Bestinvest has jettisoned the Scottish Mortgage Investment Trust and its small-cap sibling Edinburgh Worldwide from its Best Funds List following its latest update.

The removals were part of a raft of changes made since January 2023, which included adding in the Monks Investment Trust to take the place of its stablemates. All three funds are global equity strategies managed by Edinburgh-based Baillie Gifford, whose growth style has fallen out of favour with investors recently.

Scottish Mortgage, formerly the UK’s largest investment trust, has borne the brunt of this. Over three years the trust has made a loss of 31.7%, with most of its losses coming over the past year, as the below chart shows.

Total return of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Jason Hollands, managing director of Bestinvest, said the firm's analysts have grown concerned about Scottish Mortgage’s private equity exposure. The trust has a self-imposed unquoted companies limit of 30% and is close to bumping up against that ceiling with a 27.9% allocation to private equity. As a result, its ability to allocate additional capital to its portfolio companies could be constrained.

The analysts have more conviction in Monks, where managers Spencer Adair and Malcolm MacColl are heavily backing the cloud, data and artificial intelligence over the long term.

They have channelled more than a third of Monks’ portfolio into ‘digital frontier’ companies including enterprise cloud operators, semiconductor companies and next generation ecommerce operators. Top holdings include Microsoft, Amazon.com and Alphabet.

Alongside Monks, JPMorgan Global Growth & Income IT Ord and Schroder Global Sustainable Value Equity have also been added to the Bestinvest favourite funds list in 2023.

The firm’s analysts expect bottom-up stock pickers to do well in the current market environment, despite global equity indices posting strong gains so far this year.

Those gains have been concentrated amongst mega-cap technology companies, while other sectors have had a much tougher time, including utilities, healthcare and financials.

“We believe it is an environment where careful stock pickers will shine, as the gap between winners and losers widens,” the report stated.

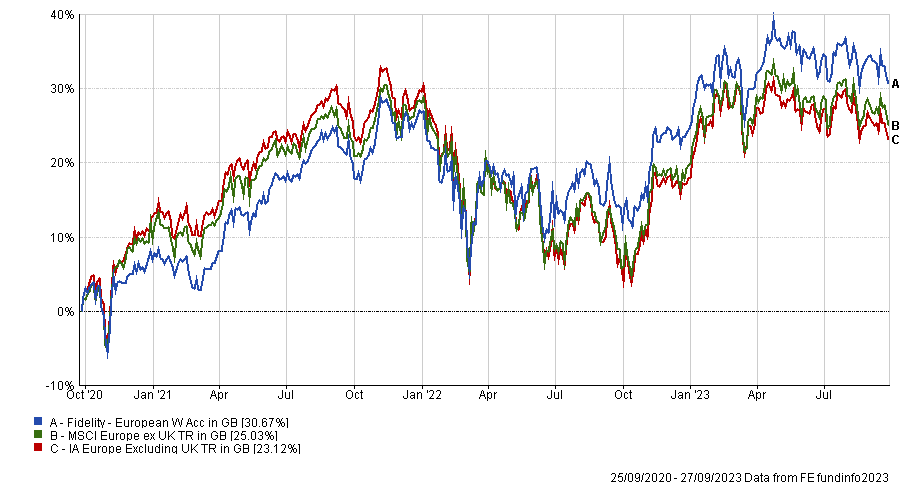

For investors looking at Europe, Bestinvest’s analysts singled out Fidelity European as a defensive, resilient fund. “We added Fidelity European as we see it as a potential core holding for those seeking a more conservative approach compared to, say, a guns blazing, high-octane fund like BlackRock European Dynamic,” Hollands explained.

FE fundinfo Alpha Manager Sam Morse “looks for companies he believes can grow their dividend sustainably over the next three-to-five years. These are typically large-cap stocks, with strong balance sheets,” Hollands said.

Fidelity European held its own throughout last year’s tough markets, losing a relatively modest -1.6% in 2022, while the average fund in the IA Europe Excluding UK sector was down -9.0%.

Its returns over three years have also been strong, with the fund up 30.7% over this time. With £4.2bn under management, it is the largest, most liquid fund in its sector.

Total return of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Those who prefer investment trusts can access the same investment strategy via Fidelity European Trust Ord, which has performed better than its open-ended peer over three years.

Bestinvest also suggested a couple of options to tap into Japan’s recovery, adding Fidelity Index Japan and JPMorgan Japanese Investment Trust PLC to its list, joining incumbents Jupiter Japan Income and JPM Japan.

Japan has turned a corner this year, showing signs of inflation after decades of lacklustre growth. The Topix index has been the best performing of the major indices over the past 12 months in local currency terms, as the below chart shows.

Total return of indices over 12 months

Source: FE Analytics

“Some fund managers, particularly those who specialise in small and mid-cap companies, have been left behind. However, there is hope that the rally will broaden out in the later part of 2023 and active managers will catch up,” the report said. “There are rays of hope in the land of the rising sun for good stock pickers in the months ahead.”

Other funds entering the best buy list since January include Schroder Asian Income, Vanguard Emerging Markets Stock Index, L&G UK MID Cap Index, Invesco FTSE RAFI US 1000 ETF, iShares £ Ultrashort Bond ETF and HgCapital Trust.

At the other end of the spectrum, Bestinvest dropped Invesco Corporate Bond (UK), Liontrust Sustainable Future European Growth, Redwheel Global Horizon, Insight High Grade ABS, Morgan Stanley US Advantage, RobecoSAM Smart Materials Equities, Fulcrum Diversified Absolute Return, JPM Global Macro Opportunities, Picton Property Income, Syncona Limited, Utilico Emerging Markets and JPM Global Macro Sustainable.