A well-diversified portfolio would struggle to avoid investing in North America, Europe and Japan , which are home to four of the five largest stock markets in the world and offer a breadth of companies and opportunities.

As such, Trustnet has researched the funds specialised in US, European and Japanese equities that would have made the most of £1,000 invested over five years.

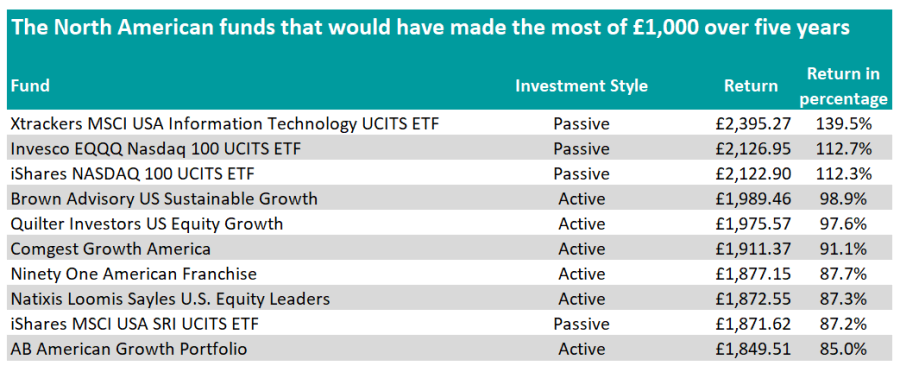

In the US, the best approach has been to hold a tracker aiming to replicate the performance of a technology index such as the MSCI USA Information Technology or the Nasdaq 100.

Over five years, Xtrackers MSCI USA Information Technology UCITS ETF has turned an initial £1,000 into £2,395.27, Invesco EQQQ Nasdaq 100 UCITS ETF £2,126.95 and iShares NASDAQ 100 UCITS ETF £2,122.90.

Ryan Hughes, head of investment partnerships at AJ Bell, said: “The rally in technology companies has been phenomenal for a long period and, while they had a sticky patch at the beginning of the rate hiking cycle, the recent focus on artificial intelligence (AI) has been another leg of growth which has come to the fore.

“For many years, technology companies have been viewed as a higher risk, satellite holding but given their weight in mainstream indices they are now very much at the core as they have entered every aspect of our lives.”

Hughes added that investors should mind the concentration risk which increases the risk of a sharp downturn should any of the big tech name falls out of favour with investors.

The North American funds that would have made the most of £1,000 over five years

Source: FE Analytics

A range of active funds would also have served investors well, although they all share an overweight in the information technology sector.

The one that would have returned the most to investors over the past five years is Brown Advisory US Sustainable Growth. The fund replicates the strategy of its older stablemate Brown Advisory US Equity Growth with the addition of an environmental, social and governance (ESG) filter.

Tom Sparke, investment manager at GDIM, said: “This fund resides in a rare cross-section of being both US and sustainable. Despite being a fund with higher volatility it’s growth approach has produced exceptional results in recent years.

“It is a concise fund with 36 concentrated positions that has managed to provide investors with much less volatility (especially on the downside) than its high-growth peers.”

Jason Hollands, managing director of Bestinvest, also found Natixis Loomis Sayles U.S. Equity Leaders worth noting due to its investment process.

He said: “Manager Aziz Hamzaogullari has enjoyed huge success both on this fund and the Loomis Sayles Global Growth Equity sister fund. Both have a distinctive well-articulated, long-term private equity-style investment process. This means they have very high bars on quality, long-term growth and value and want to work closely with management teams.

“Given this emphasis the fund is likely to outperform in volatile and growth markets but lag in more value-centric times. The largest stock in the portfolio currently is microchip group NVIDIA, which has been one of the major beneficiaries of the AI-driven rally.”

