Alternatives may be a bigger consideration for investors this year after traditional bond and equity portfolios failed in 2022, with both asset classes making losses on average.

It means that asset classes such as private equity, infrastructure and property that can hold up may attract more attention from investors.

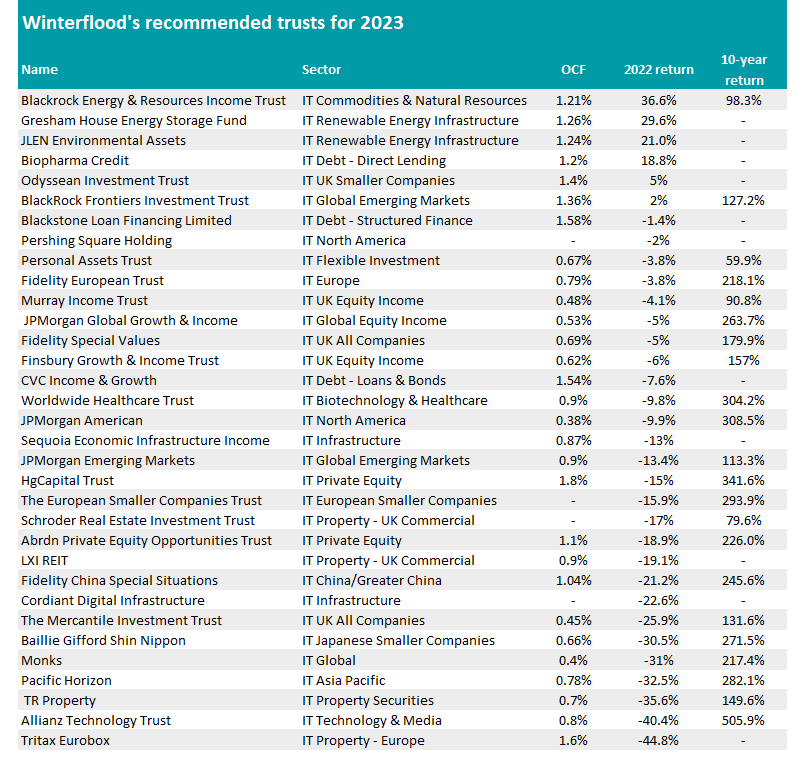

In its latest recommendations list, investment company specialist research firm Winterflood now recommends 10 alternative trusts, around a third of the 33 names suggested.

Overall, the firm dropped 18 trusts from its recommended list amid the volatility of 2022, adding 15 new names that it expects to outperform in the year ahead. Last week we looked at equity trusts.

Source: Winterflood

Private equity

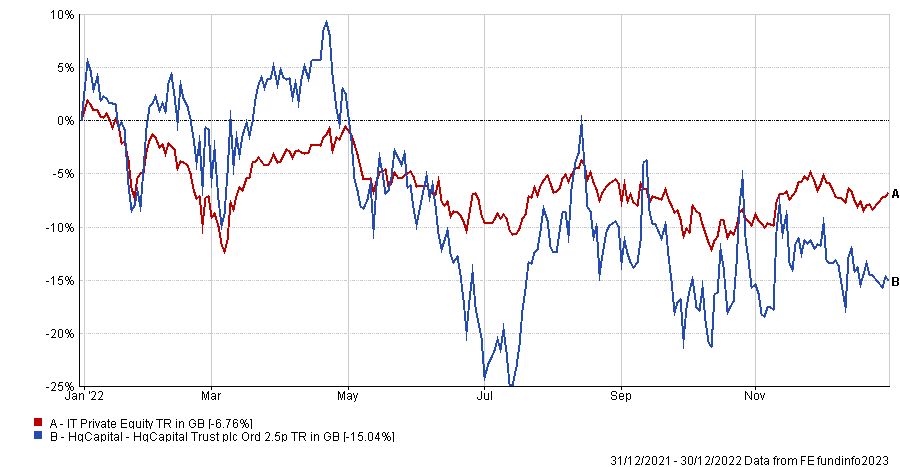

Winterflood added the HgCapital* trust to its recommended list this year, with its portfolio consisting mostly of “mid-market technology businesses with recurring revenues and high margins,” according to the report.

