The Federal Reserve has held off on raising interest rates for the first time in more than a year, but suggested that further hikes could take place before the end of 2023.

At its Federal Open Market Committee (FOMC) meeting, the US central bank kept the target for its benchmark rate at 5% to 5.25%. US interest rates have been increased 10 times since March 2022.

Like most major central banks, the Fed has been hiking rates to bring inflation under control but there are signs that it has peaked in the US, where the consumer price index stands at 4%. It was 9.1% in June 2022.

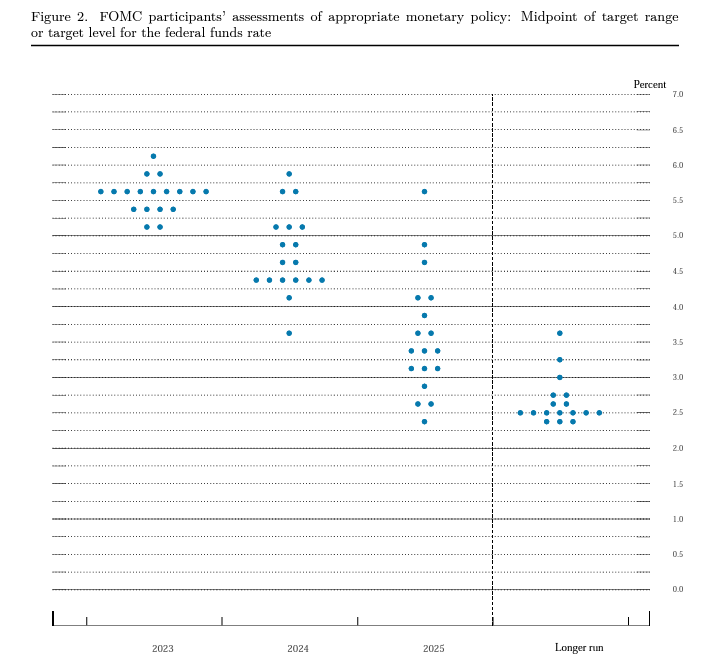

In a statement, the FOMC said it was pausing as it wanted time to assess the impact of its past hikes. However, the Fed’s forecast for future interest rates showed the majority of its policymakers expect its key rate to stand above 5.5% at the end of the year, with one seeing it rise above 6%.

The Fed’s ‘dot plot’ – June 2023

Source: Federal Reserve

“Holding the target range steady at this meeting allows the committee to assess additional information and its implications for monetary policy,” the FOMC said.

“In determining the extent of additional policy firming that may be appropriate to return inflation to 2% over time, the committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Matthew Morgan, head of fixed income at Jupiter Asset Management, said the pause in the Fed’s hiking cycle is “a wise decision” given that inflation is already slowing.

“The 5% of rate hikes already lumped onto the economy at the fastest pace for four decades is being felt. The true impact of those hikes hasn’t yet fed through, but we are already seeing pockets of fragility,” he said.

“The Fed usually overcooks its tightening, which is why the average gap over the last 50 years between last hike and first cut is only six months. The risk of a real economic accident is already running high, and with inflation slowing, a pause now does seem prudent.”

However, Principal Asset Management chief global strategist Seema Shah said it is clear that the central bank has not finished in its battle with inflation.

She noted that it is putting more emphasis on the US’ strong jobs data and sticky core inflation than its slowing headline inflation numbers, lest anyone think that inflationary pressures were easing too much.

“[It] is clearly trying to avoid a 1970s-style resurgence in inflation,” Shah said. “Despite the 500 bps of tightening to date, financial conditions have been loosening, equity markets are in a new bull run and investor sentiment is positive. The Fed had to do something to knock market optimism today, otherwise it risked a tougher inflation fight and deeper economic woes down the line.”

James McCann, deputy chief economist at abrdn, suggested the central bank could be back to hiking soon: “This pause might prove short lived. Indeed, absent some deterioration in activity, or a clearer deceleration in underlying inflation, it seems likely that the Fed will be back to tightening in July, or latest September.”

With the Fed in ‘wait-and-see’ mode and with further hikes likely, Quilter Cheviot investment manager David Henry warned that markets could be in for another rocky ride.

“Markets will continue to second guess what the Fed will do and this will only add to the volatility we have seen for the past 18 months,” he said.

“While the end of this hiking cycle is in sight, it doesn’t necessarily mean the difficult conditions for investors will wash away with it. Diversification and focusing on quality businesses continues to be the key as earnings get challenged and consumer spending potentially sours.”

Nigel Green, chief executive of deVere Group, wouldn’t be surprised if interest rates did reach 6% by the end of 2023 given the Fed’s focus on core inflation and a tight labour market. However, he railed against more hikes as “the battle against inflation is being won”.

“The time lag for monetary policies is notoriously long. It typically takes about 18 months to two years for the full effect of rate hikes to filter fully into the economy. We’re now beginning to see the drag effects on the world’s largest economy with households and businesses becoming considerably more cautious,” Green explained.

“Investors are increasingly concerned that with more hikes the Federal Reserve could steer the US economy into a major recession. As the world’s largest economy, this would clearly have a serious, negative impact on the global economy.”