Domestic stocks have been a marmite proposition for investors in recent years. While the UK market struggled first with Brexit, then Covid – when a lack of technology names meant the FTSE All Share index failed to match the returns of the US’ S&P 500 index.

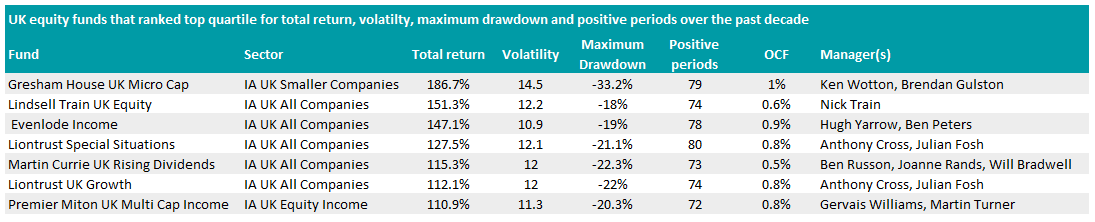

However, over the past 18 months or so it has been resurgent. Since the start of 2022 it has outpaced the US and broader global stock markets, making a 5.9% gain versus a 5.8% and 5.2% decline for the S&P 500 and MSCI ACWI respectively.

Part of this has been the rebound in ‘value’ stocks such as oil majors, miners and financials, in a world of rising interest rates, which have been upped to combat rampant inflation.

Total return of indices since start of 2022

Source: FE Analytics

With the UK seemingly in the ascendancy, investors may be taking a closer look at the domestic market, although they continue to be wary, according to the latest fund flows index by Calastone, which showed money was pulled from UK funds for the 23rd consecutive month in April.

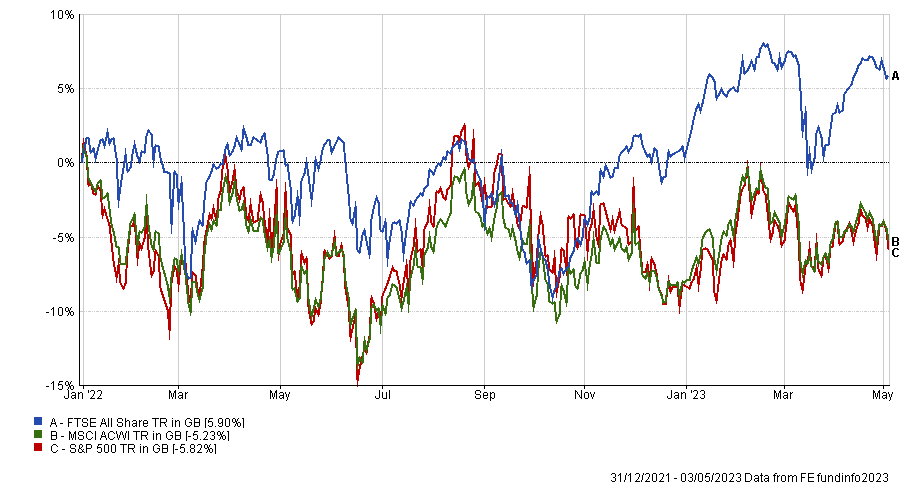

Perhaps a good way to invest in the UK is to look for those funds that have made good returns without the volatility experienced by the broader FTSE All Share index. As such, Trustnet identified seven funds that have delivered top-quartile returns in the IA UK All Companies, Equity Income and UK Smaller Companies sectors over the past decade, whilst also taking the least risk.

These funds also ranked top for lowest maximum drawdown and highest number of positive periods, meaning they were down less frequently, and by less, when the market fell.

