Scottish Mortgage and Edinburgh Worldwide belong to two different sectors but share a range of similarities. Besides being both run by Baillie Gifford, they invest with a global mandate, mix public and private equities and have highly concentrated portfolios. Moreover, they are both currently trading on a near 20% discount and are the cheapest trusts in their respective sector.

The main structural difference is that Scottish Mortgage is predominantly a large-cap portfolio, whereas Edinburgh Worldwide focuses on small-caps and is therefore part of the IT Global Smaller Companies sector.

In spite of this difference, the trusts still have a few holdings in common such as Elon Musk’s SpaceX or British grocery technology firm Ocado. Peel Hunt estimates that the overlap at the stock-level between the two strategies is between 5% and 10%.

David Johnson, analyst at QuotedData, said: “Stylistically speaking there is a huge overlap between these two strategies, a by-product of effectively having the same Baillie Gifford investment DNA running through both of them.

“As a result, they share many of the same weaknesses and strengths, such as tapping into powerful sectoral growth trends, having often idiosyncratic portfolios and also being at the behest of the same market forces (e.g. when growth stocks suffer, expect both trusts to fall in tandem).”

Given the significant stylistic overlaps, investors are unlikely to purchase both trusts in tandem. Therefore, we have asked experts to assess the strengths and weaknesses of each trust.

As small-caps have, by definition, a long runway for growth, one would assume that Edinburgh Worldwide has more potential than Scottish Mortgage. Yet, if we look at history, Scottish Mortgage has constantly outperformed its small-cap sibling, whether it is over 20, 15 or 10 years.

James Burns, managing partner, investment management at Evelyn Partners, said that it can be explained by Scottish Mortgage’s ability to capture the most successful growth stories of the past 20 years such as Amazon.

Performance of trusts over 20yrs

Source: FE Analytics

In the near future, the large-cap bias of Scottish Mortgage will be an advantage over its small-cap sibling, experts said. Given the current market conditions, Johnson said that if investors become increasingly risk on, they will likely enter into the large-cap sector first as it is perceived as a safer way to take risk. As such, Scottish Mortgage would benefit first from a resurgence in growth stocks.

Anthony Leatham, research analyst – investment companies at Peel Hunt, added: “Looking at the rally in markets and the reaction to mega-trends such as the rise of AI, the growth sectors have had narrow leadership, typically dominated by the large- and mega-caps.

“This pushes us towards a preference for Scottish Mortgage in the first phase of the recovery and, if it persists and macro-headwinds abate, then the smaller cap opportunities could respond accordingly.”

Another advantage in favour of Scottish Mortgage is its large exposure to consumer cyclical, while Edinburgh Worldwide focuses more on healthcare. That makes the former trust better positioned if we see a more resilient global economy.

Also, Scottish Mortgage is larger and a much more familiar name to investors. With a market cap of nearly £10bn, it is in fact the second largest investment trust. Johnson said that it will, therefore, benefit hugely from the familiarity bias.

He added: “This may in fact be the overwhelmingly more important factor in determining which trust is the near-term winner.”

Yet, this higher public profile may be a double-edged sword for the trust as it can attract unwanted attention at times, such as a recent spat between its board members. This adds an unquantifiable level of risk that is not present in Edinburgh Worldwide.

Another strength of Edinburgh Worldwide is its more differentiated portfolio, while Scottish Mortgage’s holdings may overlap with other global strategies.

Johnson said: “Expect your average investment strategy to have a much smaller overlap with Edinburgh Worldwide’s portfolio – something which may be important in a world where investors have flocked to large-cap technology, and increasingly healthcare, in light of the tailwinds behind these sectors, or those looking for reliable sources of sectoral growth.

“As an example, the top four holdings of Scottish Mortgage currently are ASML, Moderna, Tesla, and Nvidia, common names in many professional investment managers’ portfolios; while Edinburgh Worldwide’s SpaceX, Alnylam, Exact, and PsiQuantum are far less common.”

While it appears as higher risk at first glance due to the small-cap bias, Leatham noted that Edinburgh Worldwide has been less volatile over three years.

He said: “In terms of risk, different investors will emphasise different risk metrics, but if we look at the three-year volatility statistics, both trusts exhibit much greater volatility than the global equity indices (more than double in share price terms).

“Somewhat counterintuitively, Edinburgh Worldwide has lower three-year volatility than Scottish Mortgage, which is not necessarily what we would expect given the market-cap focus of Edinburgh Worldwide and the potential dampening effect of the greater private company exposure within Scottish Mortgage.”

Source: FE Analytics, Peel Hunt

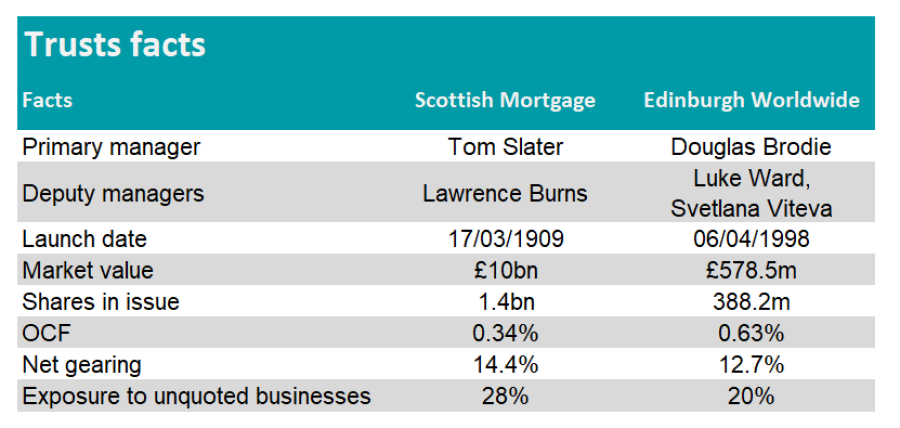

Scottish Mortgage’s exposure to unquoted businesses currently stands at 28%, compared with 20% for Edinburgh Worldwide.

As such, Scottish Mortgage is very close to its unquoted limit, which was raised from 25% to 30% in 2020. This is a concern for Mick Gilligan, head of managed portfolio services and partner at Killik & Co.

He said: “In the late ‘90s and following the tech boom and bust (2000-2002), Scottish Mortgage’s discount bottomed at similar levels to where it is now. However, on previous occasions, the board had more flexibility than it does now. That would be my concern right now – i.e. that Scottish Mortgage is close to its unquoted limit and this might hamper its ability to make further follow on investments and buy back stock.

“This situation could be exacerbated if the quoted holdings fall sharply in value. I think partial realisations of some unquoted holdings at or above NAV would provide the board and manager with more flexibility and send a reassuring message to the market.”

There have been some green shoots starting to come through for Scottish Mortgage with the recent IPO of beauty and wellness technology company Oddity. Moreover, Elon Musk’s SpaceX, a holding in both Scottish Mortgage and Edinburgh Worldwide, recently achieved a valuation of $150bn in an insider share sale. This is up from $137bn in a fundraising in January.

Gilligan added: “All of that said, Scottish Mortgage has survived many headwinds since it launched 114 years ago and I think it will survive this.”

Whether investors prefer Scottish Mortgage or Edinburgh Worldwide, he said that they should size their positions accordingly. For instance, both trusts typically have a 1% position in Killik & Co’s portfolios.

Burns added that both trusts should only be considered by investors who “genuinely” have long-term investment horizons.