The Tokyo Stock Exchange (TSE) fired a warning shot in late March to firms with a low price-to-book ratio, announcing that they will have to disclose their policies and specific initiatives for improvement, while non-compliers will be named and shamed.

A price-to-book ratio below 1x has been a feature of many Japanese businesses, including large-caps. Nikkei Asia reported on 1 April 2023 that Japanese blue-chips such as Toyota Motor, Mitsubishi UFJ Financial Group and SoftBank Group were not meeting the threshold required by the TSE.

Investors use the price-to-book ratio to identify undervalued businesses. It is calculated by dividing a company’s current share price by its book value per share. While a price-to-book ratio below 1x can signal to investors that the company does not have the potential to grow, it may also indicate that a firm’s capital is poorly exploited and that value can be unlocked.

To unlock this value, Numis and Hawksmoor Investment Management favour activist investors.

Dan Cartridge, assistant fund manager at Hawksmoor Investment Management, said: “Today, around 50% of firms listed on the TSE have a P/B below 1x and are having to act.

“Shareholder activism has stepped up too and is being recognised as a force for good in Japan for the first time; historically management teams have slammed the door shut in the face of shareholders that make any suggestions to them on how to improve, and provides another angle for investors in the space.”

AVI Japan Opportunity Trust

AVI Japan Opportunity Trust (AJOT), one of those activist investor funds, was launched in October 2018 in the IT Japanese Smaller Companies sector. The trust invests in over-capitalised mid- and small-cap Japanese equities and engage with the holding businesses’ management to help to unlock value.

James Carthew, head of investment company research at QuotedData, said: “Decades of extreme conservatism have left many Japanese businesses with inefficient balance sheets/business models.

“AJOT can take positions in these businesses and persuade them of the merits of unlocking some of that latent value. This gives a third way to extract value from an investment in the country and crucially one that can still add value even when markets are falling.”

The team at the helm is not new to the industry and has previous experience as activist investors via the AVI Global Trust.

The portfolio is concentrated and aims to have between 20 and 30 stocks reflecting the team’s best ideas.

Emma Bird, head of investment trust research at Winterflood, said: “The fund’s concentrated portfolio means that returns will be predominantly driven by stock specific factors, which has been positive for long-term performance to date but could also lead to periods of volatility compared with the index.”

Carthew added that the concentrated nature of the portfolio also means that AJOT is less correlated with the Japanese market compared to other Japanese funds.

He also highlighted the size and the ongoing charge figure (OCF) of the trust.

Carthew said: “AJOT has a reasonable size but could be a bit bigger – this would give it more firepower and help bring down its ongoing charges ratio, which is at the higher end of the peer group range.

“The board is keen to expand the trust. It trades on a small premium which helps in that regard but that means that superficially it is the most expensive trust in the two Japan sectors.”

Nippon Active Value Fund

Another trust with a similar activist approach was launched in 2020. Nippon Active Value Fund (NAVF) focuses on high asset backed small- and mid-cap Japanese businesses and engages with investee firms as well.

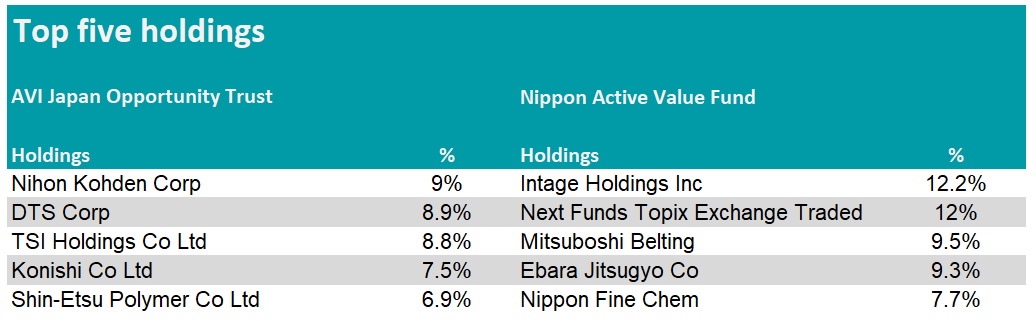

NAVF also has a concentrated strategy, with the two largest holding accounting for 12% of the portfolio’s allocation.

Bird said: “Both AJOT and NAVF have highly concentrated portfolios, with the top 10 holdings accounting for around 70%. They are also the same size, with each having a market cap of c.£165m.

