Investors are often told that the longer they can hold a fund for, the greater the total return can potentially be. With that in mind, it makes sense for investors with a long time horizon to hold high-growth names that have a greater chance of making them more money.

Trustnet asked four experts for the best funds that investors should add to their portfolios as early as possible and there was a common theme throughout.

Every fund recommended by each of the experts was predominantly invested in companies with high-growth prospects. Take City Asset Management’s head of managed portfolio service Louis Tambe’s pick for example.

As its name suggests, the Tellworth UK Smaller Companies fund invests solely in small-cap businesses, meaning those companies in their early stages that have a long runway for future growth.

The £167m fund run by FE fundinfo Alpha Managers John Warren and Paul Marriage alongside James Gerlis focuses on the smallest companies in the UK, with only 10.7% of its holdings having a market capitalisation above £1bn.

Tambe said: “Small-caps are an area where it can be important to get exposure very early on in your investing journey, such as in your SIPP with a multi-decade time horizon.

“Most empirical evidence shows that, over the long-term, investing in small-caps generates higher performance, although it can come with higher volatility.”

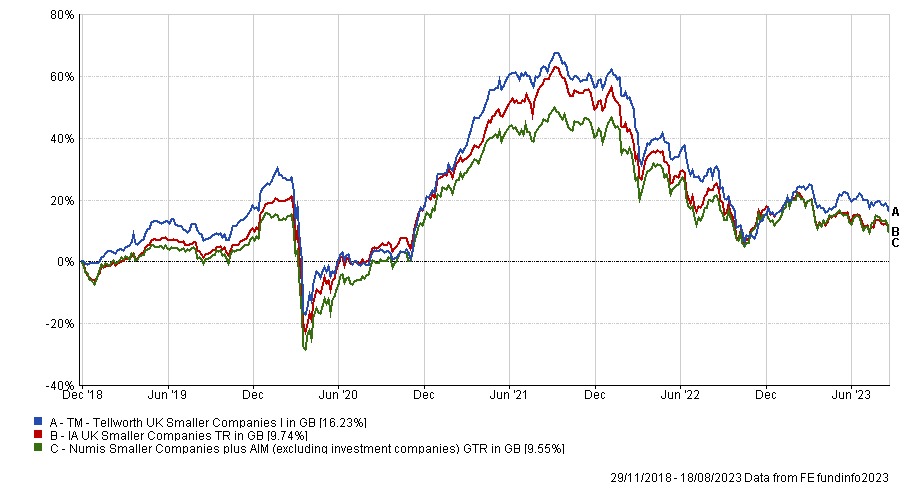

Since launching the fund in 2018, Tellworth UK Smaller Companies is up 16.2%, beating the average IA UK Smaller Companies portfolio by 6.5 percentage points.

It managed to beat the peer group despite the challenging environment facing UK small-caps for most of its history – high inflation and rising interest rates hit smaller companies harder than larger businesses, yet Tellworth UK Smaller Companies pulled through with a positive return.

Total return of fund vs sector and benchmark and sector since launch

Source: FE Analytics

Tambe added: “UK small-caps have been out of favour compared to large-caps in the recent past, which suggests it could be a good buying point for an investor with a long time horizon.”

Investors wanting exposure to companies with a long growth horizon on a global scale may want to look at Baillie Gifford Positive Change.

While not all its holdings are small in size, Rob Morgan, chief investment analyst at Charles Stanley Direct, said they have “exceptional growth themes” if investors are willing to hold it for the long term.

Thanks to these high-growth themes, the £2.3bn fund performed three times better than the IA Global sector since launching in 2017, soaring 191.4% while its peers climbed 63.4%.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

Nevertheless, Morgan did note that this high growth does come with a greater level of volatility. Baillie Gifford Positive Change had a racing start but returns are down 32.4% since its peak in 2021.

Tighter monetary condition hit Baillie Gifford’s high-growth strategy more than most, with the average IA Global fund sinking just 6.3% over that same period.

Morgan said this higher volatility leads to higher returns over the long term, so investors should start buying the fund early if they have a long time to invest.

Total return of fund vs benchmark and sector since peak

Source: FE Analytics

“Taking significant stakes in immature businesses whose success can be binary in nature is part and parcel of this fund’s approach,” he explained. “The associated volatility generally means it is best placed on the fringes of a diverse portfolio for most investors.

“However, for those with a really long-term horizon, and the ability to build a position little but often, it could make an excellent long-term investment.”

Investors looking for a high-growth portfolio with an environmental, social and governance (ESG) may also want to consider Janus Henderson Sustainable Future Technologies, according to Gavin Haynes, co-founder of Fairview Investing.

