The 2007-2009 global financial crisis was the most serious financial collapse since the Great Depression of 1929. To restart the economy, quantitative easing was widely applied, opening an era of essentially free money and low interest rates that have propped up the S&P 500 ever since.

Some 15 years on, the US index has been almost invincible, dwarfing the returns of all other major markets, with managers of US equity strategies themselves struggling to beat their own benchmark.

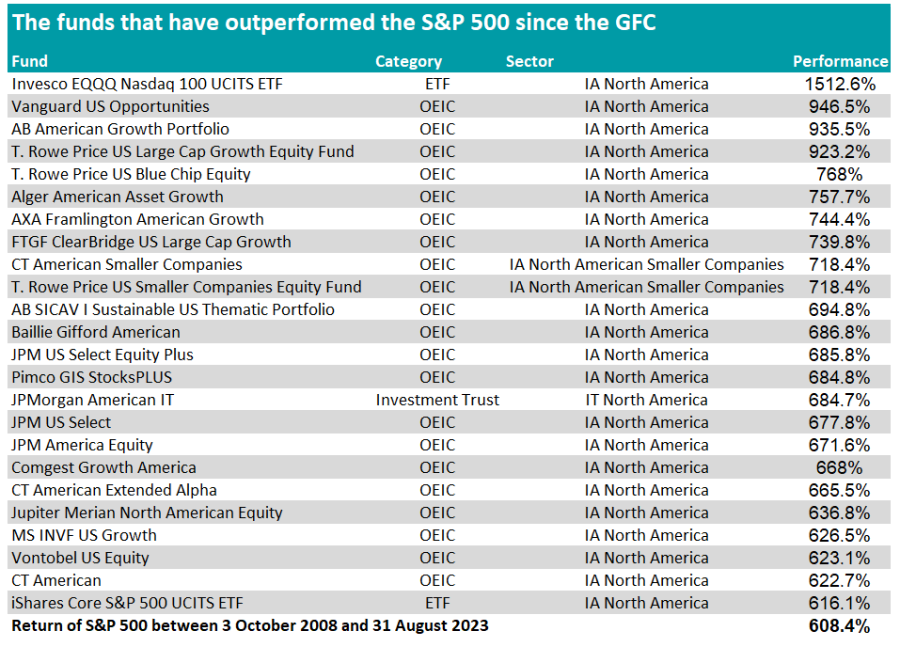

Below, Trustnet looked at the few funds and trusts in the IA North America, IA North American Smaller Companies, IT North America and IT North American Smaller Companies sectors that have done better than the S&P 500 between 3 October 2008, when the Emergency Economic Stabilization Act of 2008 was signed, and 31 August 2023.

The funds that have outperformed the S&P 500 since the GFC

Source: FE Analytics

The best performer in that period has been a passive fund, Invesco EQQQ Nasdaq 100 UCITS ETF, which has returned 1,512.6% over 15 years.

The fund tracks the performance of the Nasdaq 100 index, which has beaten the S&P 500 thanks to its larger technology weighting.

Among active funds, Vanguard US Opportunities has been the largest outperformer, returning 946.5% since October 2008.

The fund predominantly invests in the healthcare sector, followed by information technology and industrials. Its three largest holdings currently are Eli Lilly & Co, Tesla and NEXTracker.

Performance of fund vs sector and indices between 3 October 2008 and 31 August 2023

Source: FE Analytics

The second best performing active fund has been AB American Growth Portfolio, which holds 57 stocks with the top 10 making up 45% of the portfolio.

Ben Yearsley, director at Fairview Investing, said: “It’s clearly a high growth fund more closely correlated to Nasdaq and Russell 1000 Growth and not the S&P500. It isn’t too much of a surprise it has beaten the S&P 500 as the manager’s style has been in vogue for most of the period.”

Performance of fund vs sector and indices between 3 October 2008 and 31 August 2023

Source: FE Analytics

T. Rowe Price US Large Cap Growth Equity Fund is the third largest active outperformer, as it has returned 923.2% over 15 years. The top 10 holdings account for 50% of the portfolio with popular names such as Apple at 9.77% and Microsoft at 9.67% the largest weightings in the fund.

