Investors can pick between eight investment trusts with a track record of raising annual dividend for at least half a century, but owning all of these ‘dividend heroes’ may not be the best investment strategy as half invest in the IT Global sector while two are in IT UK Equity Income.

Investors can find worthy investment trusts beyond the dividend heroes but having more than 50 years of dividend growth is a commendable feat that shows longevity – something that many investors covet. Below, fund pickers choose which of these eight investment trusts they would buy.

The Bankers Investment Trust

In the IT Global equity sector, Shavar Halberstadt, equity research analyst at Winterflood, picked the Bankers Investment Trust. He said this is because this trust is large, liquid, well diversified and investing across geographies.

While its dividend performance has been strong, returns have been mixed. It has been in the bottom half of the IT Global sector over 10 years, returning 141.5%. However, this is above the sector average 116.8%.

Last year the trust was middle of the pack, but the portfolio could be in for a rebound, according to Halberstadt.

He said: “Factors that negatively impacted 2022 performance have (partially) reversed post year-end (dollar strength, oil revenue, China weakness).

“Moderate gearing is utilised, and average borrowing costs are set to fall through the repayment of a high-yield debenture. The fund also runs an active share buyback program, repurchasing 1.5% of share capital over 2022.”

Bankers invests on a worldwide basis with the aim of achieving capital growth in excess of the FTSE World Index and dividend growth above the UK Consumer Price Index inflation.

The City of London Investment Trust

Turning to the UK, the £2bn City of London is the largest of the two ‘dividend hero’ trusts in the IT UK equity Income sector.

Pascal Dowling, partner at Kepler Trust Intelligence said: “The trust’s high and growing dividend has led to it often trading on a premium, allowing the board to issue shares and the trust to grow.

“This has led to a virtuous circle forming in which fees fall as the trust grows, and it is already the cheapest trust in the IT UK Equity Income sector.”

The City of London trust aims to deliver long-term growth in income and capital through investment in equities listed on the London Stock Exchange such as British American Tobacco, Shell and Diageo.

It was launched in July 1964 and Job Curtis has managed it since July 1991. Like Bankers, the trust’s performance has been spotty. It was one of the worst portfolios in 2019 and 2021 when markets rallied, but came into its own last year, up 9.4% when the average peer lost 4.3%. Over 10 years it has beaten the average peer, up 84.5% versus 76.2% for its rivals.

Dowling added: “Job Curtis’s long experience in the markets has helped him deliver positive stock selection in eight of the past 10 years. Meanwhile the judicious use of gearing has also contributed to returns.

“We continue to take the view that its unique package of characteristics makes the trust an attractive proposition for long-term investors seeking income and capital growth.”

The Global Smaller Companies Trust

Darius McDermott, managing director of Chelsea Financial Services, was keen on the City of London Investment Trust, but also highlighted the Global Smaller Companies Trust as another worth buying.

He said: “Small-caps are always in the eye of the storm, and while the UK is particularly attractive for this part of the market, they are also extremely attractive on a global scale.

“But with recession looking increasingly likely, it is important to remember this part of the market has not only been hit hard already, but history shows us small and mid-caps often lead markets out of recession as well. I would add that the dividend yield is lower at 1.2%.”

Managed by Peter Ewins since 2005, the trust has been a boom or bust proposition. Recent performance has been stellar, with the trust making the smallest loss in the IT Global Smaller Companies sector (15.6%), having made a 20.9% in 2021 – the second among its five peers.

However, it was the worst performer in 2018, 2019 and 2020 and its 10-year returns are the worst among its four peers with a long enough track record at 105.7%.

However, it was the worst performer in 2018, 2019 and 2020 and its 10-year returns are the worst among its four peers with a long enough track record at 105.7%.

F&C Investment Trust Plc

Not all agreed with McDermott, however, and Doug Brodie, chief executive of Chancery Lane, said he would sell the global small-cap trust above in favour of the world’s oldest investment trust: F&C.

He was high on the trust due to its history and track-record in delivering dividends, adding that “everyone should have it in their SIPP (self-invested personal pension).

Brodie said: “The average age of our clients is 62, so all the work that we do is income based, which means we only operate with companies that have a very strong cash flow, because there's no chance of them running out of money.”

F&C Investment Trust fits the bill. It started in 1868 under the name “Foreign & Colonial Investment Trust” and was the first collective investment scheme in history.

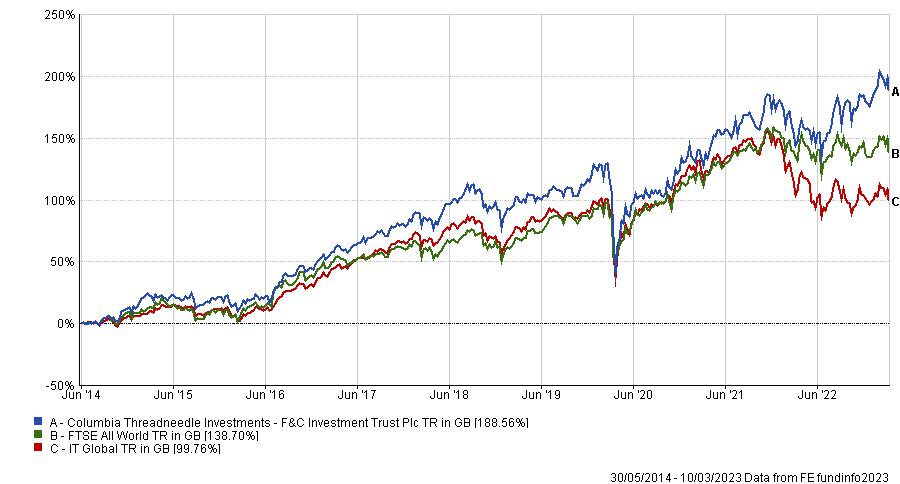

Since Paul Niven started managing F&C in June 2014, the trust has always been able to beat the IT global equity sector.

It aims to deliver long-term growth in capital and income through international investments in public equity as well as securities and private equity and returns have been strong.

Indeed, the trust has been in the top quartile of the IT Global sector over one, three, five and 10 years, with it topping the peer group over three years.