A wedding is an important step in life, but it is not cheap. According to Hitched.co.uk, the average cost of a wedding in the UK in 2022 was £18,400 with costs spanning from renting a venue to going on a honeymoon.

However, there are more expenses a couple will have to meet after the wedding, including the potential expenses of a growing family, which means extra costs for at least two decades.

They will probably need to start paying a mortgage as well, if they not already, all while making sure they are saving for retirement.

Poppy Fox, investment director at Quilter Cheviot said: “They would be better to leave any funds that might be needed soon in the short term in a cash or cash plus strategy if they want to take a little more risk with the portfolio.

“If this portfolio is going to be for a ‘mixed’ purpose, a medium risk, balanced approach would be best.”

She suggested having 65% in equity, 25% in fixed-income, 5% in alternatives and 5% in cash.

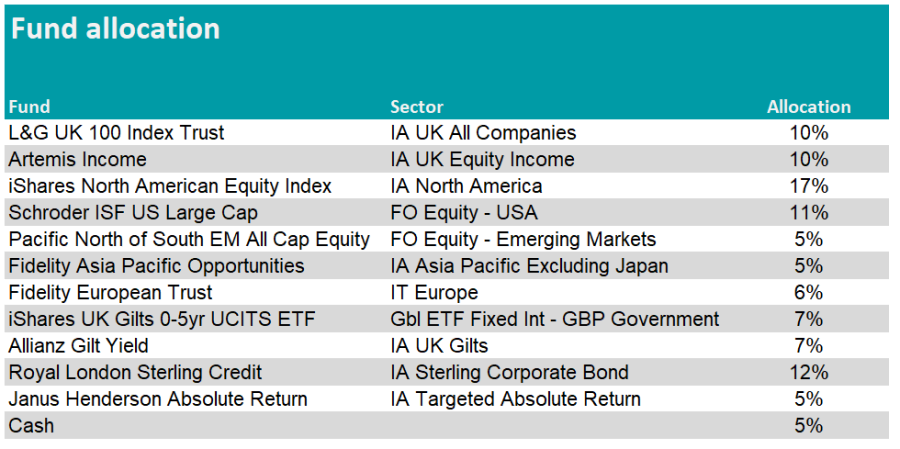

Fund allocation

Equities

The equity allocation is mostly split across the UK and US, with the combination of a passive and an active fund for both markets.

For the UK, Fox picked L&G UK 100 Index Trust and Artemis Income.

She explained that tracking the FTSE 100 via a passive fund such as L&G UK 100 Index gives exposure to multinational businesses generating their profits overseas.

Fox said: “This should be a positive for the portfolio given the negative economic environment in the UK at the moment and protect against this to an extent.”

The fund has a tracking error of 2.86% over 10 years and 2.87% over five years, with an ongoing charges figure (OCF) of 0.10%.

The Artemis Income fund’s role in the portfolio is to provide a core exposure to UK quality businesses that pay a consistent and sustainable dividend.

Fox said: “In times of economic and market stress, equity income funds can be a good way to add a bit of defensive equity exposure to a portfolio.”

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The fund sits in the first quartile of the IA UK Equity Income sector over 10 years, five years and one year.

For the US exposure, Fox used a similar structure, combining a passive and an active fund, iShares North American Equity Index and Schroder ISF US Large Cap.

Fox said: “My view is that in the US it is usually worth holding a tracker fund as a good way to get exposure to the largest companies in this space at a low cost.

“Given what we have seen year to date with US technology businesses, I think it would be sensible to make sure the portfolio has an allocation to this.”

The tracker fund, which aims to replicate the performance of the FTSE North America index, has a tracking error of 4.75% over 10 years and 5.51% over five years, with an OCF of 0.08%.

While highlighting that there would be overlaps, Fox said that Schroder ISF US Large Cap adds the flexibility to rotate in and out of sector depending on where we are in the economic cycle.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The fund is in the third quartile of the Off MT Equity – USA sector over 10 years and in the second quartile over five and three years.

The rest of the equity allocation is made of smaller allocations to emerging markets and Europe.

Starting with the former, Fox chose a broad emerging markets fund, Pacific North of South EM All Cap Equity, and added a dedicated exposure to Asian equities through the Fidelity Asia Pacific Opportunities fund.

The former is an offshore fund that was launched in September 2022. Its largest allocations are in China, Taiwan, South Korea, Brazil and the United Arab Emirates.

Fox said: “Although we haven’t seen the emerging markets benefit from the China reopening as much as we had hoped this year, this fund has seen strong performance year to date.

