Investors are often told that taking more risks will lead to higher returns, but they can pick up some of the best results without putting their savings in peril.

While much of the past decade has been relatively smooth sailing for investors, last year they were reminded that things can change quickly.

Nowhere was this more apparent than in Europe, which experienced high inflation and a central bank pivot as well as war to the east with Russia invading Ukraine.

It may be a wake-up call for investors who had become complacent that markets were relatively smooth and always on the up, which was the case for much of the decade after the financial crisis.

In this study, therefore, Trustnet looks at the funds that delivered top-quartile returns over the past decade for the lowest volatility and maximum drawdowns in the sector.

These low-risk portfolios were also up in the greatest number of months, meaning investors enjoyed a generally positive experience whilst they made some of the best total returns of their peers.

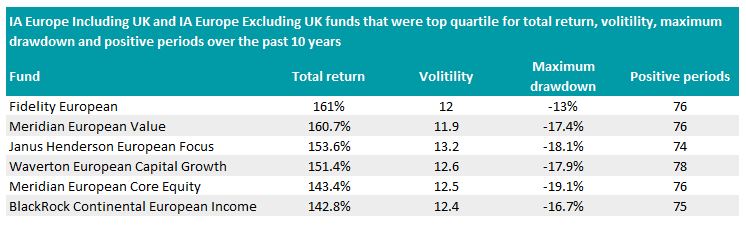

Only six actively managed funds made the list, as the below table shows.

Source: FE Analytics

The highest returner on the list was Fidelity European, which climbed 161% over the past decade, beating the rest of the IA Europe ex UK sector by 38.3 percentage points.

FE fundinfo Alpha manager Samuel Morse has run the fund since 2009 and was joined by deputy manager Marcel Stotzel in 2020.

Analysts at Square Mile Research said Morse was a “safe pair of hands” when it came to stock picking, having constructed a portfolio of 44 holdings that have remained steady over the course of the past decade.

It has the lowest maximum drawdown on the list, dropping 13% at its worst point over the period compared to the peer group’s 23.5% average.

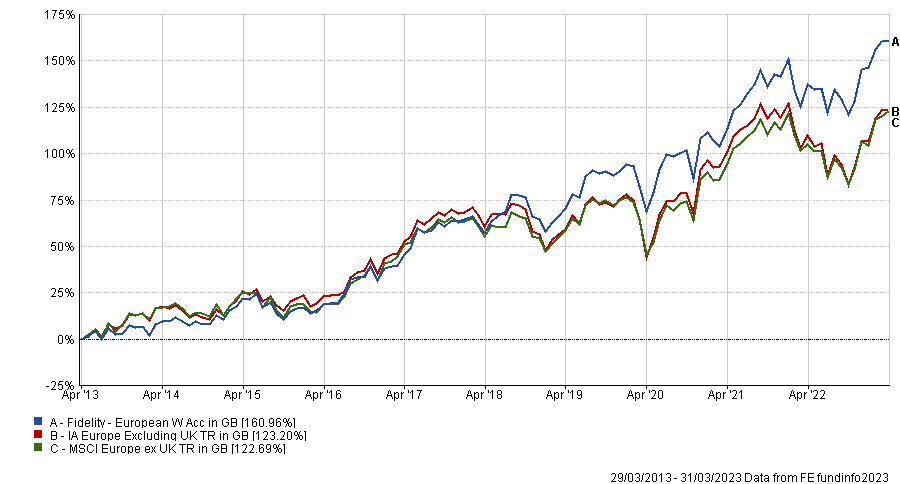

Total return of fund vs sector and benchmark over the past 10 years

Source: FE Analytics

Square Mile analysts suggested that the £4.1bn fund could be a lower-risk alternative to a European index tracker, although investors will have to consider its higher fee of 1.5%.

However, Morse’s “fairly conservative” array of assets might not be the best fit for investors wanting to take more risk in the region, they said.

“We believe this fund provides longterm investors with an attractive exposure to the region, though the strategy may underperform during periods of strong equity market returns when riskier stocks are in favour,” the researchers at SquareMile added.

This was echoed by analysts at FE Investments, who said that the managers “only have small sector deviations relative to the benchmark”, and said the fund would “suit an investor looking for core European exposure amongst a diversified portfolio of funds.”

The Meridian European Value fund followed closely behind, climbing 160.7% over the past decade and beating the IA Europe Including UK sector by 47.4 percentage points.

This €3.9bn (£3.4bn) portfolio managed by Florence Taj since 2018 was one of two Meridian funds that made top-quartile returns while taking the least risk.

Meridian European Core Equity, managed by FE fundinfo Alpha manager Roger Morley, was up a lesser 143.4% over the period, but still beat the peer group by 30 percentage points.

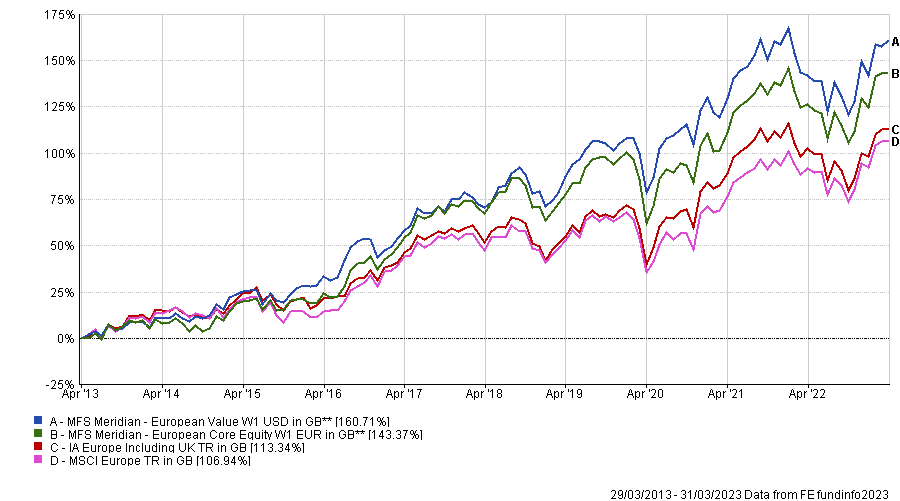

Total return of funds vs sector and benchmark over the past 10 years

Source: FE Analytics

Although both funds are run by separate managers, they share five of the same names in their top 10 holdings, so there is some overlap in their portfolios.

Each were among the least volatile in the sector, but Meridian European Value was the most risk-averse of all the funds on the least, ranking at 11.9% compared to the peer group’s 13.8% average.

However, the fund that made a positive return in the greatest number of months was Waverton European Capital Growth.

It was up 78 months over the past decade, meaning investors worried about losses in six fewer months than the rest of the IA Europe Excluding UK sector.

The fund managed by FE fundinfo Alpha managers Charles Glasse and Chris Garsten climbed 151.4% over the past decade, beating its peer group by 28.2 percentage points over the period.

Total return of fund vs sector and benchmark over the past 10 years

Source: FE Analytics

Whilst it wasn’t the highest returning fund on the list, investors could sleep easier knowing that they were making a positive return more often.

Other funds that made top-quartile returns for lower risk over the period included Janus Henderson European Focus and BlackRock Continental European Income, which climbed 153.6% and 142.8% respectively.

Alternatively, investors could have made top-quartile returns over the past decade with Invesco European Equity, although it was among the most volatile, had one of the worst maximum drawdowns and had some of the fewest positive months in the IA Europe Excluding UK sector.

The £2.8bn portfolio managed by FE fundinfo Alpha managers John Surplice and James Rutland was up 154.4% over the period, but those invested in the fund would have had a much bumpier journey to get there.