Investors in Fundsmith Equity need not worry that it is morphing into a tech fund after headlines claiming it is in the midst of a “tech-buying spree”, according to manager Terry Smith.

In his annual letter to the fund’s shareholders, Smith noted media coverage of some recent buys for the portfolio and singled out interactive investor’s November 2022 headline ‘Terry Smith tech-buying spree continues with Apple purchase’.

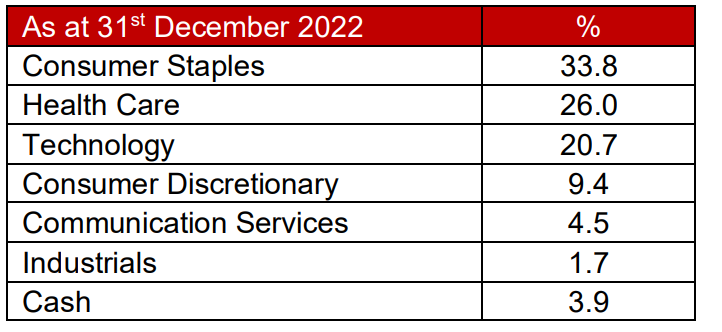

In response, the FE fundinfo Alpha Manager pointed to the sector breakdown of Fundsmith Equity’s £22.8bn portfolio:

Fundsmith Equity portfolio by MSCI sector

Source: Fundsmith /MSCI GICS Categories

He said: “20.7% of the portfolio is defined as technology by MSCI. This compares with 23.2% on 31 December 2014. I can’t see a ‘spree’. I am not that keen on relying upon sector classifications to define a business and you may note that 4.5% is in the communication services sector. As these are Alphabet (the former Google) and Meta, I regard them as technology stocks and Amazon is classified as a consumer discretionary stock, although how this fits Amazon Web Services is difficult to see.”

While this might suggest the fund’s ‘real’ weighting to tech stocks than the stated 20.7%, Smith added that he doesn’t view a number of his stocks that are also in the MSCI Technology index as primarily technology companies.

Instead, he sees them as a firms that use technology to deliver differing services. Examples he gave include ADP (payroll, employee insurance and HR), Amadeus (airline and hotel reservations and operations), Intuit (tax and accounting services), PayPal (payment processing) and Visa (payment processing).

Smith also took issue with the “all or nothing approach” that commentators take when reporting his holdings, as there is often no mention of the size of the position being talked about. However, he conceded this is “hardly surprising” as the fund only discloses its position sizes on a semi-annual basis.

“To put this in context, our combined holdings of Alphabet, Amazon, Apple, Adobe and Meta amount to just 9% of the portfolio, compared to our holding in Microsoft of 7.6%,” he said. “I would therefore suggest that the fund’s exposure to technology is a lot more subtle and nuanced, as well as smaller and more widely spread than the headlines sometimes suggest.”

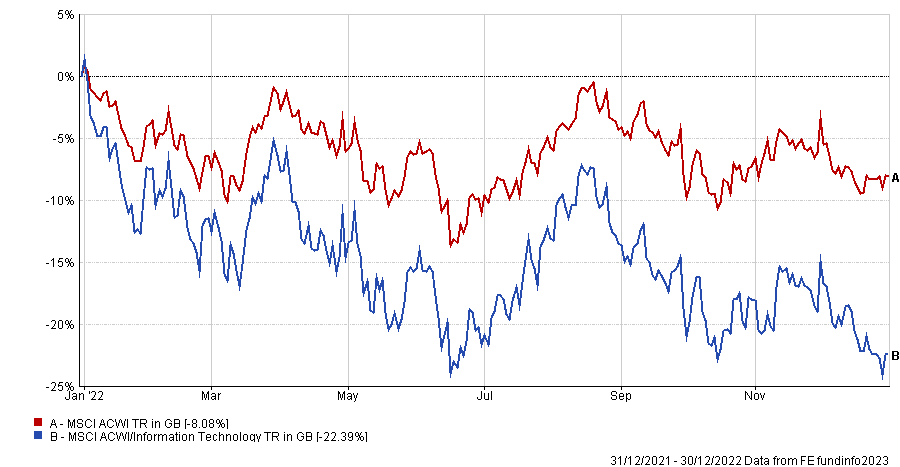

Tech stocks vs global index over 2022

Source: FE Analytics

Tech stocks were one of the worst performing areas of the market in 2022 – as the chart above shows – after rising interest rates soured investor sentiment towards growth stocks and their promise of higher future earnings. Meta, PayPal, Microsoft and Amazon, which are common holdings among tech funds, were among Fundsmith Equity's five biggest detractors in 2022.

Smith highlighted the potential for further problems in the tech space: “As well as the lower valuations caused by higher rates, technology stocks are facing some fundamental headwinds. A slowdown in the growth of tech spending is hardly surprising after the massive growth caused by digitalisation during the pandemic.

“Moreover, the cyclicality of tech spending and online advertising is probably about to become evident as the economy slows and maybe falls into recession. It may be greater than in the past simply because tech spending has become a much larger proportion of overall corporate and personal spending.”

However, the manager argued that there could be a silver lining to all this, if this pressure on revenue growth causes tech companies to “stop behaving as though money is free” and scrap some of the less promising projects outside their core business.

Amazon has already withdrawn from food delivery and technical education in India, Smith noted. “It has a highly successful ecommerce and cloud computing business on which to focus,” he added.

Among the other companies owned by Fundsmith Equity, the manager said Alphabet could stop its “hugely loss-making” other bets programme (start-up investments in potential moonshots) and focus on its core online search and advertising business while Meta could reduce its spend on the metaverse and continue to be a leading communications and digital advertising platform.