Blue Whale Capital’s Stephen Yiu, Comgest’s Franz Weis and Richard Hodges from Nomura have been added to the FE fundinfo Alpha Manager Hall of Fame in 2025.

Yiu has been the sole manager of the £1.3bn WS Blue Whale Growth fund since its launch in 2017, having previously worked on funds at Hargreaves Lansdown and Artemis.

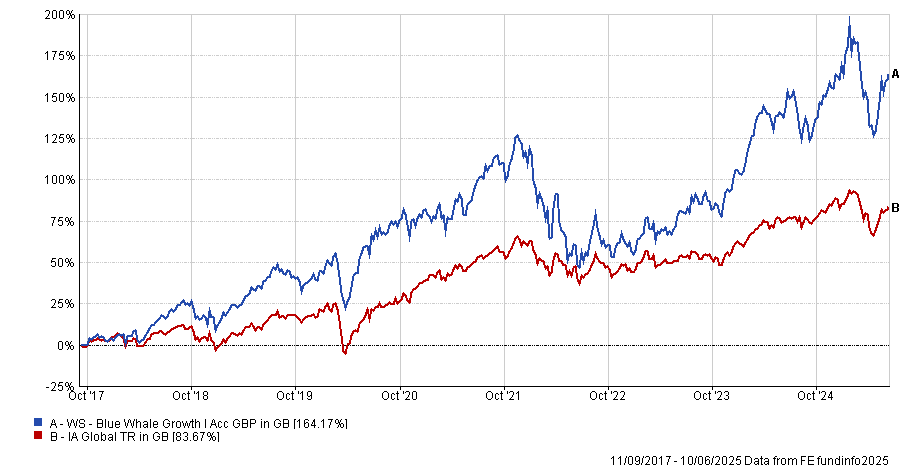

Since its launch, the fund has achieved a 164.2% return, the seventh-best in the IA Global sector, as shown in the chart below. It is also a top performer over shorter timeframes, including cracking the top 10 of the peer group over three years.

Performance of fund vs sector since launch

Source: FE Analytics

He runs the portfolio with an out-and-out growth approach – with chipmakers Nvidia and Broadcom, and taxi firm Uber, among its top holdings.

Weis runs Comgest’s seven European strategies, with his longest tenure on the Comgest Growth Europe Opportunities and Comgest Growth Europe, which he has run since 2009.

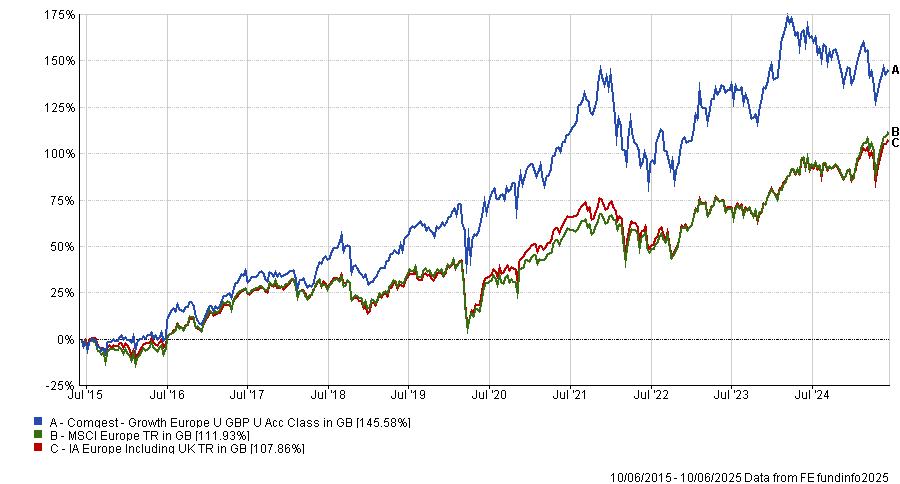

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The Growth Europe fund is his largest strategy by some distance, with £3.9bn in assets under management. While it has struggled over the past half a decade, its long-term returns are impressive, with the fund up 145.6% over 10 years – the ninth-best performance in the 63-strong IA Europe Including UK sector.

