Multi-asset investing can be complicated. With a plethora of asset classes to choose from and even the potential to short stocks, investors can become overwhelmed by the sheer range of options and the dichotomy in returns on offer from fund groups.

For Simon Nichols, co-manager of the £3.6bn BNY Mellon Multi-Asset Balanced fund, “simplicity is underrated”.

“We try to keep our portfolio transparent – we don’t use any derivatives or more complex instruments,” he said, instead sticking to a more traditional pairing of equities and bonds.

The fund currently invests around 73% in global equities, 18% in bonds – specifically UK gilts and US treasuries – with the remainder in cash.

He uses a bottom-up approach, making sure that each investment in the portfolio “really speaks to each other”.

“We want to make sure that each individual component plays its role within the portfolio,” said Nichols.

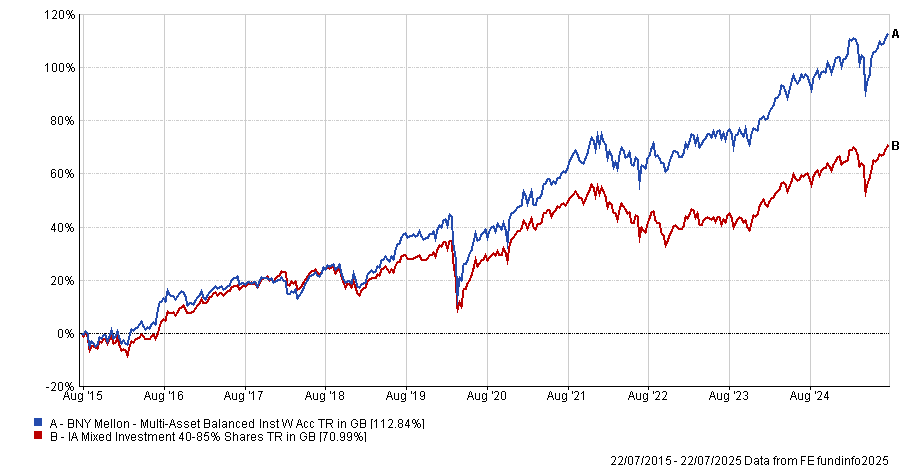

Simple has proven to be effective, with the fund logging a top-quartile performance against its sector over one, three, five and 10 years, managing a 112.8% total return over the decade.

Performance of BNY Mellon Multi-Asset Balanced vs the sector over 10yr

Source: FE Analytics

Below, Nichols explains why he doesn’t trade short-term anomalies, how disruption is the most exciting and worrying thing for fund managers and why he still believes in life sciences despite the sector failing to rebound since Covid.

What is BNY Mellon Multi-Asset Balanced fund’s process?

We take a long-term view which, for this fund, means we don’t do a lot of trading. We look to invest in companies that we think have got a future-facing business model and we try to steer away from those companies that have perhaps got a more challenged structural backdrop. We are not looking to trade any kind of short-term valuation discrepancies that may appear in markets.

We also try to invest with conviction. We want our investment to make a difference. We have maybe 50 to 60 individual equity positions in the portfolio at any one point in time.

We try to have a consistency of approach which investors can understand. We also have the flexibility to invest anywhere, which has helped us stand the test of time with this portfolio.

What have been some of your best calls recently?

Over the past 12 to 18 months, equity markets have performed better than bond markets. If we look at our portfolio from a sectoral point of view, we were really helped by this and we think we are overweight relative to our peers.

GE Vernova has done really well for us – it was spun out of GE last year. It manufactures gas turbines for electricity generation, among other things. This is a play on the new technology wave and artificial intelligence (AI) – AI especially needs a lot of power and gas is a good transition fuel.

I think the market had thought that perhaps this was not going to be a company that could grow a lot, but it turns out there is an awful lot of demand for power.

It has been a strong contributor to returns between June 2024 and 2025 with GE Vernova’s share price increasing by 185% in GBP terms.

At the end of 25 June, the company had a 1.9% in the fund.

And your worst?

On the negative side of things is a company called Danaher, which is a US-listed company operating in the life science space.

We have held it for maybe two or three years now and found that the life science industry has not started to recover significantly from the very strong period it had through Covid-19. The market has been a little bit disappointed with the pace of recovery within Danaher.

Over the 12-month period to 30 June of this year, Danaher’s share price declined by 27% in GBP terms.

However, we have used that weakness to increase our holding – taking the long-term view, we tend to want to use weakness, if we still believe in a company, to increase our position. At the end of 25 June, it was a 1.1% position in the fund.

What is exciting you about investing at the moment?

The thing that both excites and worries us the most is the amount of disruption we’re seeing. The potential for future disruption also seems to be at very elevated levels. Of course, there will be winners from that disruption and there will be losers.

What do you do outside of fund management?

I’m a keen runner. I do think it’s important to get away from the desk and the screens to maintain perspective.

Over the shorter term, I’m teaching my daughter to drive, which is taking up a lot of my free time at the moment and is quite the experience.