The analysts said defensive companies within the portfolio could provide some shelter from market volatility in 2023, although last year the £1.6bn portfolio slumped 15%.

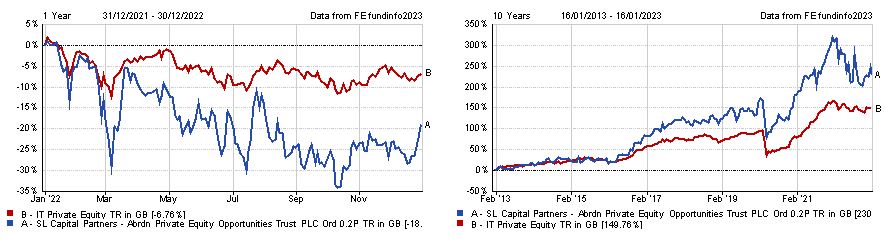

Total return of trust vs sector in 2022

Source: FE Analytics

“Faced with the prospect of geopolitical instability, economic uncertainty and market volatility, we think that the ‘boring’ companies in the HgCapital portfolio have attractive defensive characteristics,” the report said, adding that its current discount of 19% is “excessive”.

Winterflood also maintained its endorsement of the abrdn Private Equity Opportunities Trust for another year. The £658m portfolio has made 230% over the past decade, with the analysts crediting this outperformance to its thorough investment process.

They said: “In our opinion, this [investment process] has led to the construction of a high-quality private equity investment portfolio, which has produced a strong long-term track record.”

It may have outperformed over the long term but returns sank 18.9% last year. The report noted that this decline was extreme and did not accurately reflect the fund’s resilience.

Total return of trust vs sector in 2022 and over the past decade

Source: FE Analytics

“We believe that the share price reaction is excessively negative, and consistent realisations at a premium to carrying value would seem to indicate that the market is undervaluing private European exposure,” it said.

The report also included the removal of NB Private Equity and ICG Enterprise Trust from the recommended list, both of which fell less last year than the two portfolios currently on the list. ICG Enterprise Trust was down 4.4% while NB Private Equity dipped 9.7%.

Infrastructure and renewable energy

The report was positive on infrastructure and renewable energy trusts this year, retaining all previous names and adding an additional two.

Sequoia Economic Infrastructure Income and Gresham House Energy Storage joined the recommended list for 2023, with both trusts set to benefit from rising energy prices and the long-term transition to net-zero.

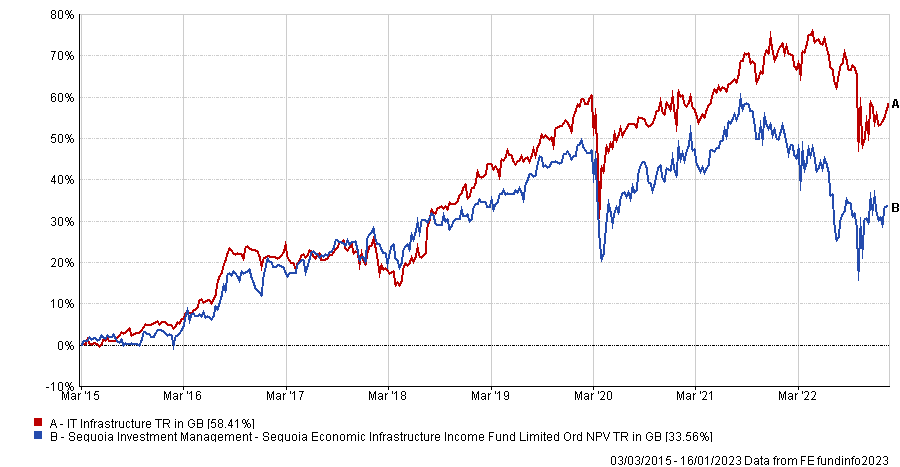

Analysts at Winterflood said that Sequoia Economic Infrastructure Income has defensive characteristics backed up by an historically low loss rate that should protect it from volatility this year.

