Soaring inflation has hit UK consumers amid the cost-of-living crisis, but concerns have been blown out of proportion, according to Ambrose Faulks, manager of the Artemis UK Select fund.

The key drivers of inflation have fallen from their peaks, making the potential recession that has loomed unlikely to happen.

Faulks said: “This must be the most well-heralded and signalled recession in my lifetime. We’ve been waiting for it to happen but the media, the government and the Bank of England have turned around and said, ‘actually we’re not having the recession we thought we were going to have’.

“Yet it’s been on everyone’s minds for a long time and dominated consumer fears, probably hindering investment.”

He pointed to the rapidly improving outlook by economic forecasters this year – the International Monetary Fund (IMF) estimated at the beginning of the year that UK GDP would shrink 0.6% throughout 2023, but that was revised to a 0.4% annual growth in its latest report.

Faulks was even more optimistic, anticipating GDP growth of up to 0.6% this year, but the market has been late to shed its cynicism and accept the improved prospects of the UK.

“It’s hardly a euphoria moment for the economy, but it’s certainly a lot better than the pessimism that we see priced into the market,” he added. “The UK has proven to be significantly more resilient than people think.”

The economic outlook may be brighter than originally expected, but it is easy to see why consumers are still concerned when the highest inflation in decades continues to bite into their budgets.

Although it may remain a difficulty, Faulks noted that the main drivers of inflation have slowed down significantly.

Although utilities and food inflation have been “very painful to consumers” amid the cost-of-living crisis, their prices have peaked and may begin to ease from here, said Faulks.

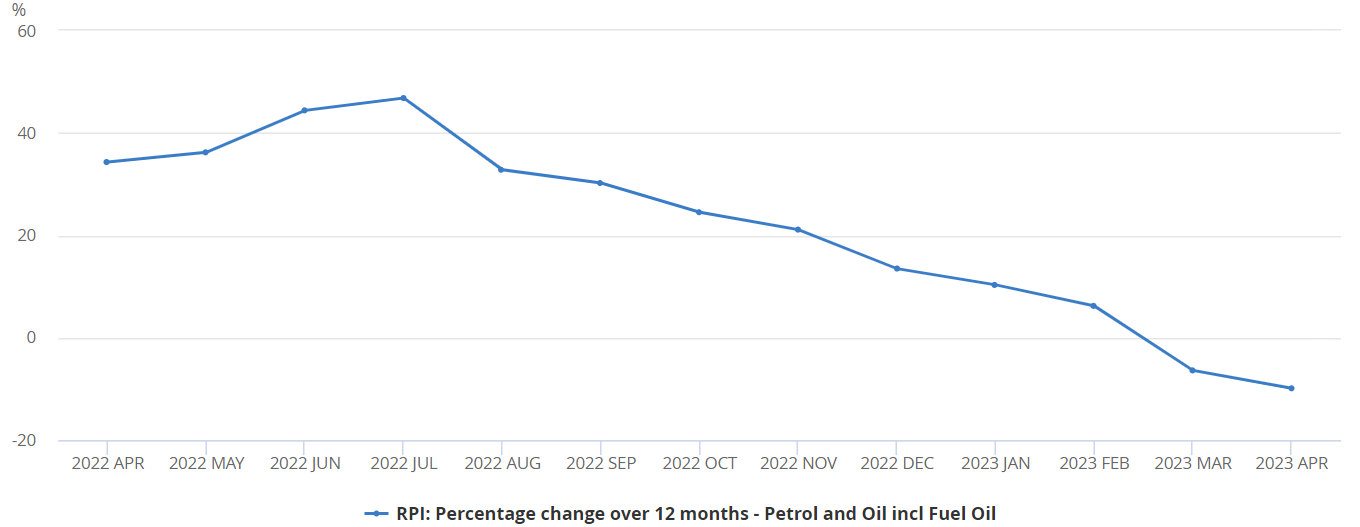

For example, petrol and oil price inflation has dropped from their peak last year and begun to shrink by 6.4% and 9.9% in March and April respectively.

Petrol and oil (including fuel oil) inflation over the past year

Source: Office for National Statistics

Faulks said: “Depending on where the price caps come in, we should see quite meaningful reductions in gas bills. Clearly it’s a lag defector that will take time to wash through.

“Food inflation has peaked at around 20% – that will probably last for another few months but in the end it will actually roll over, so we think that aspect of inflation should get a lot easier.”

Rising wages have also been a big driver of inflation recently, but this might be of benefit to UK consumers, according Faulks.

“Wage inflation is quite helpful,” he said. “It feels like it has helped consumers work through some of the inflationary issues. It’s not a complete get out of jail [free card], but it certainly has gone some way to keep purchasing power going.”

Faulks added that public sector wage inflation could peak in a few months at around 7%, with salaries in the private sector likely having already peaked at about the same level.

These increases are not in line with the 8.7% inflation rate reported in April, but could go some way to offsetting higher living costs.

Utilities, food and wage inflation may be on the way to pausing, but Faulks acknowledged that house prices and borrowing rates remain a burden on UK consumers’ minds.

However, these concerns might also have been exacerbated. Faulks pointed out that the majority (88%) of mortgages are fixed and most of them (67%) are on a five-year fix, which gives consumers a long enough time frame to plan ahead.

“It’s not a case of everyone refinancing at once and causing a shock to the system,” Faulks said. “When we sum it all up, we think consumers have got enough time to prepare and plan.

“There is enough I think to carry us through this period of slightly lower growth, to get the house in order and adjust to this world of higher interest rates.”