“The fund has a robust investment process that holds up well through the economic cycle with a combination of top-down macro and bottom up stock selection.”

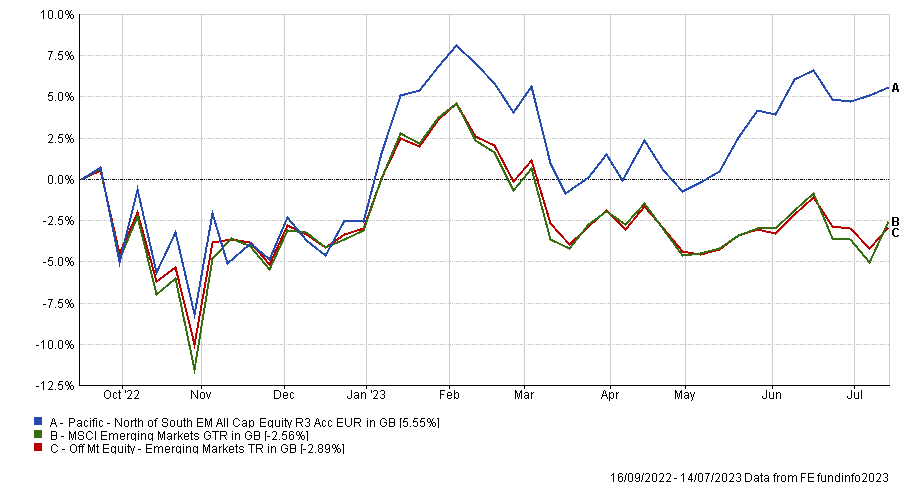

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

The fund has had a promising start, sitting in the first quartile of the Off Mt Equity – Emerging Markets sector over six months.

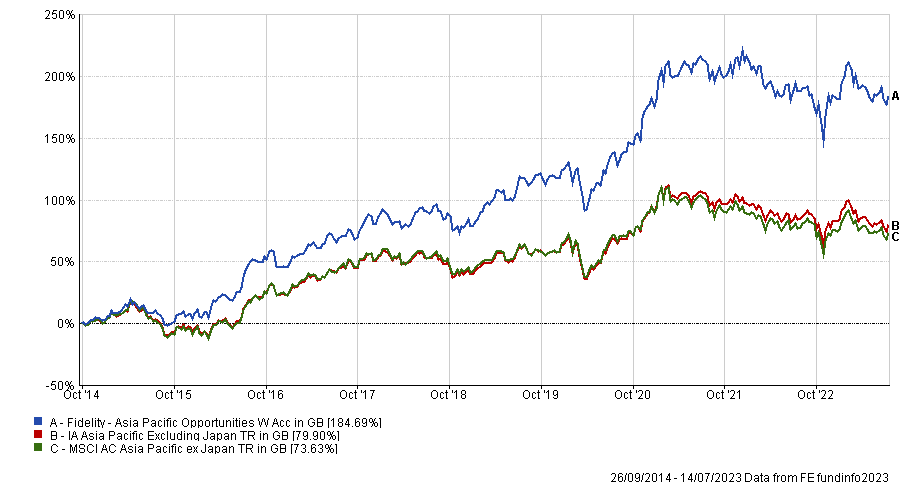

Fox added that Fidelity Asia Pacific Opportunities is an “interesting idea” for the portfolio. She highlighted the strong long-term performance of the fund as well as the manager’s contrarian philosophy and stock picking abilities.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

The fund, launched in 2014, takes off-benchmark positions, with Dutch supplier of semiconductor businesses ASML and Canadian mining company Franco Nevada in the top 10 holdings.

It is a top quartile fund in the IA Asia Pacific Excluding Japan sector over five years.

For European exposure, Fox tapped into the close-ended space with Fidelity European Trust. As it is currently trading on a discount, she said that now could be a reasonable time to buy.

She added: “The trust favours quality large-cap firms and tends to offer downside protection in falling markets with a focus on buying businesses with the ability to grow dividends over the short to medium term.”

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The trust is part of the IT Europe sector’s top quartile over 10 years, with Nestle, ASML and LVMH as its top three holdings.

Bonds

Fixed-income accounts for a quarter of the portfolio, with exposures to Gilts and corporate bonds.

Fox said: “Arguably, fixed interest is looking more attractive as an asset class than it has for some years and so an allocation to this sector is important, but will also need to be closely monitored in the current inflation/interest rate rising environment.”

As with her picks for the UK and US equities, the exposure to Gilts is split across a passive and an active fund.

