The City could turn away from the Conservatives and back Labour at the next general election, according to John Chatfeild-Roberts, manager of the Jupiter Merlin Balanced Portfolio.

He pointed to recent polling that revealed two-thirds of investment managers believe a Labour government would be best for the economy, which is a far cry from the City’s historical sentiment.

Indeed, Keir Starmer and shadow Chancellor Rachel Reeves have been on “a charm offensive with business” in the hopes of putting “as much distance as possible” between their Labour party and that of the previous leader, Jeremy Corbyn.

Markets went into a panic when former prime minister Boris Johnson called a general election in 2019 and put the prospects of Corbyn’s Labour party in power on the table. Now, almost four years on and with new leadership in place, business leaders have become more amenable to a Labour government and Chatfeild-Roberts said it could even be the City’s preferred winner at the next general election given its revamp under Starmer.

“Appealing to business and the City that Labour will be fiscally prudent and attempting to dispel fears of traditional left-wing tax-and-spend, Reeves has promised to be prudent on government expenditure and tax rates, indicating that there will be no wealth taxes and no changes to the marginal rates of income tax, capital gains tax or inheritance tax,” the FE fundinfo Alpha Manager added.

Decisions made by the Conservative party are also likely to have had an impact on the City’s change of heart towards Labour. Chatfeild-Roberts noted that the “infamous, strangled-at-birth, Trussnomics experiment” last year may have gone some way in damaging its reputation as the fiscally conservative party.

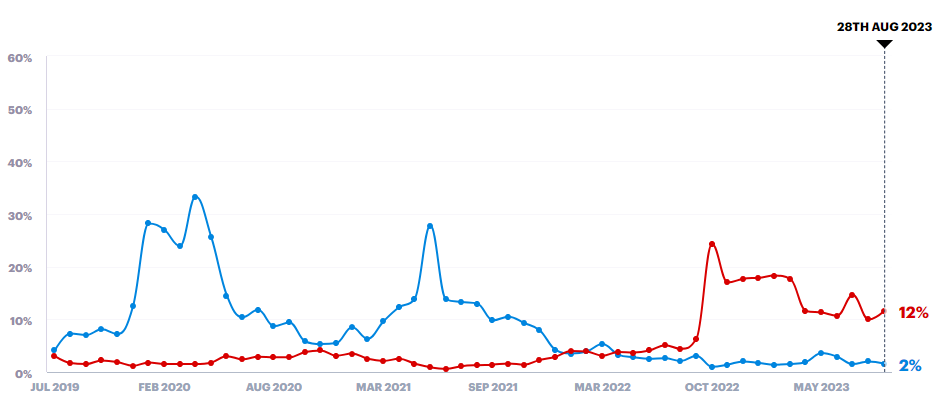

The month following then-prime minister Liz Truss and chancellor Kwasi Kwarteng’s disastrous mini-Budget was a turning point in polls, with expectations for a large Labour majority leaping from 6% in September to 24% in October, according to data from YouGov.

Expectations for a large Labour win vs a large Conservative win since 2019

Source: YouGov

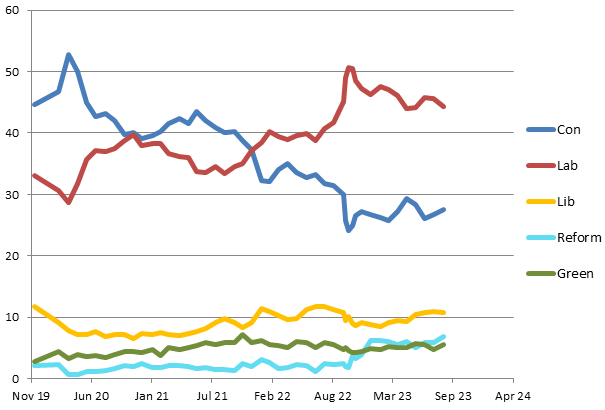

Electoral Calculus now forecasts a 93% likelihood of Labour winning a majority at the next general election, with the party accounting for 413 of seats vs 158 for the Conservatives.

This month alone, major donors such as Mohamed Amersi and John Caudwell – the largest donor at the last election – removed their support from the Conservative Party and mulled sponsorship of Labour instead.

Other business leaders are flocking to gain attendance to the party’s conference on 8 October, with Labour reportedly having to turn away meetings with senior business people amid the high volumes of attendees.

Opinion poll average since 2019

Source: Electoral Calculus

Labour has certainly captured the interest of the City, but with up to 15 months still to go before the next general election, Chatfeild-Roberts warned that the new ideas being floated by the party may not be set in stone yet.

“We would suggest that very little can be taken at face value at this stage to be able with certainty to form such an opinion,” he said. “Labour is still at that early stage in the electoral cycle of flying kites and throwing bones to dogs.”

What business leaders should bear in mind when listening to Labour’s plans is that they would be inheriting “an unenviable fiscal position” from the Conservatives if they won, according to Chatfeild-Roberts.

The party would be handed the highest tax burden in history and huge amounts of debt – all while public services are in desperate need of capital after years of Conservative cuts – which could make their plans difficult to execute.

One such area where Labour could meet challenges is in the clean energy transition. Prime minister Rishi Sunak announced his intention to severely scale down the government’s road map to net zero last week after its inflationary repercussions proved too much.

Chatfeild-Roberts said: “The immense cost of meeting carbon net-zero commitments has not gone away, nor is it likely to decrease. Sunak might be postponing the pain, but his remedy outlined this week is no more efficacious than that of taking an aspirin to cure a persistent tumour.”

However, Labour may encounter difficulties with its current plan to invest £140bn into clean energy over the next five years, according to Chatfeild-Roberts. He said money is tight already and Labour have given little detail on how this £28bn a year will be funded.

“They [markets] seem remarkably sanguine about piling a figure which may yet approach £140bn on to a government balance sheet that is already 100% geared and which, so far, has no funding plan behind it to mitigate the mounting debt,” Chatfeild-Roberts added.

“At some stage in this mutual love-in with Labour, the City and business might come up for air and ask themselves whether they’ve been tossed a bone, or are they instead being sold a pup. Time will tell soon enough.”

Another area of concern for Chatfeild-Roberts is the EU – most business leaders were supportive of the UK’s place in the union and have maintained close ties with Europe, yet Starmer is “throwing more bones” with his mixed messaging.

He campaigned to remain whilst in his position as Shadow Secretary of State for Exiting the European Union, but changed his stance to appeal to voters who liked the Conservatives’ goal to ‘Get Brexit Done’.

Now he has pledged to re-negotiate the Brexit settlement with Brussels, which could create more hassle for City leaders, according to Chatfeild-Roberts.

“Both the UK and the EU are feeling much more comfortable with the arrangement, for all the enduring deficiencies and anomalies within the Windsor Accord and the unsatisfactory hotch-potch deal brokered for Northern Ireland,” he said.

“A substantial re-negotiation merely says to Brussels that the UK is open to giving significant concessions; in return for what?”