Yearsley said: “It’s beaten the S&P comfortably over the period. However, it’s underperformed NASDAQ significantly as well as the Russell 1000 Growth.”

He questioned whether the fund has been as strong as its numbers appear, however, as “it feels like a tech fund and looks like one”, but has failed to beat the tech-heavy indices.

Performance of fund vs sector and indices between 3 October 2008 and 31 August 2023

Source: FE Analytics

Two other funds have also beaten the S&P 500 in the same period, including T. Rowe Price US Blue Chip Equity and T. Rowe Price US Smaller Companies Equity Fund, with the latter belonging to the IA North American Smaller Companies sector.

Darius McDermott, managing director of Chelsea Financial Services, said: "T. Rowe Price is one of the best active investment houses in the US that has a long and consistent track record of adding value for investors. It typically has a growth bias but T. Rowe Price US Smaller Companies Equity Fund also has a balanced core approach with addition of some value names.

“Clearly Curt Organt and the large team of analysts at his disposal have continued in this vein of providing investors with value by outperforming the sector by just under 16% since he took the helm in March 2019."

Performance of fund vs sector and indices between 3 October 2008 and 31 August 2023

Source: FE Analytics

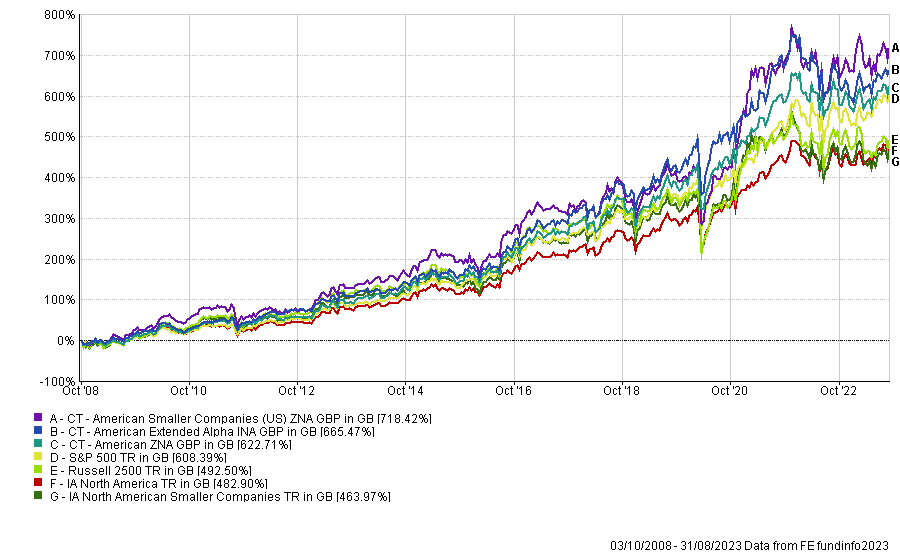

Another outperformer in the IA North American Smaller Companies sector in the same period has been CT American Smaller Companies. The fund typically invests in 80 US small-caps or fewer and is managed by Nicolas Janvier.

Two other funds managed by Janvier also feature among the outperformers, CT American Extended Alpha and CT American, which are both part of the IA North America sector.

Performance of funds vs sectors and indices between 3 October 2008 and 31 August 2023

Source: FE Analytics

Finally, JPMorgan American IT was the only investment trust in both the IT North America and IT North American Smaller Companies sectors to outperform the S&P 500 since the financial crisis, returning 684.7%.

Rob Morgan, chief analyst at Charles Stanley, said: “Oddly, there aren't many investment trust options for dedicated exposure to the US market and most of those available are specialist or highly concentrated in a particular style.

“JPM American is a sensible, core option that blends both growth and value stocks and has highly experienced and well-resourced managers. It also comes with low charges for an active investment and can add value through deploying some modest gearing to boost returns.”

Performance of trust vs sector and benchmark between 3 October 2008 and 31 August 2023

Source: FE Analytics

Other S&P 500 outperformers from JP Morgan include open-ended funds JPM US Select Equity Plus, JPM US Select and JPM America Equity.