“It is an attractive, liquid vehicle that is well-placed to capture short-term rate rises and navigate a potentially turbulent 2023,” they said.

However, the trust underperformed the IT Infrastructure sector by 24.9 percentage points over the past decade, climbing 33.6% compared to the peer group’s 58.4%.

Total return of trust vs sector over the past decade

Source: FE Analytics

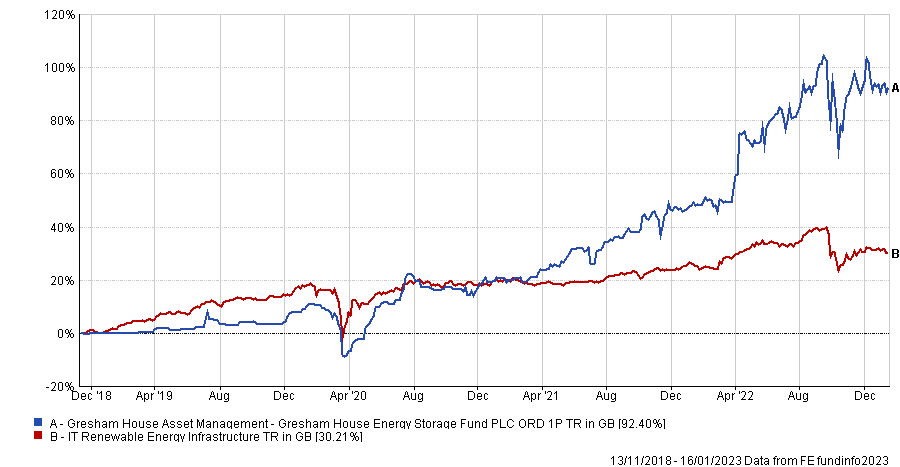

Alternatively, the Gresham House Energy Storage trust soared 92.4% since launching in 2018, beating the IT Renewable Energy Infrastructure sector by 62.2 percentage points.

Winterflood analysts said that it offers investors diversification from the usual allocations seen in renewable trusts, with exposure to areas such as batteries opening up different revenue streams.

They expect continued outperformance this year, stating: “The asset class also has the benefit of not falling under the UK Electricity Generation Levy, enabling it to better capture short-term power prices.”

Total return of trust vs sector since launch

Source: FE Analytics

JLEN Environmental Assets kept its place on this list after climbing 21% in 2022, with analysts commenting that its diversified portfolio should “deliver less volatile long-term returns compared to a single technology portfolio”.

Cordiant Digital Infrastructure also stayed on the list for another year running, although returns sunk 22.6% over the course of last year.

Property

Winterflood’s recommendations for Balanced Commercial Property Trust, Warehouse REIT and Impact Healthcare REIT were swapped for three new names.

Impact Healthcare REIT continues to be the highest-rated property investment by the wider market, but analysts at Winterflood said that they “saw better value opportunities elsewhere”.

Instead, Schroder Real Estate Investment Trust, LXi REIT and Tritax EuroBox took favour as their best options for investors looking for exposure to property.

The analysts said that the Schroder Real Estate Investment Trust is trading at a particularly attractive price at present, with its discount reaching 36.5%.

It has the widest discount in the IT Property UK Commercial sector, but the report said that its long-term track record and robust dividend growth is a positive sign for future performance.

It said: “In contrast to a number of its peers, it has gradually rebuilt its dividend following a suspension and cut in response to the outbreak of Covid-19 in early 2020, with the latest quarterly dividend now 4% above the pre-pandemic rate and fully covered by earnings.”

Likewise, analysts said that LXi REIT’s tactical capital allocation could be a good option for investors seeking inflation-linked income in the current environment.

“The disposal of assets at material uplifts and recycling capital into better growth opportunities has been successful and we expect this to remain the case,” they said.

“The use of forward funding transactions is also a positive element of the investment strategy, in our opinion, as it has led to valuation uplifts and yield advantages.”

Lastly, the report said that Tritax Eurobox’s 44.8% decline last year leaves it “materially derated,” while it still presents good exposure to long-term growth trends.

*HgCapital Trust is an investor in FE fundinfo.