For equity investors worried about the prospect of a recession at any point in the past 20 years, there has always been the option to switch their money into quality-growth stocks.

The steady cashflows produced by these companies helped cushion any falls when the market crashed and while they haven’t shot the lights out when the market has rallied, the effect of compounding meant they could be relied upon to deliver respectable returns over the long term.

However, as inflation and interest rates surged last year, Richard de Lisle of the VT De Lisle America fund warned that the high valuations left quality-growth stocks vulnerable to a re-rating, regardless of the quality of the underlying business.

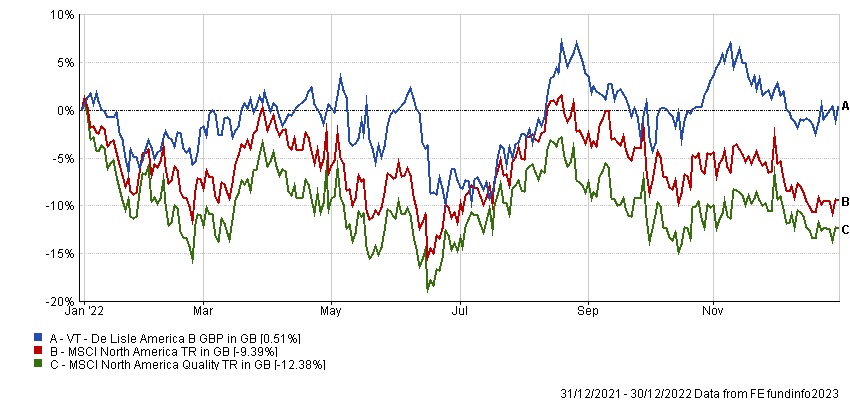

So was he right? The data suggests so, with the MSCI North America Quality index – made up of companies with a high return on equity (ROE), stable year-over-year earnings growth and low financial leverage – down 12.4% last year, compared with 9.4% from the broader index.

Performance of fund vs indices in 2022

Source: FE Analytics

VT De Lisle America eked out a small return of 0.5%, even though it had a high exposure to more economically sensitive areas such as consumer durables, housing and banks, which would usually be expected to fall further than the market in a correction.

“All these things make people really scared,” said de Lisle. “But we’re overweight because I've never seen them so cheap. I don't care if they're going to have this slowdown: if a stock's on 3x earnings, it only has to hold out for a certain amount of time, then produces so much cash that it pays off all its debt and it's all so marvellous.

“Then with the idea that there may not be a recession after all, these things have taken off strongly.”

De Lisle said that one of the reasons why quality growth did so badly last year was that many of the tech giants that were assumed to be in this category have turned out to be cyclicals – as demonstrated by the tens of thousands of redundancies they have been forced to make.

While these sailed relatively unscathed through the initial recession caused by the pandemic, this slowdown is more typical in terms of monetary tightening, while the spike in uptake of online services caused by lockdowns has also been removed.

But the manager said the main issue is valuations. Towards the start of last year, he cited Adobe as an example of a company with “fantastic fundamentals”, having increased earnings at an average annualised rate of 19% over a decade. Many fund managers said these figures would protect it in an environment of rising inflation and interest rates, and by that point it had already fallen from $700 a share down to $500.

“It’s all priced in, right? Nope, it’s still on 50x trailing P/E and in the 1980s you could get a 19% grower for 20x trailing,” said de Lisle at the time.

“Sounds like a lot more P/E multiple falling still to be done for the next few years – 19% a year is an earnings double every four years, so in four years’ time, Adobe could be at the same price but on a trailing P/E of 25x if it can keep the good times rolling on.” Adobe is now trading at $364, having troughed at $279.3 last year.

One area typically associated with quality growth that did protect investors last year was consumer staples – the S&P 500 index for this sub-sector rose 11%.

Performance of indices since start of 2022

Source: FE Analytics

De Lisle said that while these stocks were bid up in 2022 on recession fears, they quickly sold off when JPMorgan Chase & Co released a report this January saying the odds of a downturn had fallen sharply. The S&P 500 Consumer Staples index is down 8.5% since the end of November.

“The people that have got hurt this year are the people that went to hide from the recession and paid up too much,” he added. “We didn't want to play that game.”

While de Lisle’s strategy seems to be tailor-made for the current environment, inflation is now falling as fast as it rose. So how will his fund hold up if we return to the post-financial crisis environment of ultra-low interest rates? When asked this question, he said he thought such a scenario was unlikely.

“What's driving everything is the reverse of the forces that have driven the world over the past 40 years: increasing globalisation,” he said.

“The way you can defeat that argument is to say there are some short-term problems with supply chains and we're not getting along with everyone else, but the increase in productivity that's going to come through from technology is going to overwhelm that.

“Well, we've been hearing that forever and it hasn't so far – productivity gains in the past decade have been stubbornly low. You have to keep an open mind about all that and I don't want to be too dogmatic, but I don't think it will happen.”

He added: “When people want to get into a debate about this, I always say the greatest period for inflation coming down was the 1970s – twice it declined at a huge rate, only to rebuild later on. So it's quite reasonable that you can have inflation swooping down, I just don't think it'll stay down forever.”