A focus on income, getting more granular and staying nimble should be the main considerations when building a portfolio today, not a simple decision to put 60% into stocks and 40% in bonds, BlackRock strategists have said.

The 60/40 portfolio is a mainstay of investing: the 60% allocation to equities is supposed to provide growth while 40% in government bonds offers a cushion when stocks fall. This approach has been largely successful over the years, as shown in the chart below.

However, it disappointed in 2022 when stocks and bonds fell at the same time because of surging inflation and rising interest rates. A portfolio with 60% in the MSCI AC World index and 40% in the Bloomberg Global Treasury index fell 7.8% last year.

Performance of the 60/40 portfolio over 20yrs

Source: FE Analytics

This have changed again in 2023 and the 60/40 portfolio has started the year with positive returns. However, strategists at the BlackRock Investment Institute think investors should be seeking out new approaches to portfolio construction.

“We don’t see the return of a joint stock-bond bull market like we saw in the ‘Great Moderation’. That was a decades-long period of largely stable activity and inflation when most assets rallied and bonds provided diversification when stocks slumped,” senior portfolio strategist Paul Henderson said.

“We think strategic allocations of five years and beyond built on these old assumptions do not reflect the new regime we’re in – one where major central banks are hiking interest rates into recession to try to bring inflation down.”

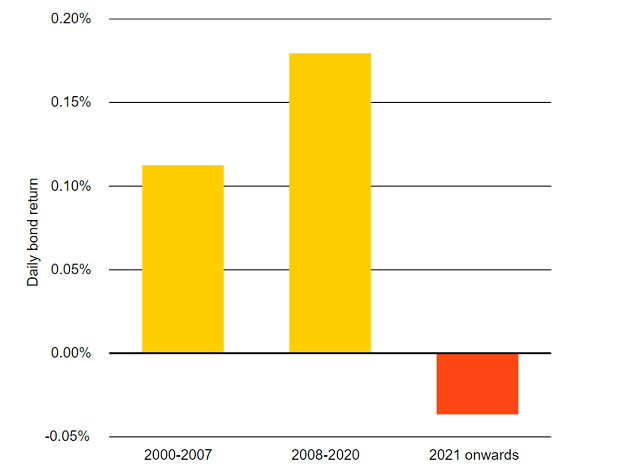

The chart below shows how bonds tended to offset equity sell-offs during the Great Moderation – a period of low inflation, stable growth, and reduced business cycle volatility – and rose when stocks fell. However, “some of that ballast has gone away” since 2021.

Average US Treasury return when equities fall, 2000-2023

Source: : BlackRock Investment Institute, with data from Refinitiv Datastream, Apr 2023

“The merit of long-term bonds as portfolio diversifiers has fuelled a debate over the future of the 60% stocks, 40% bonds portfolio. We think talking about numbers misses the point,” Henderson said.

“The debate should be more about the approach to portfolio construction rather than the broad allocation levels. We believe in a new approach to building portfolios.”

The first element of this new approach is income. Income from short-term bonds has greater appeal the longer interest rates stay high, the strategist pointed out, and BlackRock doesn’t see much chance of central banks going back to a historically low interest rate environment any time soon.

“This reinforces the appeal of income in short-term paper,” Henderson explained. “Yet we also see long-term yields rising on both strategic and tactical horizons as investors demand more term premium, or compensation for holding long-term bonds in an environment of higher inflation and debt.”

The second portfolio construction element is breaking up traditional asset allocation buckets instead of sticking with broad weightings.

The BlackRock Investment Institute said investors’ strategic views need to be more granular if they are to have success in building resilient portfolios, by digging deeper into equity sectors and private markets.

“On a tactical, six- to 12-month view, we prefer to get more granular by digging into sectors such as energy and healthcare, actively selecting companies with quality characteristics: stronger earnings and cash flow that can better weather a recession, resilient supply chains, strong market share and the ability to pass on higher prices,” Henderson added.

Finally, investors should be more nimble instead of “coasting” with strategic allocations. This is because structural forces such as geopolitical tensions, the energy transition and banking sector turmoil can rapidly change market dynamics.

Owing to this, BlackRock has been adjusting its strategic portfolios more frequently in response to new information and market shocks.

“We think that getting the asset mix right in the new regime will be crucial for maximizing returns: Our work finds that getting it wrong could be up to three times greater the impact now than in the Great Moderation,” Henderson explained.