In spite of benefiting from a global mandate, Bellevue Healthcare Trust (BBH) invests almost entirely in US equities. In fact, more than 97% of the trust is invested in the US, with China and Switzerland the only markets where it has residual allocations.

Manager Paul Major explained this is because American investors are more willing to back healthcare businesses than any other group in the world.

He said: “Healthcare development is very expensive and time consuming. Historically speaking, American investors have been more willing to back healthcare.

“If we look inside healthcare, 90% of every venture capital dollar available to support healthcare investment comes from the United States. That's just a fact. There's this natural gravitational pull towards America.”

In addition, Major said that the US regulator, the Food and Drug Administration, is more supportive of innovation, with things such as the fast regulatory approval processes. This helps businesses and facilitates running clinical trials.

Major said: “Hospitals like to be involved in clinical trials because it makes them look like they're a centre of excellence.

“This is because hospitals in the US are private and therefore competing with each other. It’s a very different cultural approach to getting stuff on the market.”

One area he has avoided is the UK, despite signs that things could be about to improve. As a result of Brexit, the European Medicines Agency has moved from London to Amsterdam, leaving the UK regulator overstaffed and well equipped. Moreover, Covid has encouraged the UK to pursue more clinical trials.

Major said: “We can look at what Europe is doing and follow it, we can follow the Americans or we can just do our own thing.

“We're now encouraging a lot more clinical trials here. The only good thing you can say that came up with Covid is that we are picking up American-style support for innovation.”

He also said that the UK has the most healthcare start-ups in the world and hosts three of the five top academic institutions for healthcare patents: Cambridge, Oxford and Edinburgh.

However, the manager said there is a key part of the equation letting down companies: investors.

Major added: “We should be killing this stuff, but we're not. The reason we're not is because investors do not like supporting healthcare.”

Bellevue also has a bias toward mid-caps, with a 41.3% allocation. Major explained that it is because innovation in healthcare tends to happen in smaller businesses.

He said: “A third of what large healthcare firms launch on the market is either acquired through M&A or through licencing.”

Major also said he likes businesses that tend to do one thing well so the trust can model and forecast that area of specialism.

He added: “For example, if we look at the orthopaedics market, it grows 4% or 5% a year. Pricing is kind of neutral. If you break down into it, there's large joints, hips and knees and there's extremities and traumas.

“But all the growth and all the pricing are in extremities and traumas. If you look at hips and knees, pricing is negative and volume is stable, because once you've invented a hip or knee, they're all the same. Large businesses end up buying smaller firms or licences to get some growth, because innovations happen outside.”

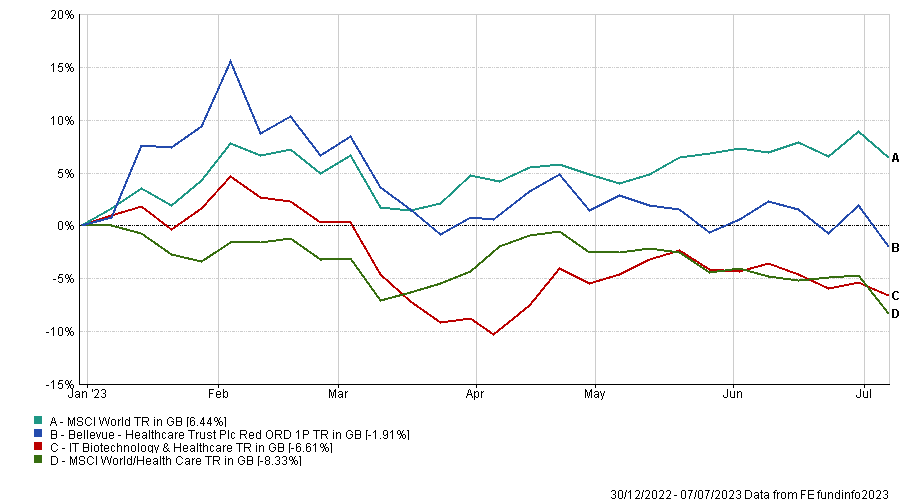

Performance of the trust vs sector and indices

Source: FE Analytics

Since the beginning of the year, the trust has outperformed both its sector and benchmark, the MSCI World Healthcare.

However, Major is surprised that the healthcare index is lagging its parent index, the MSCI World, given the current economic backdrop.

He said: “At times like these, you would have thought investors would flock to defensive growth, but people seem to be quite happy to stay invested in relatively pedestrian things. The market is speculating on what the future looks like and for now, it's decided that it wants to be pro energy transition and pro AI.

“It has forgotten that healthcare has very predictable compounds of growth. In terms of incremental value added, this is a $10trn industry that every government in the world agrees is going to grow 5% to 6% a year for the foreseeable future. I think it’s naive of people to ignore that.”

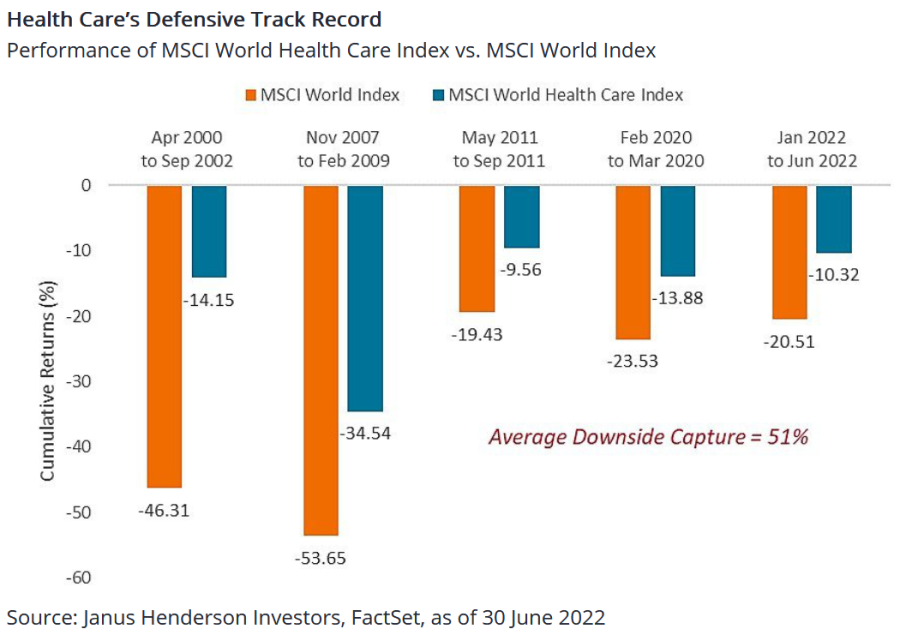

Health Care’s Defensive Track Record

The trust is currently trading at a 6.6% discount, which the investment company is aware of. It has an annual redemption option which takes place in November where investors can liquidate their shares at net asset value. Its broker also manages a share buyback programme for which the predetermined financial criteria is agreed with the company’s board.

Major said: “I think we're pragmatic in the current environment. Most investment trusts are on a discount, so it is unrealistic to think that we could magically do something that would mean that we weren't at a discount.

“But it is important to us how much that discount is and that we are within the bounds of our peers.”