Eastern European stocks and bonds have been penalised in latest years, but the region has been a success story since the early 2000s and the recent repricing has brought even more opportunities to the surface, according to experts.

Valuations in eastern Europe were seriously impacted by the Russian attack on Ukraine and the subsequent collapse of Russian equities.

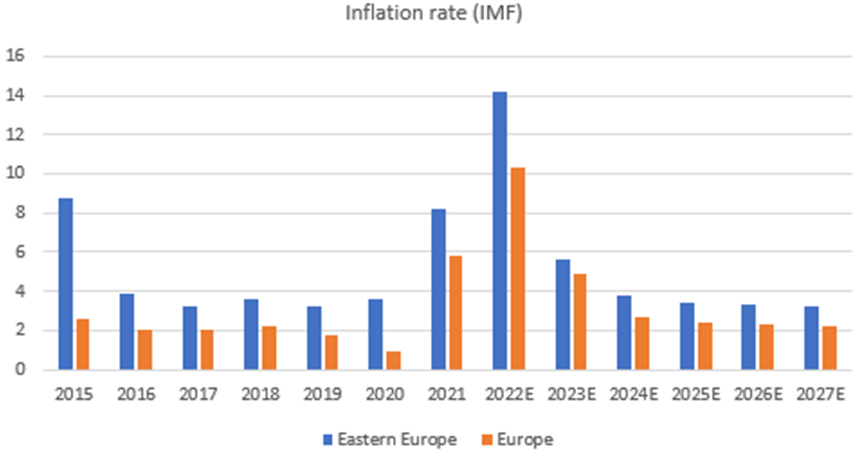

Sanctions against Russia, the interruption of major Black Sea trade routes and the cessation of Russian gas supplies to Europe caused inflation to rise, but eastern Europe has been impacted much more than the rest of the world (as shown in the graph below) due to the dependency on Russian oil and energy imports.

Inflation rate in Europe and Eastern Europe

Source: Utilico Emerging Markets, IMF

However, the region has proven resilient and investors are starting to find value in the market, as valuations have decreased excessively.

Charles Jillings, manager of the Utilico Emerging Markets trust, noted how Russia’s expulsion from the MSCI indices in March led to a disproportionate reduction of the overall ‘emerging Europe’ presence in the wider MSCI EM index.

“The region went from 5.2% to just 2%, which severely misrepresents its real economic weight within the emerging and frontier markets space and is attributable to eastern Europe’s smaller, fragmented capital markets that tend to have lower liquidity,” he said.

“But we have seen strong recovery across most central and eastern European markets since then, and current valuations, near 10-year lows, appear attractive.”

The manager currently invests 11.7% of his £446m emerging markets portfolio in Europe. Polish logistics company InPost is among his top 25 holdings.

Jillings expects future growth in eastern Europe to be spurred even further by the European Union’s €2trn budget, of which eastern European member states are typically big net beneficiaries.

Some 30% of the budget will be spent on climate-related projects that will assist the green transition in countries such as Poland, Hungary and Bulgaria and this includes a “just transition mechanism” which aims to provide financial and technical support to the regions most affected by the move towards a low-carbon economy, he explained.

In a similar way, another 20% of the budget is destined to digitalisation projects and a specific quota is allocated to Europe’s less developed regions.

“The EU budget will be an important structural driver for the central and eastern European economies for the next five years and provide a certain level of support in the current environment.”

The region also presents advantages if considered in historical perspective, continued Jillings, who highlighted the average real GDP growth of 3.4% per year as one of the main success stories. Added to this is the fact that some countries are overcoming of the middle-income trap, an economic development situation in which a country that attained a certain income gets stuck at that level.

“Since the year 2000, not only has eastern Europe far outpaced developed economies for its GDP growth, but also most of the developing world,” said the manager.

“And even more impressively, nine countries from the region attained the ‘high income’ status as per the World Bank’s classification over the same period. This is a notoriously difficult challenge for any middle-income country and its achievement sets the region apart from all others.”

Joseph Mouawad, manager of the Carmignac Portfolio EM Debt, also highlighted the region’s bonds as a place of interest.

“Within emerging market debt, Eastern Europe is an attractive opportunity,” he said. “Much of the region was punished too harshly by Russia’s invasion of Ukraine and some countries look better positioned than what their bonds might imply. Hungary, for example,” he said

“Looking forward, the pressure on the energy and gas markets is easing as Europe adapts to the shock. Moreover, with China reopening and stimulating its economy, European manufacturing and eastern Europe specifically will be in a favourable position given the trade links between Europe and China.”