“The two portfolios do not have the overlap that one may expect, with no common holdings amongst their top 10s at the end of May, potentially indicating the wide opportunity set that Japan presents for these strategies. [Note: NAVF does not publish full portfolio data so it is not possible to see the overall portfolio overlap with AJOT].”

Performance of trusts vs sector and benchmark

Source: FE Analytics

Since the launch of NAVF, both trusts have beaten the MSCI Japan Small Cap index as well as the IT Japanese Smaller Companies sector, but NAVF has also outperformed AJOT so far.

Carthew said: “Even though they have the same approach, they will not move in tandem – the portfolios look quite different. Currently NAVF’s returns are ahead of AJOT’s but that could flip quite quickly.”

A key differentiator between the two trusts is that AJOT has a discount control mechanism, with the board committed to buying back shares if the average discount exceeds 5% over any four-month period.

AJOT also offers a potential opportunity to exit at net asset value every two years.

While both trusts are similar in size, NAVF is set to grow in the coming times with the absorption of abrdn Japan Investment Trust (AJIT). The board of AJIT decided to wind up the trust following a persistent discount and a prolonged period of underperformance. Therefore, it suggested a rollover into NAVF. Shareholders of both trusts will vote on the proposals that will be implemented in Q3 2023 if accepted.

What trust do experts prefer?

AJOT was part of Numis’s recommendation list in May, highlighting the trust’s successes in its engagement with pump manufacturer Teikoku Electric.

Numis added that the trust benefits from a strong management team and presents an attractive way to access the Japanese market.

Top five holdings

Source: AJ Bell, Nippon Asset Value Fund

While Hawksmoor used to own AJOT, it now prefers NAVF.

Cartridge said: “We have a preference for Nippon Active Value in our funds, but we have owned both over the years and enjoyed good returns from both.

“NAVF has a stronger performance record from launch, returning 51% compared with 22% for AVI Japan Opportunity Trust. Both have significantly outperformed the MSCI Japan Small Cap Index (+10.6%) over that period.”

However, he added that both trusts should be seen as a complement to another Japan fund rather than a standalone exposure to Japanese small-caps due to their differentiated nature.

For an exposure to Japanese small-caps, Winterflood prefers Baillie Gifford Shin Nippon (BGS), which features in its recommendation for 2023.

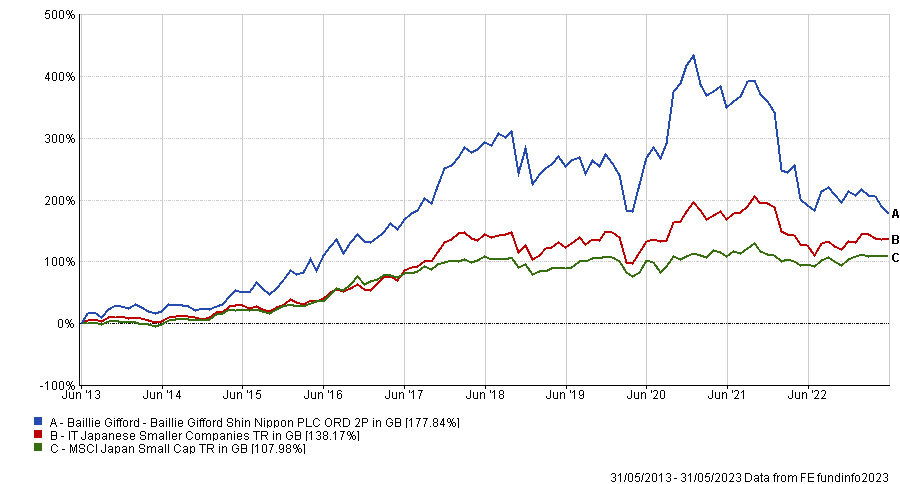

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Bird said: “We believe that BGS’s focus on high-growth Japanese smaller firms, coupled with its high active share (95% as at 31 May) and the manager’s ability to select successful businesses, as demonstrated by its long-term performance, is likely to deliver significant returns over the long run.

“While performance is likely to be volatile due to the manager’s focus on small businesses in disruptive sectors that are subject to large price swings, we note that risks are diversified across c.80 portfolio businesses with all position sizes less than 3% and the top ten investments representing less than 25% of the portfolio.”