Value investing tends to do well in a high interest rate environment like the one we have now, hence Aviva Multi Strategy Target Return manager Peter Fitzgerald’s surprise when those assets “actually lost money”.

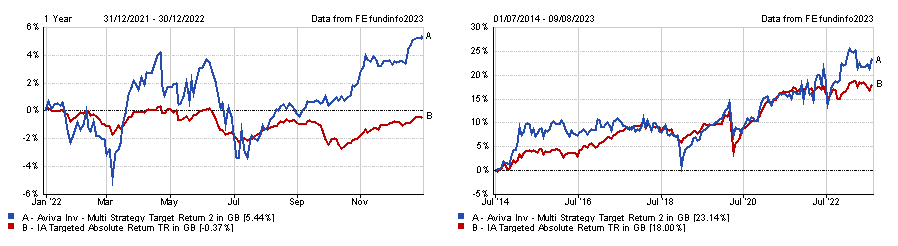

Holding value index trackers helped the £2.5bn fund generate a 5.4% return last year whilst most others dropped into the red, but the reverse happened this year despite Fitzgerald’s forecasts.

Nevertheless, he explains to Trustnet why the growth stocks that rallied this year could be facing headwinds and how those investors who jumped on the artificial intelligence (AI) bandwagon are unlikely to win over the long term.

Total return of fund vs sector in 2022 and over 10yrs

Source: FE Analytics

What is the objective of the fund?

The Aviva Muli Strategy Target Return fund looks to generate a return of cash plus 5% over a rolling three years. It also has an objective of capital preservation, so not losing money is a key focus.

Last year when most investors lost money is an example of that when our fund – while not quite generating cash plus 5% – generated a 5.4% positive return, which is an outcome we, and most our investors, are pleased about.

Where the fund fits into clients’ portfolios is its liquid alternative framework – some people will use it instead of hedge funds because it's got daily liquidity and lower fees.

What kept the fund steady in the turbulence of last year?

One was the ability to take our equity exposure down to very low levels. For a period of time we actually went to a low of negative 4%, but we don't generally tend to go that short.

It's now at 22% so we have built it back up, but not quite to the highs that we had previously. The key input last year was really the ability to go outright short on fixed income, predominantly in the US.

How have you rebuilt your equity exposure this year?

We bought a reasonably even split between S&P 500 and Euro Stoxx. The US market is the largest market in the in the index – around 60% depending on which one you use – so we wanted to take exposure through S&P futures, and its rally has surprised most people including ourselves.

I don't think stocks are cheap, but if you avoid a recession and a material fall in earnings, equities can still generate a positive return for investors.

The S&P’s rally was led a handful of companies – does that concern you?

That level of concentration is always a concern and I would like to see a broadening of those returns across a wider number of companies and sectors.

You’re starting to see some of that. but that high concentration in a small number of relatively large companies is not the sign of a healthy market.

What drove performance over the past year?

Equities have helped, but the key drivers have still been fixed income. We’ve since closed our position in short US rates but that was a key driver which generated almost 2% for the fund.

A more recent driver that we still have a position in is short Japan rates – we view the Bank of Japan as being behind the curve, so it will be forced to be more aggressive in terms of ending its yield curve control policies.

That exposure has performed very well for us since we added that position in February last year. A bigger contributor for us over the past year has actually been long UK government bonds.

We started to buy UK bonds after the mini-Budget fiasco and added government bonds again this year, and they’ve added 75 basis points to fund performance over the past 12 months.

What were the main detractors over that period?

One area where we have lost money has been in commodities. We have a small position in copper which has cost the portfolio 25 basis points over the past year.

The most disappointing has been the performance of value equities, which was the biggest detractor, costing us about 1.25 percentage points.

We screen the US and the European equity markets for companies with relatively low valuations and build a basket that we short the market against. That strategy hasn't worked and it’s actually lost us money.

How did value investing disappoint you?

That was most disappointing because we were surprised that in a world where interest rates are higher, we expected value equities to do much better than they have.

We had an allocation to value last year that worked reasonably well, but everything that did well last year has effectively done poorly this year and vice versa.

We expected value companies to do better against the broad market given a rising interest rate environment but we haven't seen that materialise so far.

We've retained those positions because, while the market has focused on a couple of key themes that have played out well for growth, our view is that value will start to come through again when it becomes clear that interest rates will remain higher for longer.

Could that be bad for your S&P holdings?

I don’t buy into the AI story that has driven equity markets. It’s going to change a lot of people's lives and have a big impact in the workplace, but it reminds me too much of the tech bubble.

Everyone was excited by how the internet was going to change the world – which was correct – but the majority of people lost a lot of money by investing into those names because they paid too much for future growth.

AI is going to revolutionise a lot of things, but it’s very difficult to make money from that as an investor because you’re running the risk of either overpaying, or you're just simply not going to be able to identify the successful names.

What are your interests outside of fund management?

I've got loads of them – I brew beer, I play football, I go cycling, I run... if you don't have lots of interests outside of being a fund manager you’d probably go mad because it’s a really intense role.