Unless you have been living off-grid in recent years, artificial intelligence (AI) will need little introduction. While AI itself is nothing new, the increasing availability of generative AI and large language models (LLMs) to the general public and first steps into commercialisation over the past year has thrown the sector even further into the spotlight.

Its potential is huge. The latest tools are multi-purpose and easy to use, meaning they could transform a wide variety of activities and industries over the coming decades.

The long-term, game-changing potential of AI makes it a clear fit for thematic investing. However, investing in the sector is not without challenges. AI adoption has progressed at unprecedented speed, helping to raise the level of hype around AI companies to fever pitch.

Furthermore, size matters in AI – larger models display disproportionally greater performance – which means there are a lot of dollars pouring into what is a computing arms race. This is despite, or perhaps because of, the fact that the sector is still at an early stage. AI adoption may ultimately progress in unexpected ways.

Investing in both the ‘AI winners’ and the overlooked beneficiaries

The hype around AI has caused large differences in the valuations of those perceived as beneficiaries from AI and those perceived as being left behind by the advance in technology. Lofty valuations have left investors questioning how to invest without overpaying for hyped stocks.

We broadly favour the firms that stand to make immediate gains from AI over those where potential profits are further into the future. Many AI enablers, including software and hardware makers, are already turning the AI rush into bottom-line performance.

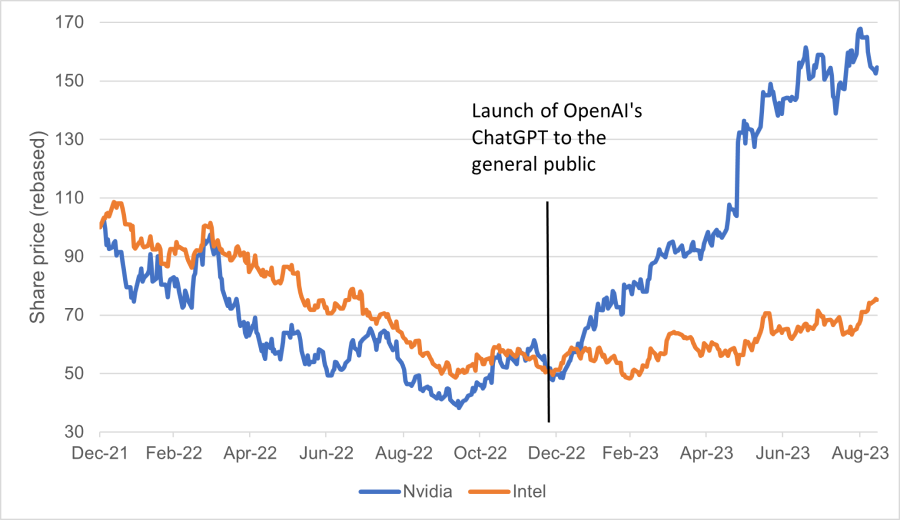

Nvidia, for example, owns critical components for the early AI investment cycle and recently recorded another quarter of blowout earnings, 20-30% above expectations that were already high.

On the software side, Microsoft is an example of a legacy company that already has direct AI offerings as well as infrastructure that will enable the building of AI tools. The company’s ‘Copilot’ AI is a premium service that boosts productivity across its popular Office apps that could grow quickly to become a significant contributor to revenues in the next few years.

We tend to take a more cautious approach to the companies that already have high valuations but do not stand to convert their promise into profit in the near term. The path of AI adoption from here is difficult to accurately predict so we are wary of paying too high a premium for companies not yet generating revenues from AI in what is a highly uncertain market.

Investing in both near-term revenues and underappreciated long-term potential

Source: Refinitiv, Fidelity International, September 2023.

We have also identified underappreciated beneficiaries of AI. These are companies that we believe will benefit significantly if AI becomes mainstream but that potential is not yet reflected in their stock prices. For example, Intel will likely benefit from the growing need for general computing chips but does not have valuations that match this potential yet.

We believe this forward-looking stock selection is vital to harness the AI theme. Passive indices, for example, are typically dominated by those already widely believed to benefit from AI. By investing not only in these companies but also in underappreciated stocks, we aim to identify long-term AI beneficiaries before their valuations become stretched.

AI is a good fit for thematic investing because it represents a structural shift that has longevity

Bottom-up stock selection is particularly important in thematic investing. It might be clear which sector a company sits in but it is less obvious what sort of technology the current management plans to develop or adopt in the next decade.

The level of a company’s exposure to a theme is also a matter of judgement, particularly considering it will vary over time depending on business priorities. This sort of knowledge often requires specialist research and experience to understand each company’s unique drivers in the context of external shocks and a constant baseline of change.

Caroline Shaw is a multi-asset portfolio manager at Fidelity International. The views expressed above should not be taken as investment advice.