Choosing between the best and worst performing funds is becoming increasingly difficult, according to Kelly Prior, multi-manager at Columbia Threadneedle, as the correlation between different funds’ returns widened significantly last year, even within the best performing sectors.

This puts more pressure on investors to pick the right portfolio, as selecting the wrong fund could have a sizable impact on returns.

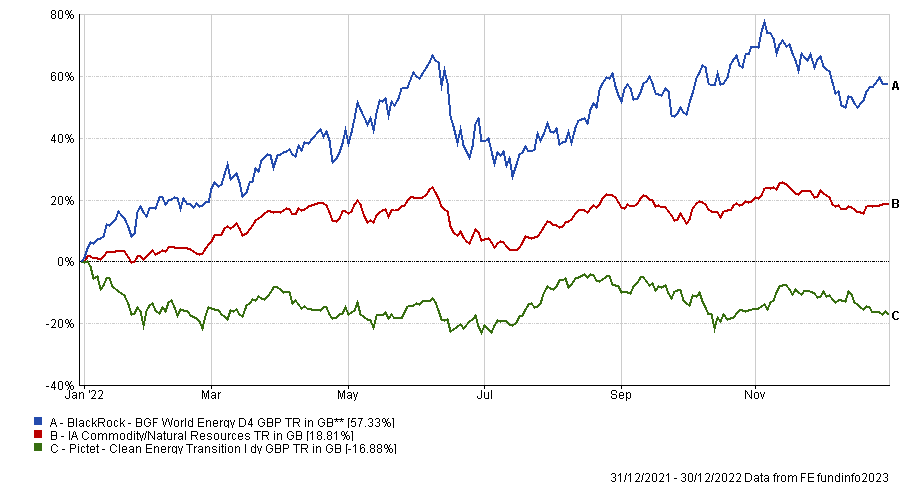

For example, the IA Commodities/Natural Resources sector was the best performing group in the Investment Association (IA) universe last year. The average fund in the sector made a total return of 18.8%, but the performance of individuals within this varied massively.

The BlackRock BGF World Energy was the best active fund, up 57.3%, but those invested in the Pictet Clean Energy Transition fund would have been down 16.9%.

Total return of funds vs sector in 2022

Source: FE Analytics

Prior anticipates this trend of widening fund returns to continue moving forward, noting that selecting a good manager could be the key to avoiding losses.

She said: “In this new era, we think it's going to matter an awful lot in terms of the skill of individual managers and how they operate within this market.”

Looking at how a manager’s portfolios have performed historically is a good indicator of their skill, but track records might not be enough in future, according to Prior.

Instead, investors should consider each manager’s strategy to work out whether they have been disciplined in maintaining that style.

Prior said: “We don't need a fund to have consistently been top quartile – what we want to do is find the best investor in any one style of investing.”

In the above example, comparing the two funds is fruitless. Instead, investors would need to evaluate the BlackRock fund against other energy funds, while the Pictet portfolio would be best compared with other renewable specialists.

Once an investor has evaluated a manager’s style, they can then consider how they expect that strategy to perform in the current environment and how it would work alongside the other funds in their portfolio.

Prior added: “A couple of decades ago you had more generalist managers, whereas now you see more defined styles of investing, I guess because the markets has become more defined in terms of capital structures.

“We certainly don't box people into styles necessarily, but it's about appreciating what a manager is trying to achieve and their ability on the basis of how they're actually managing their money to achieve that.”

Deciding between these contrasting styles could become increasing difficult as the market becomes more diluted by new fund launches, however, with more than 280 new funds entering the market last year along. Prior said this was “not what I would have expected to see” given the general decline in markets over the year.

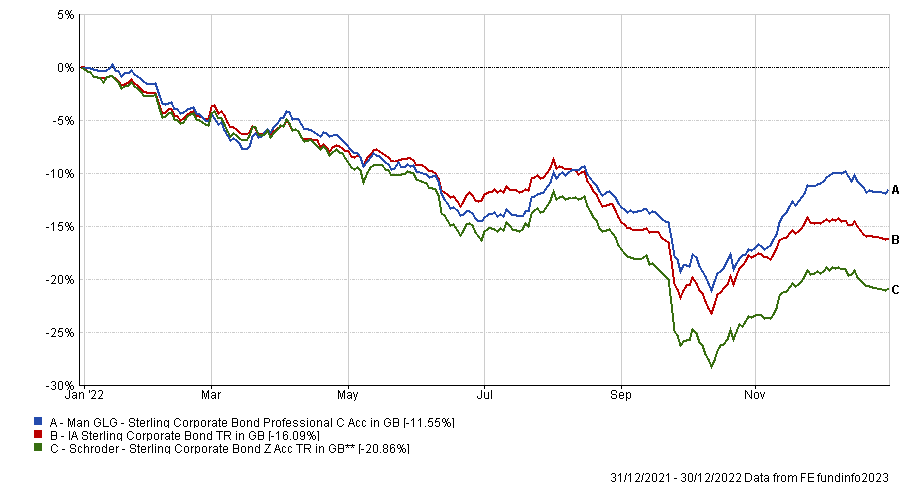

The importance of individual managers became apparent in the case of the Schroder Sterling Corporate Bond fund last year.

Prior pointed out that there has been a downgrade in performance since former manager, Jonathan Golan left the fund in 2021.

After topping the IA Corporate Bond sector over the past decade, it sunk to the bottom quartile in 2022 as returns dropped 20.9%.

However, Golan’s new fund with the same strategy – Man GLG Sterling Corporate Bond – made a shallower loss of 11.6% in 2022 and beat the sector average by 4.5 percentage points.

Total return of funds vs sector in 2022

Source: FE Analytics

The corporate bond space is an area where skilful management could be particularly important moving forward, with the approaching recession increasing the likelihood of defaults significantly.

This became noticeable last year when active funds greatly outperformed their passive counterparts in many fixed income sectors.

Prior said: “In the past, you've not been paid for differentiating between the good and the bad companies. It's now very much about the individual managers who are looking under the bonnet, finding the right debt and lending to the right companies – that's what's going to really matter now.”