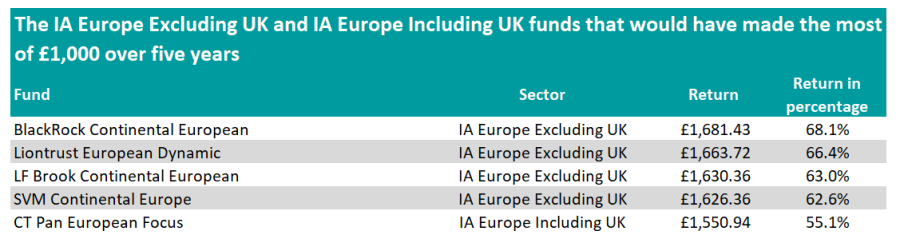

If the information technology sector has led the US market over the past five years, quality growth has been the dominant investment style in Europe over the same period.

This is perhaps best exemplified by Blackrock Continental European, which is managed by Stefan Gries and Giles Rothbarth.

Darius McDermott, managing director at Chelsea Financial Services, said: “Their primary emphasis is on investing in businesses with high and predictable returns with strong cash conversion. As a result, the fund typically has a bias to quality-growth stocks.

“Ideas are generated from screens, team analysts and external research. The final portfolio is usually between 35 and 65 stocks, which tend to be large-cap.”

The IA Europe Excluding UK and IA Europe Including UK funds that would have made the most of £1,000 over five years

Source: FE Analytics

Source: FE Analytics

Liontrust European Dynamic comes in a close second, with cashflow being at the core of this fund’s investment process.

Ben Yearsley, director at Fairview Investing, said: “Unusually the team isn't interested in seeing company management. Companies with a high cash flow yield are their area of focus as well as deep dives into report and accounts.”

CT Pan Euro Focus, managed by Frederic Jeanmaire, is the only fund in the list that includes the UK in its investment remit on top of the continental markets.

McDermott said: “Jeanmaire looks for companies that are unloved and have a share price that is not reflective of its prospects.

“The manager is not afraid to take large sector or individual company bets and the portfolio will typically be made up of less than 50 companies from across Europe (including UK).”

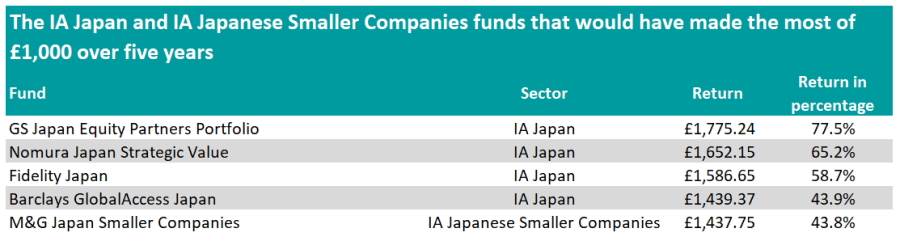

While there has been a leading sector in the US or a dominant investment style in Europe, there is no common denominator in Japan.

GS Japan Equity Partners Portfolio, led by Ichiro Kosuge, has been the fund that have returned the most to investors over five years.

Sparke said: “The manager concentrates on some of the key themes emerging in Japan, including automation and demographic trends.

“The fund’s performance has been impressively consistent, sitting in the top quartile on the sector in four of the past five years.”

Fidelity Japan is another fund that has put investors’ money to good use, although it has done so using a different approach to the previous fund.

Hughes said: “The fund has a strong five-year track record but this highlights the importance of doing proper due diligence rather than relying just on past performance.

“Fidelity Japan benefited from being positioned as a core value fund in recent years, which has propelled it to the top echelons of the performance charts.”

Ronald Slattery, who has managed the fund for most of the period measured, left a year ago and has been replaced by Min Zeng.

Zeng has been at the firm for more than a decade but Hughes said investors should not assume the the portfolio will continue as it has before.

The IA Japan and IA Japanese Smaller Companies funds that would have made the most of £1,000 over five years

Source: FE Analytics

Unlike in the two other regions, a small-cap fund features in the list – M&G Japan Smaller Companies, led by Carl Vine and Dave Perret.

McDermott said: “The fund employs a disciplined investment strategy focused on selecting individual companies and capitalising on price volatility caused by behavioural biases that can lead to market mispricing.

“The fund manager expects stock selection to be the key driver of performance and will typically end up with a portfolio of fewer than 50 names.”