Savers planning on a comfortable retirement should not eschew high-growth companies entirely in favour of lower-risk options when they finish work, according to experts, as there is still a long time to invest.

The average life expectancy for a 65-year-old is currently 84 for men and 87 for women. Someone who lives until 84 – 18 years after an assumed retirement at 66 years old – will require a pension pot of £212,000 for a moderate retirement and £452,000 if they plan to live comfortably in their post-work years, according to data from interactive investor.

It used the Pension And Lifetime Savings Association’s guide, which suggests single retirees need a private pension income of £15,383 for a moderate retirement and £32,882 for a comfortable one.

However, someone living to 100 will need considerably more, with a nest egg of between £324,000 and £692,000 required – a difference of between £112,000 and £240,000 compared with the 84-year old.

Alice Guy, head of pensions and savings at interactive investor, said: “With more of us living for longer it’s difficult to know how long our pension needs to last. Live until you’re 100 and you could need, £240,000 more than if you lived until 84 years old. And running out of money could mean relying on just the state pension, which will only be enough for a no-frills, frugal retirement.”

It may be an almost impossible task for some to accrue the almost £700,000 required for a modest retirement until their centenary year, but another option is available – continuing to build wealth throughout.

While some will move their savings into lower-risk assets and draw down their income, experts suggested keeping a part of the retirement pot in higher-risk assets that can grow over time.

Simon Evan-Cook, manager of the VT Downing Fox funds range, said inflation was the biggest threat to retirees, particularly today, where year-on-year price rises are far above the Bank of England’s 2% target at 6.8%.

He suggested going for a global equity portfolio, which would reduce the threat of one market leading scuppering returns, and said he would pick a “well-run active fund” over a global tracker.

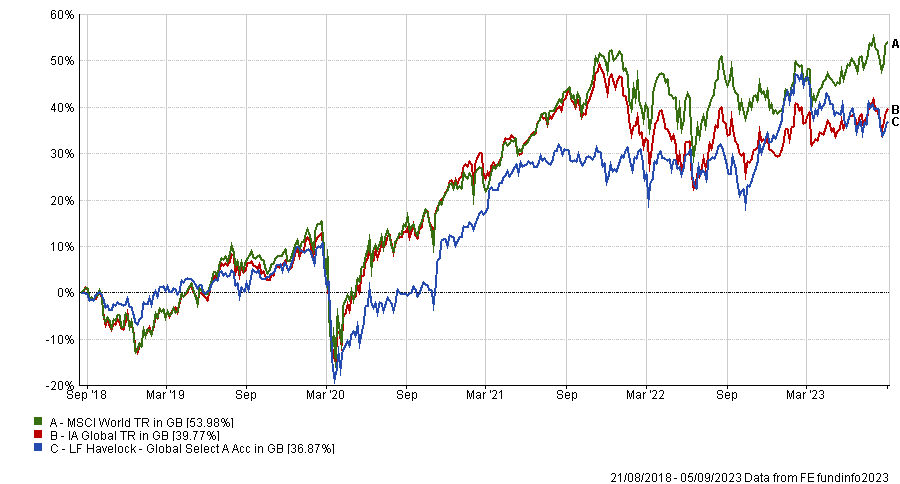

“On this basis, I think the LF Havelock Global Select fund, run by Matthew Beddall, is a great option. It’s genuinely global, in so far as the manager will happily forgo a market or company if he thinks there’s a good reason to, while he also considers each company’s quality and valuation when setting the portfolio,” Evan-Cook said.

Launched in 2018, the £158m fund has made 36.9% since inception, slightly behind the average IA Global fund (up 39.8%) and lagging the MSCI World index (54%).

Performance of fund vs sector and MSCI World index since launch

Source: FE Analytics

However, the fund has around half the US weighting of the index and very little in technology, which has been a headwind in 2023 as tech names – particularly in the US – have soared on the back of a rise in artificial intelligence (AI).

Rory Maguire agreed with Evan-Cook, noting that “anyone with a time horizon of 10 years or more should be considering equity investments”.

