The reopening of China at the end of 2022 after three years of a strict zero-Covid policy has nurtured a lot of hopes among investors and China’s GDP growing by 4.5% in the first quarter was encouraging to some such as the abrdn Research Institute, which raised its forecast for China’s real GDP growth from 2.9% in 2022 to 6.0% for 2023.

However, this economic data has not yet translated into stock market performance, with most of the indices tracking the markets in China and Greater China recording negative performance since the beginning of the year.

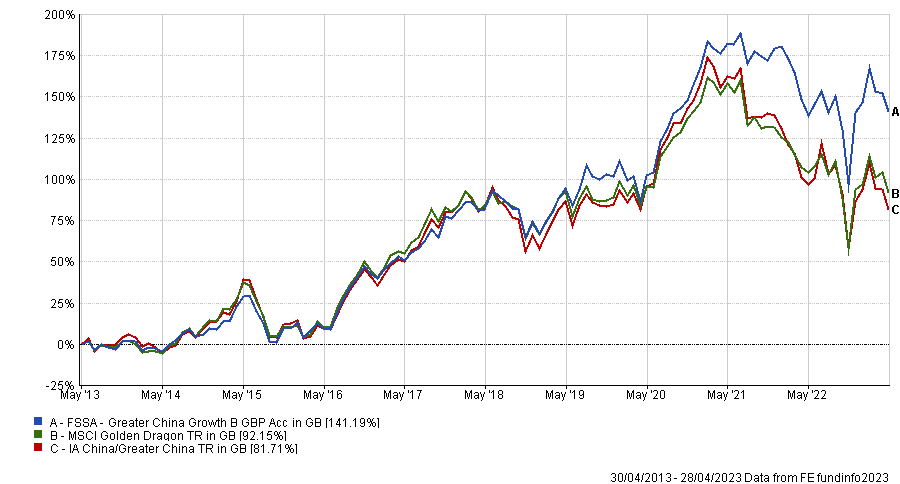

Active managers have also struggled and the FSSA Greater China Growth fund is no exception, although it has still done better than both its benchmark and the IA China/Greater China sector.

Although making a loss, it has been one of the best performing funds in the sector, regularly ranking among the top quartile across different periods and never falling below the second quartile.

Performance of the fund vs sector and benchmark over 10 years

Source: FE Analytics

Here, manager Martin Lau tells Trustnet about the benefits of investing in Taiwan and Hong Kong in addition to mainland China, how the geopolitical tensions are impacting his investment process and how the investment landscape in China is changing.

Can you explain your investment process?

We do everything on a bottom-up basis, we do not look at the benchmark. We invest long-term for at least three to five years in companies that we believe in.

There are three criteria that we look at to define what a good company is: management, business franchise and finances.

We're very focused on the long term, we don't chase momentum. If people want momentum we are not the right managers for them. Our portfolio turnover is low, around 15%. If you look at our competitors, their turnover is typically around 120%.

Are you personally invested in the fund?

I am. As a team, one of our philosophies is that we need to invest in all the funds that we manage. We have something called the long-term incentive: on a rolling basis, we have three years of our incentive income tied up in the funds.

The fund invests across three markets: mainland China, Hong Kong and Taiwan. What are the differences between those markets?

The China A-shares market is the onshore stock market. It is very retail driven and highly volatile. It has a tendency to get either very expensive or very cheap. We keep an investment discipline, which means that we shy away from certain sectors within the A-shares market when they become too expensive.

Unlike China which is a very big domestic market, Taiwan is an export-oriented market where we also find great quality technology companies.

Hong Kong is a very well regulated, very transparent and quite mature market. A lot of the stocks listed in Hong Kong, including many Chinese stocks listed in Hong Kong, tend to have better reporting and governance. We have a large part of our fund exposed to Hong Kong-listed China shares as a result.

Taiwan Semiconductor Manufacturing (TSMC) is the largest holding in the fund. What do you like about this stock?

We have been shareholders of TSMC for more than 15 years because of its global competitiveness, efficiency, vision and culture.

One of our concerns going forward is the potential for complacency, because it has between 50% and 60% of the market share in chip foundries and high-end technology. It almost has a monopoly.

Whenever we talk to companies, one of the important signals is whether there's any sign of complacency or of lax attitude. So far with TSMC, it's been okay.

We've also been encouraged by the initiative to diversify the production base outside of Taiwan, which helps mitigate geopolitical risks. Also, the board used to be Taiwanese-centric, but it now has three foreigners. In an increasingly political world, it makes sense for the board to be more international.

What are the headwinds for people investing in China?

For China in particular, there are three issues.

One is that the economy has definitely stalled. The latest GDP growth of 4.5% is actually the lowest in the past 30 years. China is now growing at a slower pace because the economy has matured and people are getting old.

The second headwind is regulation. The government is taking a heavy hand on a number of areas in the economy.

Geopolitics is the third headwind and it is not going to go away. In fact, it's probably going to get worse.

How are the geopolitical tensions between China and the US impacting investment decisions?

In the past, if you invested in Japan and bought Toyota, you would have done very well. If you bought Samsung Electronics in Korea, you would also have done very well.

If a Chinese company is doing well, there are chances the US or Europe will sanction it. TikTok was very successful, but it’s been sanctioned. Huawei was very successful and has also been sanctioned.

It almost goes against your instinct of finding a successful company, because the more successful it is, especially internationally, the more it attracts politicians’ attention.

Do you see the common prosperity goal in China as a tailwind or a headwind?

It is good on paper. It’s honourable to look after the less well-off. The UK has something called levelling up, which is a bit similar.

Protecting people on lower income, increasing the minimum wage, etc are probably the right things to do. Generally speaking, for the past 10 to 15 years, shareholders have actually enjoyed the bigger share of the pie.

But it could also mean that the government may look more at the social stability than share prices. It is a headwind, but arguably, it will make the whole system more stable in the long run.

What are the tailwinds for the fund?

I personally believe that steady, lower economic growth is not a bad thing. As long as the economy is growing and people focus more on innovation, research and development, improving their brand, governance, shareholders return, et cetera, it is rather positive. If you look at the US or even Japan, you can see that you actually do not need a lot of economic growth to generate stock market performance. What you need is innovation.

One of our areas of focus is to find where innovation is happening in China. We believe the days of investing in just cement, steel plants, property companies and simply riding the GDP growth are over. We want to find companies that are innovating or upgrading their brand and services in a different way.

Another tailwind is the rise of consumer power or how people improve their lifestyle. LVMH, which is not a Chinese stock, reported a 17% increase in revenue. I'm sure 50% of those revenues came from Chinese consumers. There is that aspiration for consumption.

A third tailwind is industry consolidation. Everything is very fragmented in China. For example, we are invested in the largest drugstore company in China which has 1% to 2% of the market share. If you look at the UK, which is a very bad example because it is a relatively small country, Boots has got about 20% of the market share.

What do you like to do outside of fund management?

I've got three kids, which is very time consuming. In terms of sports, I do boxing and tennis. I also like to run, but I enjoy boxing most. I am also quite heavily involved with my church and I’m on the board of a school in Hong Kong.