Source: FE Analytics

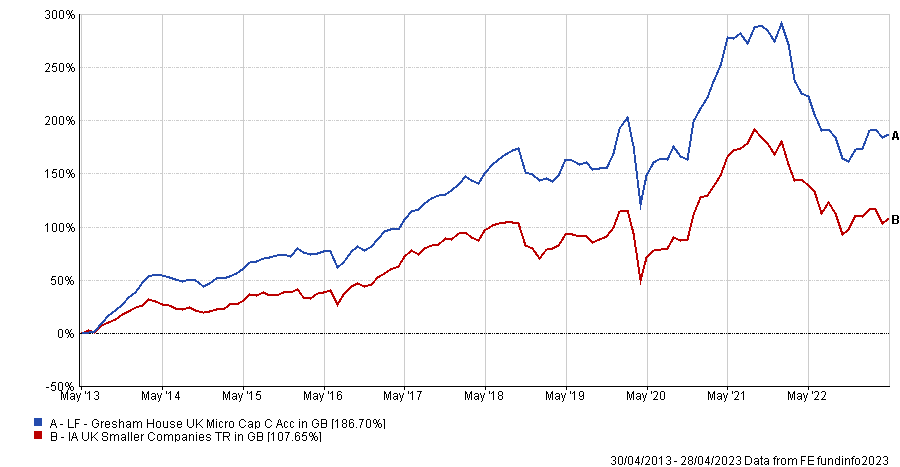

The highest returner was Gresham House UK Micro Cap, which soared 79.1 percentage points ahead of the IA UK Smaller Companies sector over the past 10 years with a total return of 186.7%.

This £233m fund run by FE funfinfo Alpha manager Ken Wotton was the most volatile on the list at 14.5%, but this is unsurprising given its focus on mid and small-cap companies – most of its holdings (89.6%) are in the FTSE AIM and FTSE Small Cap indices.

It also had the biggest maximum drawdown over the period at 33.2%, but this is shallower than the small-cap peer group’s 38.1% average.

Total return of fund vs sector over the past 10 years

Source: FE Analytics

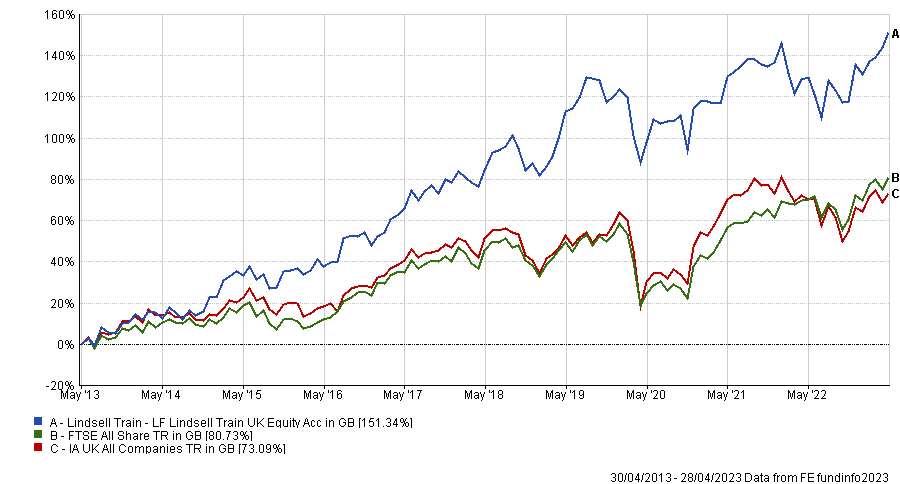

The second best performer was Lindsell Train UK Equity, with its total return of 151.3% soaring more than twice as high as the IA UK All Companies sector average of 73.1%.

This £4.5bn fund managed by Alpha Manager Nick Train also had the lowest maximum drawdown on the list, sinking 18% at its lowest point over the past decade compared to 29.4% among its peers.

Its dominance in the sector was supported by Train’s preference for quality-growth companies, which analysts at RSMR said made it a good long-term holding.

“Given the strong quality-growth bias, this fund would be most appropriately held with a value-oriented UK equity fund and would not be appropriate as a short-term core holding as its style may go in and out of favour over the medium term,” they said.

Total return of fund vs benchmark and sector over the past decade

Source: FE Analytics

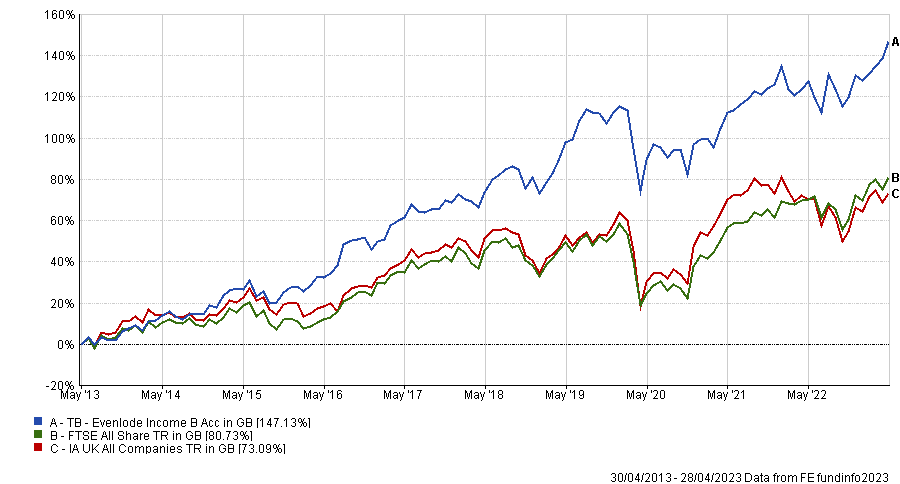

The least volatile fund on the list was Evenlode Income, with its 10.9% rating lower than the IA UK All Companies average of 16%.

