Investment trusts and open-ended funds both have their pros and cons but there are clear areas where one is better than the other, according to research by Trustnet.

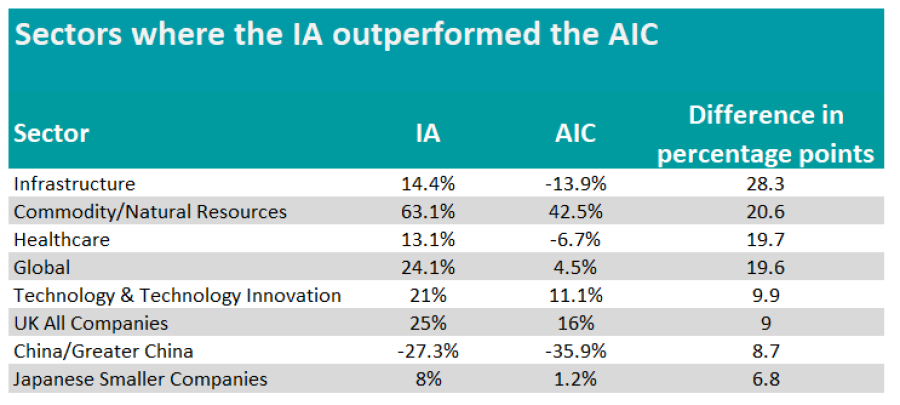

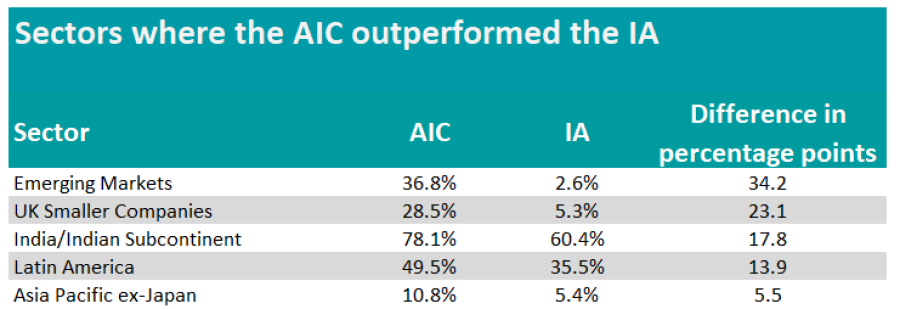

Below we look at the performance of equivalent Association of Investment Companies (AIC) and Investment Association (IA) sectors over three years to see where each structure has done better.

We concentrated on those where the difference between the two was at least 5 percentage points – giving investors a material benefit for investing in one or the other.

Where funds have trounced trusts

Open-ended funds have done better than their close-ended rivals in popular sectors such as Global and UK All Companies. For instance, the IA Global sector returned 24.1% over three years, while the AIC equivalent made 4.5%.

Ben Yearsley, director at Fairview Investing, said much of this can be attributed to the difference in the number of constituents in the two sectors.

“With only 13 trusts in the AIC global sector and three of those from Baillie Gifford, it’s no wonder they’ve underperformed the IA equivalent,” he said.

“There is a broad spread of styles represented but if one quarter has had a shocker then it’s hard to recover from that.”

Sectors where the IA outperformed the AIC

Source: FE Analytics

The gap between the IA and IT UK All Companies sector was narrower, with a difference of 9 percentage points. The AIC sector is relatively small, with a pronounced bias toward mid- and small-caps, which have underperformed large-caps over the past three years.

James Yardley, senior research analyst at Chelsea Financial Services, added: “It is also not surprising that many trusts have this mid- and small-cap bias since the investment trust closed-ended structure is more appropriate for investing in these less liquid holdings.”

Outside of these two mainstream peer groups, in the healthcare sectors funds have performed significantly better than trusts, returning 13.1% versus 6.7%.

Although the best portfolio across both universes was an investment trust, Polar Capital Global Healthcare Trust, the remaining members of the IT Biotechnology & Healthcare dragged down the sector average.

Yearsley said: “The AIC sector is mainly biotech, which has had a shocker over the past 18 months.”

The same pattern applies for infrastructure, with the IA sector returning 14.4% while the AIC equivalent fell 13.9%.

All investment trusts in the sector made losses, with the exception of 3I Infrastructure. Most trusts in this sector are purely renewable energy plays and have gone from large premiums of 20% or more to large discounts of 10% or more (although the widest is now 40% in some cases) as a result of rising interest rates.

Yearsley said: “ It has been beneficial to be diversified like 3i but I actually think there are many good opportunities in this sector today.”

Technology & Technology Innovation, Commodity/Natural Resources China/Greater China and Japan Smaller Companies are other sectors where funds outperformed their trust counterparts.

Where trusts have beaten funds

Trusts have generally fared better in more specialist areas, such as emerging markets where the gap between the AIC peer group and the IA one is the widest, with a 34.2 percentage points difference between the two sectors.

The performance of the IT Global Emerging Markets sector was boosted by portfolios such as Gulf Investment Fund and BlackRock Frontiers. The trusts invest in the Middle East and Frontier Markets respectively, making them less reliant on Chinese equities, which have collapsed in the past three years.

Sectors where the AIC outperformed the IA

Source: FE Analytics

Yet, the worst performing portfolio in that portfolio was an investment trust. JPMorgan Emerging Europe Middle East & Africa Securities, which was formerly known as JPMorgan Russia, has fallen 81.1% over three years as the Russian market collapsed following the country’s invasion of Ukraine.

Rob Morgan, chief analyst at Charles Stanley, said: “A significant part of the former portfolio is now effectively in limbo and currently assumed to be worthless, albeit there is a very outside chance of some recovery of value should the political situation radically change.”

Trusts have also significantly outperformed funds in most regional and country-specific emerging markets sectors such as Asia-Pacific ex-Japan, Latin America and India/Indian Subcontinent.

It should be noted that the IT Latin America sector only has one member, BlackRock Latin American IT, whereas the IA equivalent has 10.

UK Smaller Companies is another area where trusts have beaten funds, with the AIC portfolios returning 28.5% and IA funds 5.3%.

Yardley said: “The investment trust structure is generally better suited for investing in smaller companies, which are often very illiquid. There is a danger that if an open-ended manager is in outflow they become a forced seller of their holdings, which can drive prices and performance down further. This might explain some of the difference.”