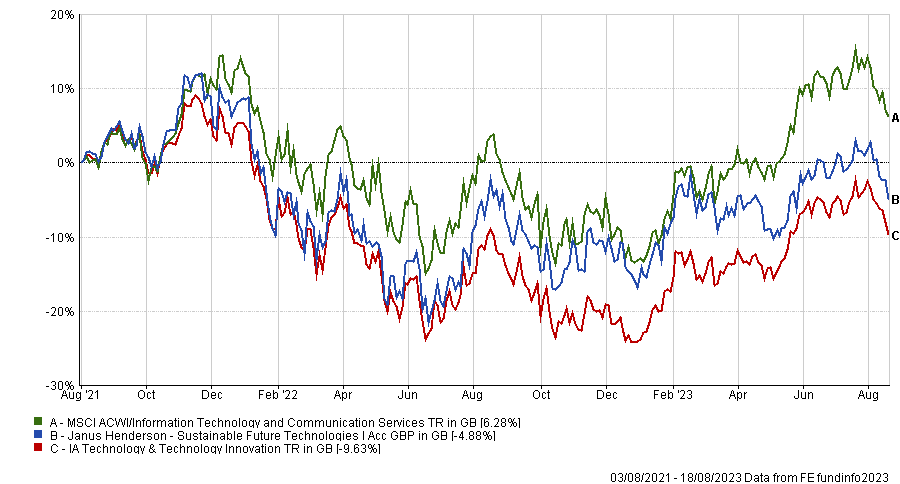

It was launched as growth investing took a turn for the worst in 2021, but its performance since then has been more resilient than its peers.

Janus Henderson Sustainable Future Technologies fell 4.9% while the IA Technology & Technology Innovation sector average was down a more sizable 9.6%.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

Haynes credited the fund’s durability in an otherwise “hostile climate for tech and sustainable theme stocks” to manager Richard Clode’s investment approach.

He puts a strong emphasis on valuations and not overpaying for high-growth names unlike many other funds investing in technology, which has protected investors from the worst of the market conditions, while its mid-cap bias is in the “sweet spot” for growth names.

Alternatively, Darius McDermott, managing director of Chelsea Financial Services, suggested long-term investors look at Federated Hermes Global Emerging Markets SMID Equity.

He said emerging markets and smaller companies are the two highest growth areas that can increase wealth the most over the long term and this fund combines the two.

“Both are high on the risk scale, but both also offer the potential for significant growth over long periods of time,” McDermott added.

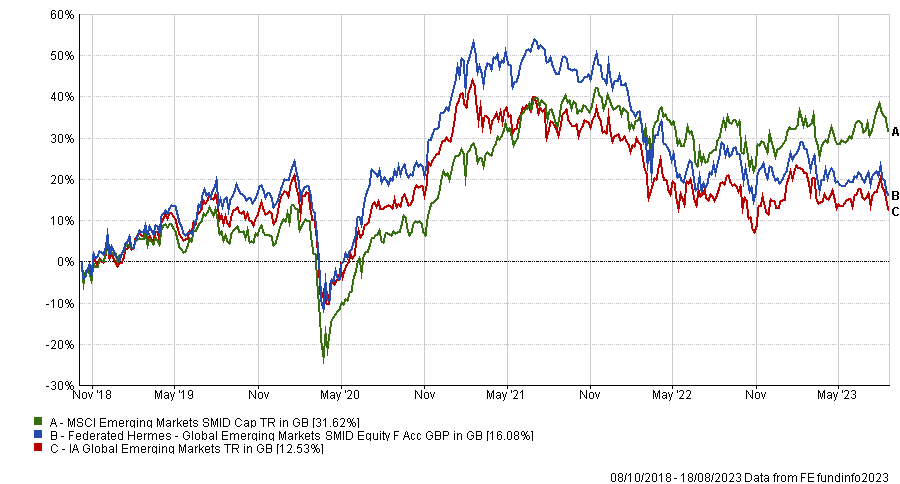

The £278m fund is up 16.1% since inception in 2018, surpassing its peers in the IA Global Emerging Markets sector by 3.6 percentage points.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

McDermott noted that manager Kunjal Gala’s freedom to invest across a broad set of themes and geographies also gives the fund a unique advantage.

“The comprehensive process of the fund helps to manage the potential pitfalls and the manager has identified certain themes that he believes will drive growth in the asset class over the years to come, including 5G, the digitalisation of the economy and improving financial requirements for the burgeoning lower middle class,” he said.