Not only was it one of the least risky funds in its sector, but its total return of 147.1% over the past decade was 74 percentage points higher than the peer group average.

FE fundinfo Alpha managers Hugh Yarrow and Ben Peters buy companies that deliver sustainable growth with limited need for capital reinvestment, with surplus cash that is returned to investors through dividends.

Total return of fund vs benchmark and sector over the past decade

Source: FE Analytics

Although it may seem simple, analysts at Square Mile Research said there are a “surprisingly low number of funds that actually follow this philosophy”.

However, they did note that Evenlode Income’s low exposure to cyclical sectors such as real estate and materials (which account for 2.6% of its assets) can leave performance lagging in some cases.

Researchers at the firm added: “Patience is required, and while the underlying holdings should be better insulated from a sharp market downturn, theoretically the fund is unlikely to outperform in a strongly rising market, particularly when cyclicals are leading the way.”

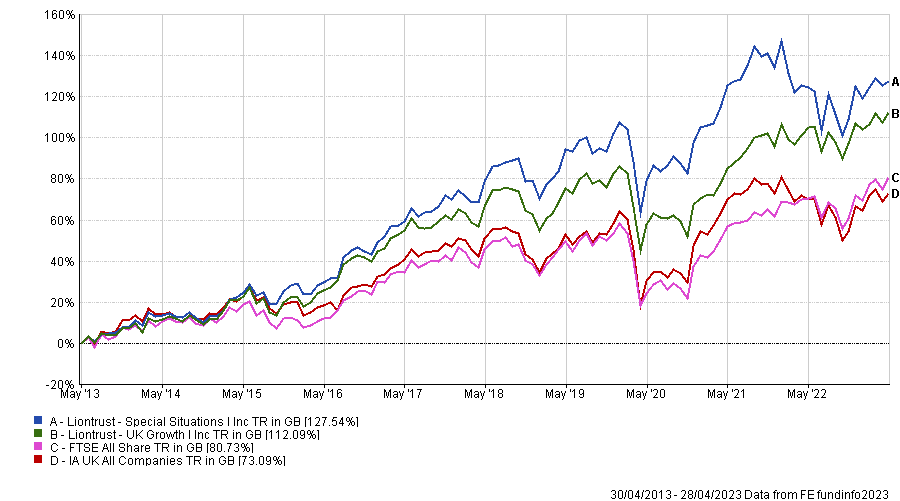

Elsewhere on the table, Liontrust Special Situations stood out as the fund that reported a positive return in the highest number of months over the past decade.

Returns were up in 80 months over the period, whilst most funds in the IA UK All Companies sector recorded a positive results in almost 10 months fewer. Its total return over the past decade of 127.5% was ahead of the peer group’s 73.1% average.

Another fund managed by the same team, which is spearheaded by Alpha Managers Anthony Cross and Julian Fosh, also beat the sector without taking as much risk.

Liontrust UK Growth was up a shallower 112.1% over the past decade, with six fewer positive months than its sibling fund, but it still beat the IA UK All Companies sector on both counts.

Total return of funds vs benchmark and sector over the past decade

Source: FE Analytics

Another fund to beat the IA UK All Companies sector while also remaining low-risk was Martin Currie UK Rising Dividends, which climbed 115.3% over the past 10 years.

Researchers at RSMR said that Alpha Manager Ben Russon and his co-managers Joanne Rands and Will Bradwell had “demonstrated their ability to be opportunistic in volatile markets by buying stocks that have been heavily de-rated”.

The lowest returning fund in the list was Premier Miton UK Multi Cap Income, which climbed 110.9% over the past decade. Even so, it still beat its peers in the IA UK Equity Income sector by 37.8 percentage points.

Alternatively, investors could have beaten the market by taking the highest amount of risk with the Thesis Stonehage Fleming Opportunities fund.

It ranked bottom for volatility, max drawdown and positive periods over the past decade, but its total return of 97.3% was 24.2 percentage points ahead of the IA UK All Companies sector.

Nevertheless, all of the lowest risk UK funds listed above performed better than Thesis Stonehage Fleming Opportunities over the period.