Pension savers need to carefully consider how much they are saving every month, as putting the minimum amount into a workplace pension might not be enough for a ‘moderate’ retirement, according to research by interactive investor.

What a ‘comfortable’ retirement looks like will depend on expectations, but a study by the investment platform has put a number to it – £36,500 for a minimum retirement, £248,000 for a moderate retirement and £530,000 for a comfortable retirement, based on the 2022 Pensions and Lifetime Savings Association retirement living standards.

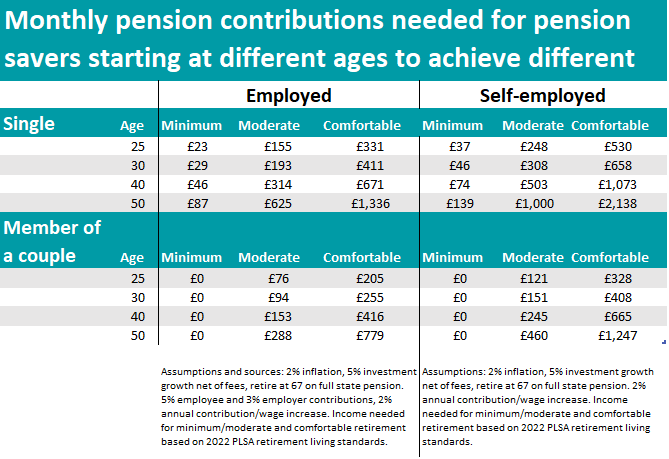

But these goals aren’t easy to achieve, especially if using a standard workplace pension scheme with minimum monthly contributions. It gets even harder for older savers, singles and the self-employed, who will need to save around 60% more than someone who is employed to achieve the same level of retirement.

A new pension saver aged 25 needs to save around £155 each month to achieve a moderate retirement, but that goes up £248 if self-employed. At 50, that’s £625 for employees and £1,000 for self-employed, more than four times as much, the report showed.

Source: ii

Auto-enrolment to a pension scheme has allowed many workers to better plan for their retirement, but that doesn’t mean that all the work is done, said Alice Guy, head of pensions and savings at interactive investor.

“Pension savers need to watch out because saving the minimum amount into your workplace pension might not be enough for a moderate retirement,” she said.

“A 25-year-old earning £30,000 who pays 5% of their salary into their workplace pension and receives 3% contributions from their employer would only be saving £125 each month into their pension themselves, which will fall short of a moderate retirement income.”

If your pension pot is lagging, Guy’s practical tips include boosting pension contributions by paying in more than the minimum amount, checking your pension and any ISAs at least once a year and seeing if you could save money and hassle by consolidating old pensions.

“Also, if moving jobs, take a look at your prospective employer’s pension contributions as well as the salary,” she added.

“Some employers pay in more than the minimum 3% required and a small percentage boost could make a big difference in retirement.”

In fact, this point could make an enormous difference, as the minimum employer contributions of 3% could leave the average UK worker £100,000 worse off during their working lifetime, as highlighted by another study carried out by wealth manager Quilter.

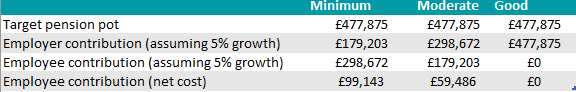

There is a stark difference between what a minimum and a good employer contribution scheme looks like.

The former offers the minimum auto-enrolment pension contribution of 8% of qualifying earnings (any pay between £6,240 and £50,270), of which 5% is deducted from the employee and 3% comes from employer contributions.

In a good pension scheme, however, the contribution is based on a non-contributory arrangement, whereby the employer makes the full 8% pension contribution based on qualifying earnings with no deduction from salary.

On an annual basis, a non-contributory pension scheme can significantly boost an overall remuneration package by over £1,400 when compared to an employer scheme offering only the minimum requirement, read the report.

A 22-year-old employee earning the average UK wage of £34,476 and receiving only the minimum employer pension contribution of 3% would have to sacrifice £100,000 of their salary over the course of their career in order to achieve the same pension pot (after growth) as someone with a good 8% non-contributory scheme who would pay nothing, as shown in the table below.

Source: Quilter

This is why Jon Greer, head of retirement policy at Quilter, recommended checking exactly what is being contributed towards your pension.

“We tend to focus on our salary and what we take home each month, but this doesn’t tell the full story. There is a huge difference between an employer paying the minimum pension contribution compared to one with a more generous scheme,” he said.

“Not only can this make a significant difference to your total remuneration package over the course of a year, and in the longer term your working life, but it can also have a real impact on your quality of life in retirement too.”