Industry veteran Hodges meanwhile is the only bond manager on the list. He has run the £1.6bn Nomura Global Dynamic Bond fund since its launch in 2015, having previously been at Legal & General Investment Management (LGIM).

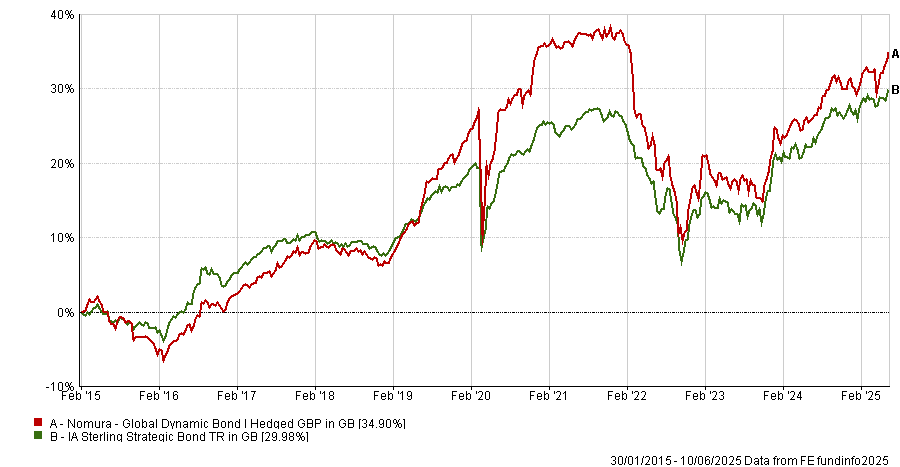

During this time it has made 34.9%, around 5 percentage points ahead of the IA Sterling Strategic Bond sector, as the below chart shows.

Performance of fund vs sector since launch

Source: FE Analytics

Analysts at FE Investments rate the fund. They said: “We consider Hodges to be one of the most successful and proven fund managers for managing flexible global bond strategies such as this.

“His departure from LGIM took us by surprise as we previously recommended the LGIM Dynamic Bond fund. His move to Nomura was considered a gamble as the firm does not have a strong reputation for bond investing, but he has successfully built a diverse and experienced team around him to support in building a portfolio that accurately reflects their views.”

The Hall of Fame is made up of managers who have held the coveted Alpha Manager rating for seven years or more.

Alpha Manager ratings are awarded to the top 10% UK retail-facing managers based on their entire career performance. It centres around three main factors: risk-adjusted alpha; consistency of outperformance versus the benchmark; and performance in both rising and falling markets.

Managers with longer track records of delivering strong performance receive additional weighting to reflect the value of their experience and resilience through market cycles.

Charles Younes, deputy chief investment officer at FE fundinfo, said: “The Alpha Manager Hall of Fame recognises those whose performance is not only impressive, but enduring.

“These managers have weathered multiple market regimes, from the global financial crisis to Covid-19 and more recent geopolitical upheavals, while delivering consistent, risk-adjusted returns. Their ability to outperform in both calm and volatile conditions makes them exceptional.”

The list has shrunk this year, down to 41 from 46 in 2024. Liontrust’s Julian Fosh, Fidelity’s Leigh Himsworth and Jeremy Podger and Jupiter’s Daniel Nickols all retired last year.

Meanwhile Luke Kerr, who had been an Alpha Manager, left Jupiter after the firm restructured its small- and mid-cap equities team. All have been excluded from the Hall of Fame as they are no longer eligible for the Alpha Manager title.

Bond manager Ariel Bezalel, UK small-cap specialist Chris Hutchinson and global quality investor William Lock – from Jupiter, Unicorn and Morgan Stanley respectively – all lost the Alpha Manager title in the latest rebalance earlier in 2025, bringing an end to their time in the Hall of Fame.