Investors in the most prominent forms of renewable energy don’t have to worry about disruption from new technology such as nuclear fusion, according to Dale Robertson, manager of the MI Chelverton European Select fund.

However, he warned that the industry faces a more potent long-term threat that could prevent it from growing at its current rate.

Researchers at the US National Ignition Facility in California recently announced that nuclear fusion experiments had, for the first time, released more energy than they took to power.

This is significant as nuclear fusion is the most efficient method of producing energy and also among the cleanest, emitting no greenhouse gases.

While even the most enthusiastic champions of this technology would agree that it is a long way from commercialisation, long-term investors may be concerned that the renewable energy sector could be disrupted in the same way it is currently disrupting oil & gas.

However, Robertson dismissed these concerns.

“I share the hope [in nuclear fusion] for all of us and our children’s future,” he said. “But it’s way beyond practical for an investment time horizon.

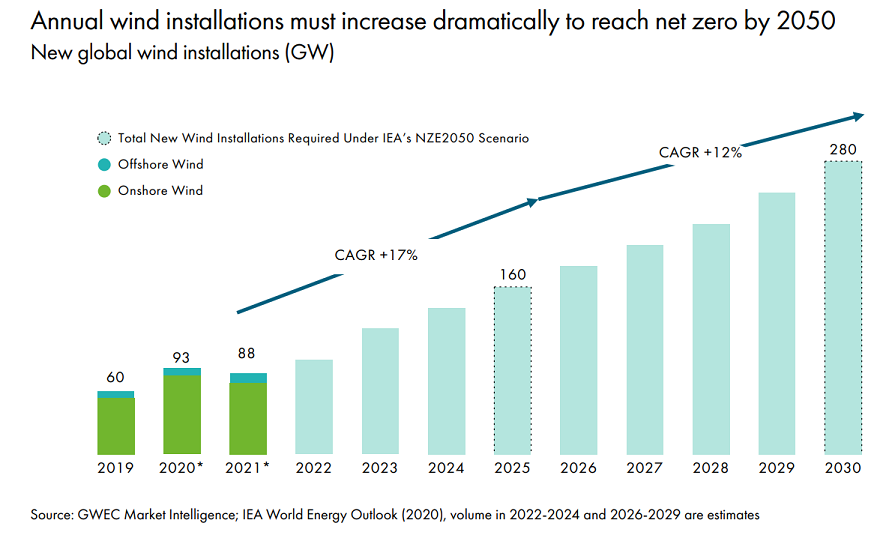

“If we're to meet net zero, there has to be 16 or 17 times the number of wind farms over the coming decades, and you could argue that what's happened in that industry over the past 20 years has only now got it to the point where it's ready for proper commercialisation.

“Most investors describe themselves as long term, but that's too long to make it practical.”

He added that, as investors, it is important not to get distracted by what is exciting at the expense of what is profitable, pointing out that many other renewable technologies that have been around for several years such as carbon capture and hydrogen fuel-cell technology are still a long way from profitability.

Gareth Rudd, who co-manages MI Chelverton European Select along with Robertson, said a recent meeting with a chief executive of a lithium battery maker – a company that is not a portfolio holding – underlined the danger of chasing the next big thing.

“For about a decade, the company’s been really good at finding innovative ideas and then making absolutely no money out of them,” he said.

“When I asked the chief executive if the founder still sits on the board, he said: ‘Yeah, but thank goodness he doesn't run the company anymore. Because if he did, he’d put all the money we get from lithium technology into fuel cells and we wouldn’t make any money out of that for another 10 years.

“And by the time we did, he’d move the company on to something else and we wouldn't make any money from that either.’”

However, while the managers aren’t concerned about nuclear fusion disrupting modern-day renewables, there is one threat to the sector they are worried about: China.

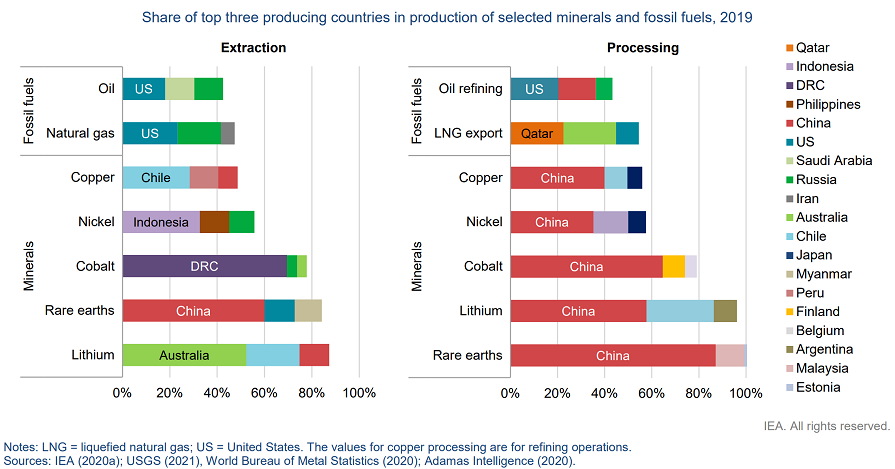

In a 2022 paper titled The Role of Critical Minerals in Clean Energy Transitions, the International Energy Agency said that the Democratic Republic of the Congo (DRC) and China were responsible for some 70% and 60% of the global production of cobalt and rare earth elements respectively in 2019.

“The level of concentration is even higher for processing operations, where China has a strong presence across the board. China’s share of refining is around 35% for nickel, 50% to 70% for lithium and cobalt, and nearly 90% for rare earth elements.

“High levels of concentration, compounded by complex supply chains, increase the risks that could arise from physical disruption, trade restrictions or other developments in major producing countries.”

Sally Clifton, head of responsible investing at Chelverton, said: “I think everyone sees that as a big problem in the future.

“China currently dominates everything from the supply of strategic minerals like lithium and copper, to the manufactured components like batteries and turbine blades.

“Resource nationalism is a real concern. We're already seeing some parts of the world corralling assets for themselves. In terms of the global effort, I think that the US and Europe took their eye off the ball for too long.”

However, Rudd said that this doesn’t just present obstacles for investors.

“Our response is to look at nearshoring,” he added. “We own AMG, which is a Dutch company that owns lithium mines in Brazil, and Boliden a Swedish company that owns copper mines in Europe.

“The big picture for all of us is of concern. I get that. But as a stockpicker, there are a lot of ways to take advantage of this.”