Markets followed the UK weather in August by disappointing investors as few asset classes made any meaningful gains over the course of the past month while some dropped heavily.

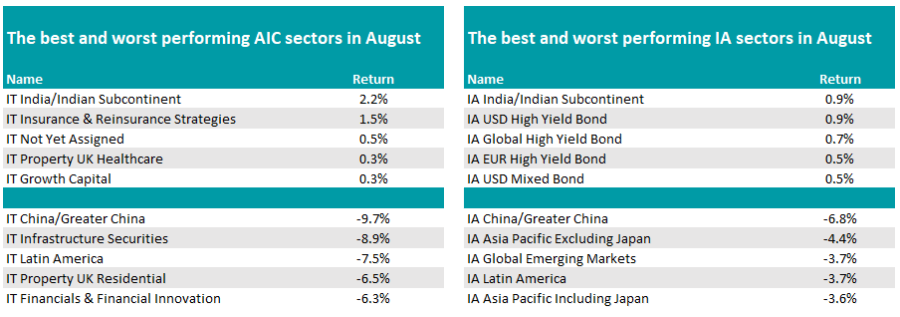

Those who managed to get away for a holiday will return to see their portfolios barely moved, or at worst down by single digits, after a month in which the best returning Investment Association sector – IA India/Indian Subcontinent – managed a paltry 0.9% gain.

It was followed by a host of bond funds, which were the only areas able to eke out a return above 0.5% for the month, as the below table shows.

Things weren’t much more impressive across the investment trust universe, with the IT India/Indian Subcontinent sector topping the pile, up 2.2%, while IT Insurance & Reinsurance Strategies was the only other with a gain above 1%, with the two trusts in the peer group making an average return of 1.5%.

Source: FE Analytics

Most of the major moves came at the negative end. In the fund world, China dragged any associated asset classes lows, with the IA China/Greater China sector losing 6.8%.

IA Asia Pacific Excluding Japan, IA Global Emerging Markets and IA Asia Pacific Including Japan all joined it in the worst five sectors of the month.

The country is reeling from another major property crisis. Property titan Evergrande filed for bankruptcy having previously defaulted on its loans in 2021 while Country Garden, another real estate giant, is also suffering. The latter is one of the largest Chinese private property developer and recorded losses of £5.3bn in just the first half of 2023.

Ben Yearsley, director at Fairview Investing, said: “In anticipation, the People’s Bank of China has started stimulating the economy with various rate cuts. Market watchers are keeping a close eye on the Chinese property sector as, if that implodes, markets both in the Far East and globally will be extremely messy.”

The IT China/Greater China was the worst performer in the Association of Investment Companies space, down 9.7%, while there were also large losses for property and infrastructure portfolios.

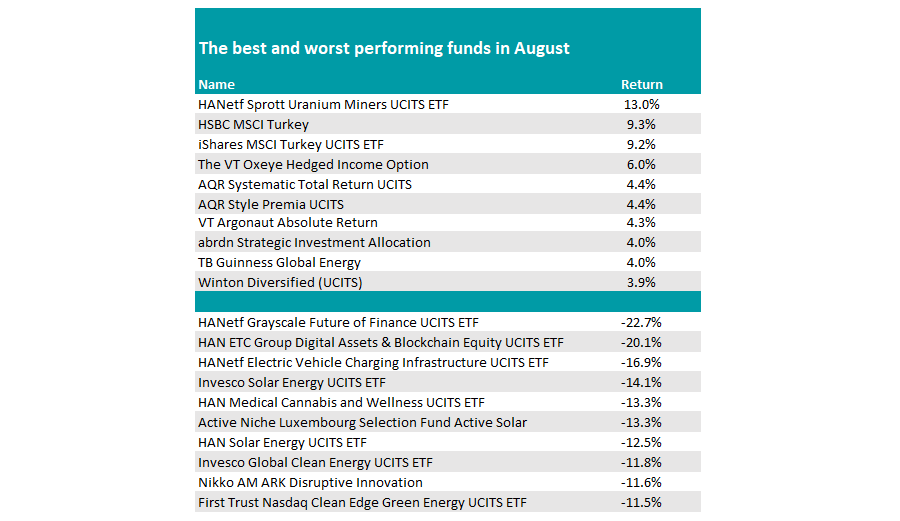

Turning to individual funds, it was an eclectic mix at the top of the charts, with HANetf Sprott Uranium Miners UCITS ETF, up 13%, leading the way.

Turkey also had a good month with both HSBC MSCI Turkey and iShares MSCI Turkey UCITS ETF making gains north of 9%.

Conversely, renewable energy – and in particular solar power funds – took the brunt of the falls, with half of the 10 worst performers investing in clean energy.

Source: FE Analytics

Yearsley said: “Looking at individual funds now and there was no clear trend last month. Despite the India sector topping the tables, there were no India funds near the top 10 (or top 20). In fact, the only real trend was energy funds doing well on the back of a stable oil price.

“[At the foot of the table] there was no discernible reason for clean energy performing so poorly last month but a variety of funds were at the foot with Active Solar the worst.”

The worst performer, however, was HANetf Grayscale Future of Finance UCITS ETF followed by HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF, with losses of 22.7% and 20.1% respectively.

Source: FE Analytics

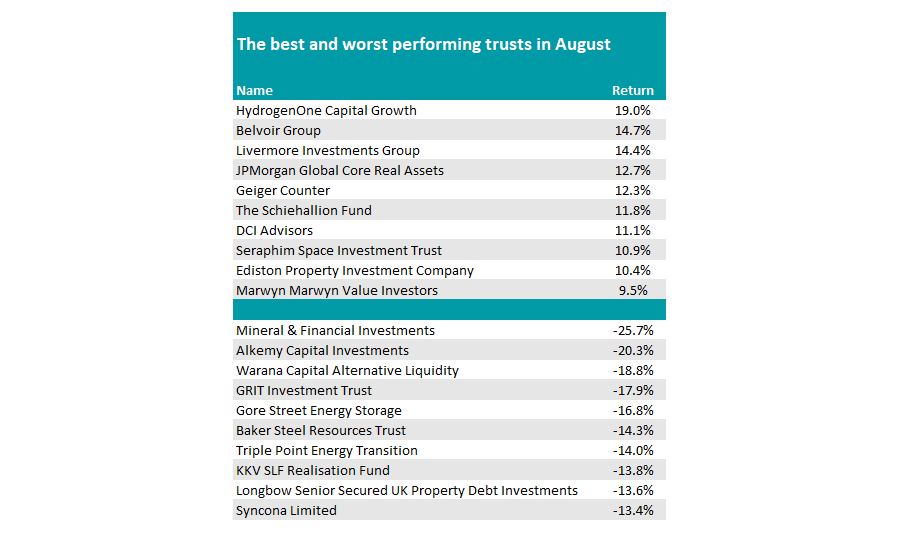

On the trust side, the mix of investment companies at the top and bottom end in August were equally as muddled. Prominent names such as JPMorgan Global Core Real Assets and Baillie Gifford’s The Schiehallion Fund were among the top 10, while the best return was made by HydrogenOne Capital Growth, up 19%.

Leading the fallers was Mineral & Financial Investments, down 25.7%, while healthcare specialist Syncona snuck in 10th place with a loss of 13.4%.