Three actively managed funds outperformed the whole funds market in the first six months of 2023, with North American and technology equities coming out on top as the clear winners between January and June.

Investors who have been holding a global, tech or US tracker will have made significant gains as well, with this category also standing out on a total return basis.

According to Sam Buckingham, investment manager on abrdn’s managed portfolio service team, there have been three positions investors should have taken within equities in the first half of this year: developed markets over emerging markets, growth over value and large-cap over small-cap.

“Emerging market weakness was driven by a disappointing six months for China equities, with the MSCI China index ending down 10% in sterling terms,” he said.

“At the other end of the spectrum was the US, posting strong gains to propel developed market equities – the S&P 500 was up 11% up for the period in sterling terms.”

Value’s relative resurgence last year has not followed into this year, with value underperforming growth across major developed market equity indices – not just the US. This trend was of particular surprise to the manager, as bond yields have risen over this period – something you would typically associate with value outperforming.

A tilt to large-cap would also have been “significantly beneficial”, considering the “eye-watering” performance of the newly labelled ‘Magnificent Seven’ stocks: Apple, Microsoft, Nvidia, Amazon, Meta, Tesla and Alphabet.

“The overarching lesson from these six months, at risk of sounding boring, is to remain well-diversified during times of such uncertainty,” said Buckingham.

“In an environment where you expected yields to rise, it would have seemed sensible to heavily tilt your exposure to value. However, this would have been hugely detrimental to returns this year. We believe remaining balanced is crucial, and to do so you need to ensure you are fully aware of the active exposures of your portfolio.”

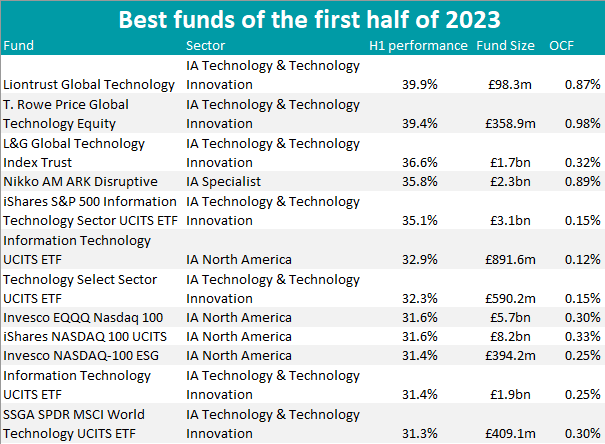

Investors who bought the HANetf Grayscale Future of Finance UCITS ETF have made 63.9%, the best return of the year-half. However, excluding IA Unclassified funds, the first place in the list goes to Liontrust Global Technology, which grew 39.9%.

Co-managers James Dowey and Storm Uru invest at least 80% of the portfolio in shares of technology and telecommunications companies across the world, with an overweight in communication services and consumer discretionary in relation to the MSCI World Information Technology index, which serves as benchmark.

With a growth of 39.4%, T. Rowe Price Global Technology Equity wasn’t too far behind, but achieved this result with a wider portfolio, encompassing the Americas, Japan, the Pacific basin and the UK, which Liontrust isn’t invested in, preferring a larger weighting to the US.

Securing third position, the first passive vehicle to make its appearance in the list is L&G Global Technology Index Trust, which is benchmarked against the FTSE World Technology Index. In 2023, its assets under management (AUM) have grown from £1.2bn to £1.7bn.

All funds in the top three have a significant exposure to the semiconductor industry and Nvidia in particular, which makes up 4.4%, 6.3% and 6.5% of these portfolios, respectively, and will have generated additional returns with its stellar growth this year, as highlighted in the chart below.

Performance of stock over the year to date

Source: Google Finance

The next up is Nikko AM ARK Disruptive Innovation, a multi-cap strategy run by US investor Cathie Wook. It has the biggest AUM in the list so far among active funds and focuses on genomics as well as industrial, fintech and web innovation. It is almost entirely skewed towards US tech and healthcare stocks.

From here on, S&P 500, MSCI World and Nasdaq 100 trackers abound, including solutions by major providers such as iShares, Xtrackers, SSGA SPDR and Invesco, as the table below shows. The growth of these popular funds will have benefited investors, who notched a return of between 31.3% and 35.1%.

The first IA North America active fund, PGIM Jennison US Growth, isn’t too far behind, with a 31.1% gain. It is another one with a substantial weighting to Nvidia, its first holding at 8.6% of the portfolio.

Japan was another success story of the year-half, with GS Japan Equity Partners Portfolio, a five FE fundinfo Crown-rated vehicle, conquering the Japan table with a return of 28.6%.

“Japanese major indices have been hitting the highest levels since 1989,” said Buckingham. “Much of this performance in local currency terms was a reaction to the weakening of the Japanese yen as the Bank of Japan continued with its policy of low interest rates and yield curve control.”

Other winning strategies included Nomura Japan Strategic Value, Barclays GlobalAccess Japan and the Amundi MSCI Japan tracker, returning 27.3%, 22.4% and 20.4%, respectively.