There are four funds in the IA Europe Excluding UK sector that have consistently posted some of the best information ratios over the past decade, Trustnet research has found.

The information ratio is a risk-adjusted measure designed to reflect the skill of a fund manager in generating excess returns relative to a benchmark and is used to evaluate the performance of an investment portfolio

The ratio takes the portfolio's active return (the difference between the portfolio return and the benchmark return) and divides it by the tracking error, which is the standard deviation of the active return. A higher ratio indicates a better risk-adjusted performance.

In this series, Trustnet is looking for funds that have consistently had the highest information ratios relative to the rest of their sector in each of the past 10 calendar years as well as 2023 so far and it’s the turn of the IA Europe Excluding UK sector.

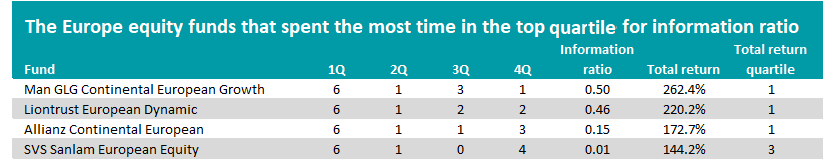

The four funds that have been top quartile for the information ratio in more than half of the 11 periods examined in this research can be seen in the table below. All were top quartile in six of the periods, with varying amounts of time spent in the other three quartiles.

Source: FinXL. Data to 31 May 2023

Rory Powe’s Man GLG Continental European Growth fund tops the list after being top quartile for information ratio in six of the periods, second quartile for one, third quartile for three and fourth quartile for one period.

Over the period under consideration, the £844m fund has made a total return of 262.4% - the second highest of the 90 funds in the IA Europe Excluding UK sector.

Powe, who was joined by Virginia Nordback as co-manager earlier this year, fills Man GLG Continental European Growth’s portfolio with either ‘established leaders’ (companies with an established leadership position but still improving economics) or ‘emerging winners’ (companies that are in their ascendancy and benefitting from faster growth trends).

The FE Investments team said: “Since Powe took over the fund in 2014, he has significantly outperformed its benchmark and has done so consistently due to his excellent stock selection.

“Superior stock selection fuelled the significant outperformance in 2020, above and beyond what would be expected from a quality-growth strategy. The fund has struggled in periods where cyclical and cheaper parts of the market outperform, such as in the last quarter of 2016 and in first half of 2021.”

In second place with a total return of 220.2% (the seventh highest in the peer group over the entire period looked at in this research) is Liontrust European Dynamic.

Managed by James Inglis-Jones and Samantha Gleave, the fund is run using Liontrust’s Cashflow Solution process – which is built around the idea that analysis of company cash flows can be a guide to future profitability. It seeks out companies that generate more cash than they need for their growth, but are under-appreciated by other investors.

Square Mile analysts said: “The long-term performance record of the fund is excellent and suggestive that the managers are identifying anomalously priced securities. We like the managers adherence to their process, but this can mean that there will be periods where the market does not reward their stocks.

“It should be noted that this strategy is unlikely to suit investors who are looking for brief forays into Europe or for those seeking index-like returns.”

Allianz Continental European is another fund with a consistently high information ratio and strong returns over the period examined here. It’s made 172.7% over the entire period, another first-quartile result.

The fund has been managed by Marcus Morris-Eyton since June 2017 with Darina Valkova joining as deputy in 2021. Four of the fund’s six periods of top-quartile information ratio have come under Morris-Eyton’s tenure.

This is another quality-growth fund, in particularly seeking out quality companies where the growth potential has yet to be recognised by the wider market, buying them early and selling before they reach the point of their growth being fully priced-in by the market.

SVS Sanlam European Equity is the only one of the four that has been in the top quartile for information ratio in more than half of the periods we looked at but is not in the top quartile for total returns over the entire period.

Its 144.2% return puts it in the IA Europe Excluding UK sector’s third quartile.