Finding funds that can consistently beat their peers is no easy feat, but it got slightly easier in the fourth quarter of 2023, according to the latest fundwatch survey by the Columbia Threadneedle Investments' multi-manager team.

The quarterly report found that a strong end to the year meant the number of funds able to boast top-quartile performance in each of the past three years ticked higher from the all-time low at the end of the third quarter

In the final quarter of 2022, 44 of the 57 Investment Association sectors made positive ground, with the US and dollar-linked assets accounting for the vast majority of the sectors that were down in the final quarter.

All UK equity sectors improved from the lows of third quarter, while bonds were also much healthier. However, there were still only six out of the 1,219 funds (0.5%) that achieved top-quartile returns over each of the three discrete years to the end of the fourth quarter of 2022, a stark fall from the 31 that managed a year ago.

When the consistency bar was reduced to above-median in each of the last three 12-month periods, there was an uptick to 82 (6.73% of the universe), compared to 60 funds (5.1%) in the previous quarter.

The most consistent sector on this measure was the IA UK Smaller Companies sector with 15.2% of funds performing above the median for three consecutive years, followed by the IA Sterling Strategic Bond sector with 11.1% of funds. The IA Europe ex UK sector was the least consistent with 4.4% making the grade.

Kelly Prior, investment manager in the multi-manager people team at Columbia Threadneedle Investments, said: “Unsurprisingly, consistency remains elusive in the rolling three-year periods to the end of 2022 as we move from low inflation, low interest rate world to something a little less familiar in the investment universe.

“With the Federal Reserve now closer to the end of its tightening cycle while the Bank of Japan is potentially just getting started, the fortunes of the relative currencies against sterling, which is sitting somewhere in the middle, is stark.

“Often seen as the release valve when economies come under pressure, it is lining up to be an interesting 12 months for the world major currencies as the central banks of the world enact their quantitative tightening plans at different points to reflect the various drivers of inflation and how to combat them.”

The super six

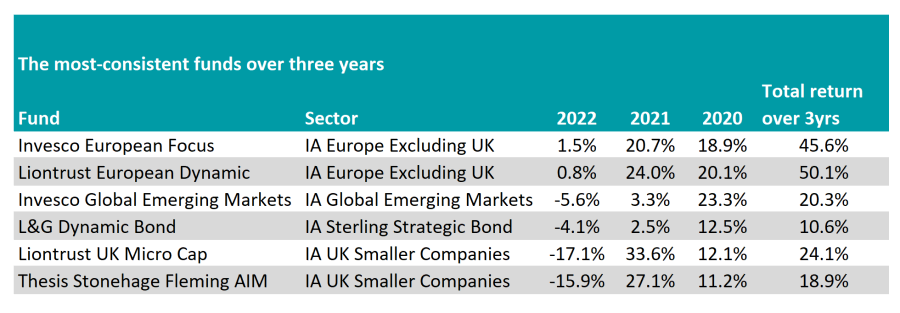

The six funds achieving top-quartile performance in this quarter were from four different IA sectors. On the continent, Liontrust European Dynamic and Invesco European Focus (both in the IA Europe Excluding UK sector) achieved the feat.

The former is a £652m portfolio managed by James Inglis-Jones and Samantha Gleave while the latter is a £39m fund run by John Surplice and James Rutland.

They are third and fourth in their sector respectively over the entire period in question and were in the top 20 in each of the three calendar years.

Another sector with two entrants is the IA UK Smaller Companies. Despite making double-digit losses in 2022, both the Liontrust UK Micro Cap and Thesis Stonehage Fleming AIM funds made the top quartile of the sector.

The £168m Liontrust fund is the small-cap fund run by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh's team, which focuses on companies with an economic advantage such as intellectual property. The latter is managed by industry veteran Paul Mumford and Nick Burchett, focusing solely on the AIM market.

Over three years, the Liontrust fund was slightly ahead, finishing 2022 as the third-best performer in the sector over the period, while the Stonehage Fleming portfolio was seventh.

Source: FE Analytics

Elsewhere, Invesco Global Emerging Markets was the only IA Global Emerging Markets fund to achieve the feat of consistent returns in 2022, 2021 and 2020 as well as a top-quartile return in three years overall. The 23.6% return achieved by managers Ian Hargreaves, William Lam and Charles Bond was good enough for eighth in the sector over this time.

Meanwhile, the only bond fund on the list was Colin Reedie's and Matthew Rees’ L&G Dynamic Bond, which sits in the IA Sterling Strategic Bond sector. It’s 12.7% return over three years was the third highest among its peers, despite a 4.1% fall last year.

None of the funds listed were the best in any given year, while only Liontrust UK Micro Cap (second in 2021) and Thesis Stonehage Fleming AIM (fifth in 2022) ranked in the top five of their sector in a calendar year.