but rather from young, ambitious, and entrepreneurial start-ups.

“Not all will succeed but there’s now much more support compared to, say, 10 years ago – from incubators and accelerators to public and private funding – so they should have a better chance.”