Despite a reputation for high growth, emerging markets have struggled over the past decade and offered investors lacklustre returns when compared with the likes of the US. But fund managers now see opportunity in the unloved asset class.

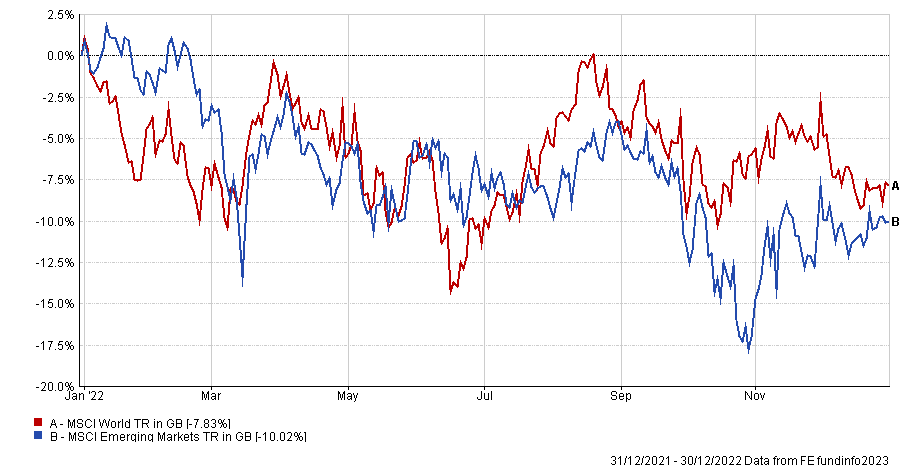

Emerging markets fell harder than developed markets in 2022 thanks to headwinds such as the strong US dollar, which makes borrowing conditions harder for many emerging markets, and interest rate hikes from the Federal Reserve, which can discourage investment in ‘riskier’ assets.

Performance of emerging market vs developed markets in 2022

Source: FE Analytics

However, Premier Miton emerging market manager Will Scholes does not foresee these headwinds blowing as hard in 2023. The Fed is expected to pause on its rate hikes as inflation looks to have peaked while inflation is likely to fall faster in many emerging markets.

This leaves Scholes focused on the positives of the asset class: “When I look at emerging markets, I see high growth opportunities married with relatively cheap valuations.

“I see young populations, more than 80% of the world’s total, living on three-quarters of the world’s land mass. I also see young companies battling for market share across regions whose investment spending priorities are shifting. That shift is towards delivering resilience, through diversification of suppliers, power sources, and customers, with the goal of bringing about sustainable growth.”

BlackRock is another highlighting opportunities in emerging markets. It is positive on emerging markets on a tactical view but prefers developed markets when thinking further ahead than five years.

The asset management house went overweight emerging market stocks in February to get short-term exposure to the impact of China’s ending its strict Covid lockdowns.

China’s restart meant the country beat market expectations for economic growth in the first quarter of 2023. It’s also helped the wider emerging market economic activity to outpace the developed world in 2023 so far.

Wei Li, global chief investment strategist at the BlackRock Investment Institute, said: “Even with investors leaning into emerging market shares, they’ve underperformed developed market stocks for over a decade. We don’t think emerging market shares are reflecting the likely growth outperformance of emerging economies this year.”

The latest forecast from the International Monetary Fund expects emerging market economies to grow by 3.9% in 2023 compared with just 1.3% for the developed world. In 2024, emerging economies growth is tipped at 4.2%, versus 1.4% for developed markets.

A major reason for BlackRock’s optimism in emerging markets over the short term is the likelihood of interest rate cuts.

While the likes of the US and UK continue to battle high inflation, emerging market central banks started their rate increases up to a year before their developed market peers. Some have already stopped hiking and can start cutting sooner than in the developed world, BlackRock believes.

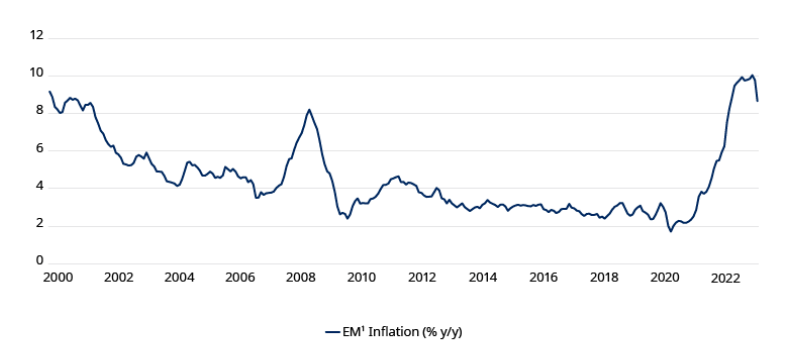

David Rees. senior emerging markets economist at Schroders, noted that emerging market inflation has surprised to the downside in recent weeks.

An equal-weighted average of headline inflation in 17 major EMs fell below 9% year-on-year in March from a near-14 year high of 10% in January. While inflation is still above target “almost everywhere”, the majority of major emerging markets have experienced falling inflation in the past few months.

Emerging market inflation since 2000

Source: Schroders, Refinitiv

Rees said: “Falling inflation and slowing economic growth ought to see emerging market central banks pivot towards interest rate cuts later this year. The messaging of emerging market central banks remains cautious as they await confirmation that inflation will decline in the months ahead, against a backdrop of still-rising rates in developed markets.

“However, most central banks have now paused aggressive hiking cycles. And if we are right in fearing near-term downside risks to growth then it may not be long before attention turns to supporting ailing economic activity.”

Fidelity’s Graham Smith adds another reason for investors to consider emerging markets: attractive valuations.

Emerging markets are currently trading at “depressed valuations” when compared with both their own history and relative to the rest of the world. Smith argued that this dynamic is “bound to be picked up by global investors at some point”.

He added: “Based on the amounts companies are expected to make over the next 12 months, emerging markets trade at a 27% discount to world stock markets. This valuation seems to take little or no account of the likelihood that emerging markets will grow at premium rates in 2023 and beyond.”

For investors wanting exposure to emerging markets, Smith pointed them in the direction of global emerging markets funds rather than single-country strategies and highlighted three in particular.

The iShares Core MSCI EM IMI UCITS ETF offers the broadest exposure to emerging markets, along with the low costs that come with tracking the market.

Lazard Emerging Markets, meanwhile, is a value-oriented fund that aims to beat the MSCI Emerging Markets index with lower volatility. The £428m fund is currently top quartile in the IA Global Emerging Markets sector over one and three years.

Finally, Comgest Growth Emerging Markets takes a quality-growth approach to investing and has a very concentrated portfolio. Smith said it is best suited to investors with relatively long time horizons; the fund is fourth-quartile over three, five and 10 years but has jumped into the top quartile more recently.