Royal London Sustainable Leaders is one of 10 UK equity funds that have consistently benefitted from manager skill rather than luck over the past decade, analysis by Trustnet suggests.

The information ratio is used to evaluate the performance of an investment portfolio. It’s a risk-adjusted measure is designed to reflect the skill of a fund manager in generating excess returns relative to a benchmark.

The ratio is calculated by taking the portfolio's active return (the difference between the portfolio return and the benchmark return) and dividing it by the tracking error, which is the standard deviation of the active return. A higher ratio indicates a better risk-adjusted performance.

In this series, Trustnet is looking for funds that have consistently had the highest information ratios of their sector – starting with IA UK All Companies.

To do this, we ran the information ratio of each fund relative to its average peer over the past 10 full calendar years as well as over 2023 to date, then sorted them by quartile to see which have spent the most time at the top of the sector for this measure.

Performance of Royal London Sustainable Leaders vs sector since start of 2013

Source: FE Analytics

Coming in first place is the £3.1bn Royal London Sustainable Leaders Trust, which has been run by FE fundinfo Alpha Manager Mike Fox since November 2003; George Crowdy and Sebastien Beguelin were appointed co-managers in 2021.

Of the 11 periods examined in this research, the fund has been in the top quartile of the IA UK All Companies sector for its information ratio in seven of them. It was second and third quartile in two periods each and has not been in the bottom quartile.

Over the same period, which spans 1 January 2013 to 31 May 2023, Royal London Sustainable Leaders Trust has made a top-quartile total return of 203.1%, versus an 87.3% gain for its average peer.

Analysts at FE Investments said: “The team investment style brings something different to UK equity funds as it combines the sustainable principles with in-depth company financial analysis.

“Mike Fox is a very experienced manager and his track record highlights the benefits of his style – despite several periods of outperformance of cyclical sectors, the fund continues to beat its peers and the wider market over the long term.”

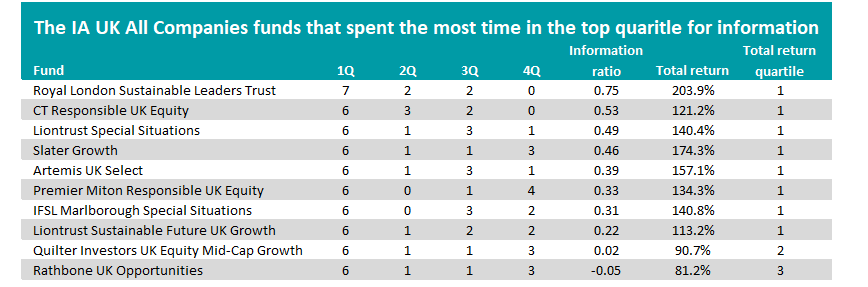

There are another nine funds in the IA UK All Companies sector that have been in the top quartile for information ratio for more than half of the periods we examined. They can be seen in the table below, which shows the number of periods in each quartile as well as the annualised information ratio of the whole period, the total return and the total return quartile.

Source: FinXL

CT Responsible UK Equity, which has been managed by Catherine Stanley since June 2009, is in second place after spending six of the periods in the top quartile for information ratio, as well as three in the second and two in the third. It has also made a top-quartile total return of 121.2% over the entire period.

The £562m fund seeks out companies with have high quality, understandable businesses and benefit from long-term drivers of growth, with strong sustainability characteristics and management teams with a proven track record of delivery.

Analysts with Rayner Spencer Mills said: “The primary focus of the investment process is to hold quality companies with strong balance sheets whilst being aware of the overall risk of the fund. Due to this, the team are conscious of the downside for companies rather than holding speculative investments.”

Liontrust Special Situations is in third place, also with six periods in the top quartile but it has been in the bottom quartile for information in one of the years this research looked at. It’s still a top-quartile performer over the entire period, however, with a 140.4% total return.

This fund looks for companies with a durable competitive edge, such as strong intellectual property, a robust distribution network or recurring revenue streams. These competitive edges create valuable intangible assets that may not be reflected in a company's balance sheet.

Square Mile Investment Consulting & Research said: “There is a very well-considered and defined investment process in place, which steers the managers towards relatively steady businesses that are gradually growing and generating high levels of cash.”

Of the 10 funds on the above list, nine have spent six periods or more in the top quartile for information ratio relative to the average peer and have generated a higher total return than the sector for the whole period.

However, Rathbone UK Opportunities has underperformed the IA UK All Companies average return since the start of 2013.

Despite having spent six periods in the top quartile for information ratio, it also spent three in the bottom quartile. The contributed to an annualised information ratio of -0.05 for the whole period and should serve as a reminder for investors to consider a range of metrics when assessing funds and to understand their nuances.

In the case of Rathbone UK Opportunities, it’s worth knowing that the fund has performed strongly for both total return and information ratio in years when the growth style of investing has led the market, such as 2020, 2021 and 2023 so far. However, the fund has struggled when value has been dominant, such as in 2022, offering some insight into which conditions suit its approach.