UK investors pulled out of the stock market and moved into cash last month as worries about the health of the economy continued to grow, the latest data from Calastone shows.

Calastone’s Fund Flow Index revealed that money market funds captured net inflows of £419m in May, which is the highest since the disastrous mini-Budget of 2022 rattled the markets and caused a sharp sell-off in UK assets.

The move to cash came amid concerns over the outlook for economic growth, persistent inflation, the likely path of interest rates in the UK and abroad, and brinkmanship around the US debt ceiling.

Edward Glyn, head of global markets at Calastone, said: “Money market funds invest in bonds with very short maturities, so they are typically among the least risky assets available. These bonds have yields very closely linked to central bank policy rates which are of course at their highest levels in over a decade at present and have therefore been looking attractive compared to still meagre bank savings rates.

“Wobbles in the US banking system have reminded investors of the risks of having bank deposits above insured thresholds too, leaving money markets as an obvious place for wealthier individuals to park surplus cash.”

The only time that money market funds received higher inflows was March 2020, when the first wave of the Covid-19 pandemic hit the UK and the country was locked down.

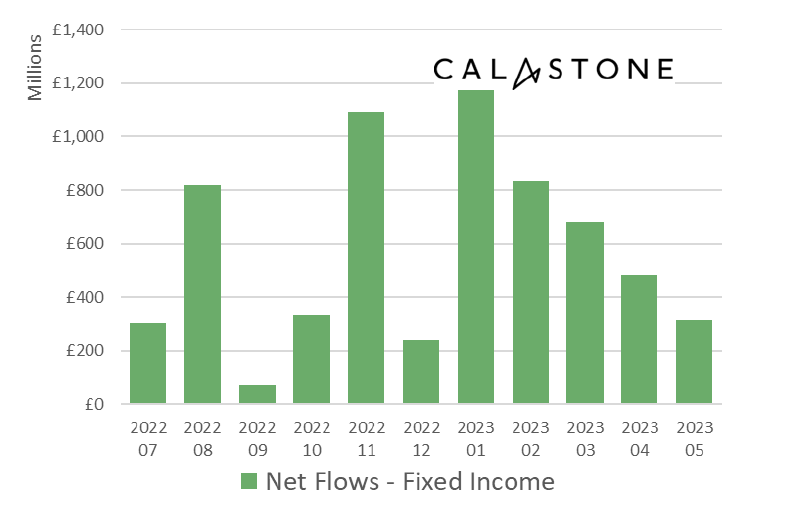

Net flows into fixed income funds

Source: Calastone Fund Flow Index – May 2023

But volatility in fixed income markets made investors less willing to buy bond funds that invest in debt with longer maturities and are therefore riskier.

Bond funds still managed to attract net inflows of £318m last month as rising yields made fixed income more attractive. Corporate bonds funds, which invest in debt issued by large companies, won most of this.

However, these inflows to bond funds were much lower than have been seen in the recent past: half the average of the last year and down by three-quarters from January’s five-year high.

“A relatively large amount of two-way trade in fixed income funds for a lower net inflow indicates more diverse opinion among investors on the asset class,” Glyn added. “This is consistent with volatile market conditions. Some are attracted by higher yields, others deterred by capital losses on funds already invested.”

But the real pain was felt by equity funds. After strong inflows in March and April, UK investors pulled a net £302m from equity funds in May – their worst showing since September’s mini-Budget.

Funds investing in UK stocks were hit the hardest after £583m was withdrawn but investors also moved out of North American funds after two months of inflows, redemptions from European equity funds intensified and sentiment towards Asia-Pacific turned negative.

Only global funds and emerging market funds had inflows, totalling £849m and £212m respectively.

“May’s bond market ructions had surprisingly little impact on share prices but fund investors, recognising that higher yields are bad for stock markets, clearly contracted buyer’s remorse after ploughing so much cash into equities in the previous two months,” Glyn said.

“Most stock markets were flat across the month, with the exception of the UK, where the index fell as equity investors reeled at the impact of UK bond yields soaring above Italy’s for the first time since the mini-Budget.”

Funds with an environmental, social and governance (ESG) approach were hit with £304m of outflows. This is their largest outflow on record in Calastone’s Fund Flow Index and only the second month during which investors have been net sellers in ESG funds in over five years.

Among other asset classes, mixed asset funds and property funds also suffered outflows in May.