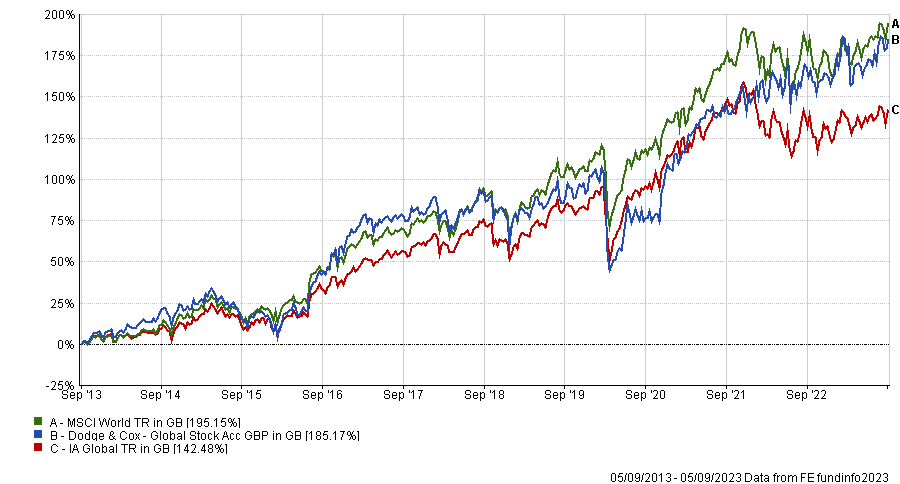

“Our pick would be the Dodge & Cox Global Stock fund, which has a good long term track record and is reasonably priced,” he said.

The $4.7bn fund has beaten its average IA Global peer over the past one, three five and 10 years. It has beaten the MSCI World index in recent times, but lags the index over the decade.

Performance of fund vs sector and MSCI World index over 10yrs

Source: FE Analytics

Analysts at Square Mile also like the fund, giving it an ‘AA’ rating. They noted the portfolio typically has more of a “value bias” but that it was “not completely at the mercy of this style of investing”.

“It is worth noting that due to the longterm nature of the investment approach and significant focus on valuation, the fund's return profile can exhibit periods of heightened volatility versus the wider global equity market. Nevertheless, our view is that over a full market cycle investors should be well rewarded on a risk-adjusted basis,” they said

Another global option is Orbis Global Equity, selected by Gill Hutchison, research director at The Adviser Centre. The £124m portfolio has been a top-quartile performer in the IA Global sector over one and three years and has beaten peers over five and 10 years as well.

“The fund is unconstrained by the benchmark and the team manages it with a patient, long-term investment horizon and a focus upon mis-priced companies,” she said.

“Orbis Global Equity’s shorter-run investment journey is not without its challenges but for an investor who is more interested in the future outcome we think it is an attractive option.”

Overall, Guy said retirees should aim for a mixture of funds covering a range of investing risk, meaning a balanced portfolio remains crucial even in our latter years.

“With many of us living for longer it’s also important to consider investing for growth as well as income,” she said, although both will be critical.

For the high-growth part of the portfolio, she noted that many will choose a global tracker, which will invest in the world’s biggest companies such as Apple and Microsoft.

“Another option could be a growth-focused investment trust or fund, such as Terry Smith’s Fundsmith Equity or Jupiter Merian North American Equity,” Guy added.

Performance of funds vs MSCI World index over 10yrs

Source: FE Analytics

They have both beaten the MSCI World index over 10 years – the comparable option most investors use, according to Guy – with the former up 308.7% over a decade, while the latter gained 293.9%. Both are in the top quartile of their respective sectors – IA Global and IA North America – over this time.

Guy added that retired pension savers often “focus on investing in funds that pay a healthy dividend income” and should also consider investment trusts that have achieved Association of Investment Companies (AIC) ‘Dividend Hero’ status for increasing their payouts over at least 20 years.

“They include Merchants Trust, City of London and JPMorgan Claverhouse, all with historic yields of above 5%,” she said.

However, if picking individual funds and portioning out a portfolio is too much, a “super simple” retirement option is to buy a ready-made fund that invests in a mixture of equities and bonds such as the Vanguard LifeStrategy 60% Equity portfolio, which invests 60% in equities and 40% in bonds.

This will keep investors accruing wealth in their retirement, although lower-risk options are also available depending on an individual’s ability to stomach losses.