Fox added: “I’ve chosen the iShares UK Gilts 0-5yr UCITS ETF given the attractiveness of short-term government bonds at the moment and this will give a better spread than selecting just one individual gilt. The yield to maturity (as at the 12/07) is 5.11%, which I think is pretty good.”

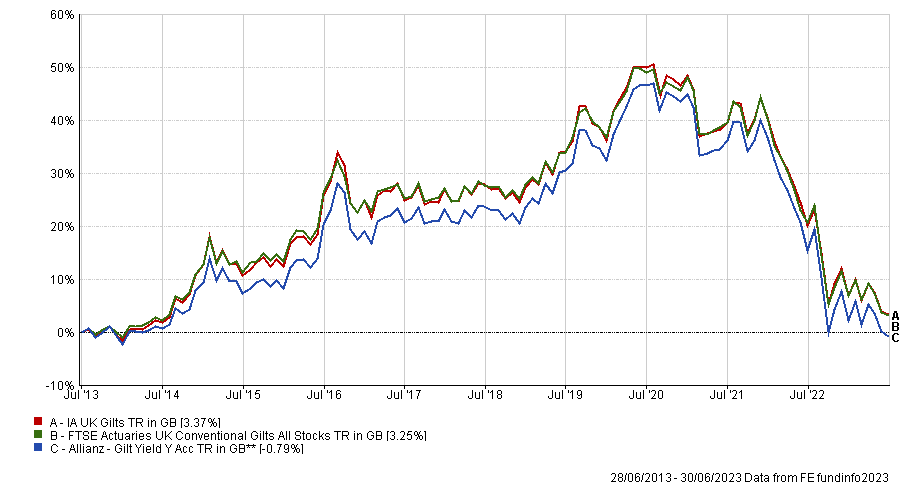

The active fund Fox selected is Allianz Gilt Yield, which tends to have exposure to longer dated bonds. She explained that the fund adds diversification as well as the option to invest in other opportunities in the fixed interest market should they arise.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The fund sits in the second quartile of the IA UK Gilts sector over 10 years. While it has a 87.3% allocation to Gilts, it also has some smaller allocations to other sovereign bonds.

Royal London Sterling Credit completes the fixed-income allocation, but invests in corporate bonds unlike the two previous funds.

Fox said: “I see it as a well-diversified sterling corporate bond fund with a relatively cautious approach and a good long-term track record in this space.”

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The fund is in the top quartile of the IA Sterling Corporate Bond sector over 10 years and has small allocations to US and various European corporates alongside its main UK exposure.

Alternatives

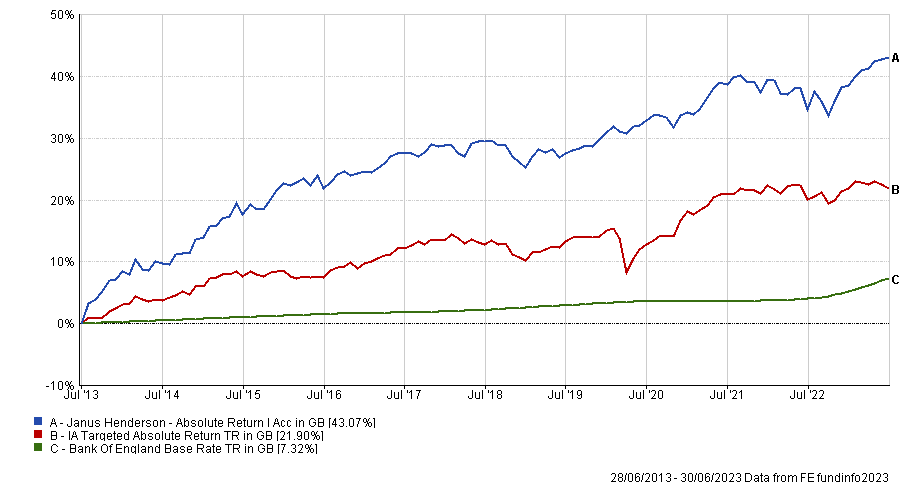

The allocation to alternative assets consists of one single absolute return fund, Janus Henderson Absolute Return.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Fox said: “The aim of an absolute return fund is to deliver a profitable return regardless of overall market conditions.

“I have chosen the Janus Henderson Absolute Return Fund for its defensive lower risk nature as a good way to add some lower risk exposure into the portfolio.”

She highlighted that the couple could take more risk in this space, however, if they see their investment portfolio as a pure retirement pot.