The US market has come bounding back in 2023 after a poor period for equities, thanks to the excitement surrounding artificial intelligence (AI), but the UK has yet to reap the benefits despite much of this technology originating here.

Technology companies that led markets this year such as Alphabet, Apple and Microsoft built up their AI divisions by acquiring British companies Autonomy, SwiftKey and DeepMind, respectively.

These companies could have boosted the UK market, but are instead supporting US large-caps. That’s why, rather than seeing AI as a tailwind, many investors see it as a negative for the UK, according to James Gerlis, manager of the Tellworth UK Smaller Companies fund.

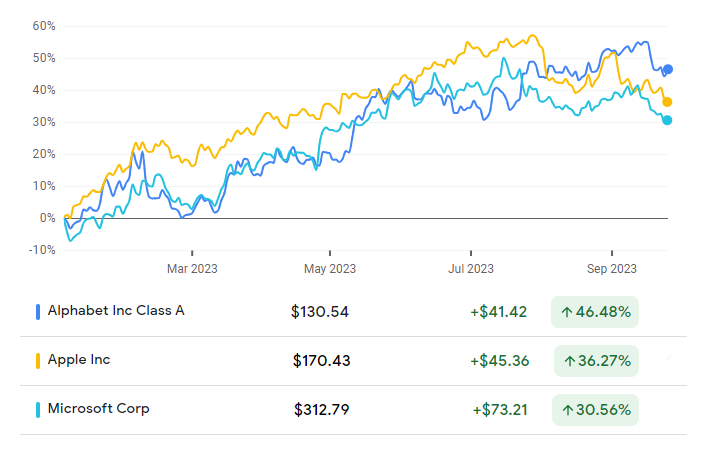

Share price of Alphabet, Apple and Microsoft in 2023

Source: Google Finance

Speaking of the many UK fund managers promoting AI as a transformative force, Gerlis said: “It’s easy to dangle the AI carrot as a reason to stick with risky assets, but does the UK really offer much exposure to AI?

“Exacerbated by the lack of equivalent tech heavyweights in the listed market, the UK has not been able to capture the limelight to nearly the same extent [as the US]. In fact, much of the discussion focused on the negatives for incumbent businesses.”

Technology companies account for just 1.2% of the FTSE All Share, with only 17 of the index’s 575 companies situated in the tech sector.

As more emerging technology companies are picked up and taken to the US, Gerlis said many of the businesses left behind are being penalised for having models that could be disrupted by AI.

Video game services company Keywords Studios is one example of this. Shares in the £1.2bn company plummeted 45.7% this year as investors feared that generative AI could provide the same services faster and cheaper.

Share price of Keywords Studios in 2023

Source: Google Finance

Gerlis said: “The threat of AI tools undermining the need for the same extent of outsourced support when making games has been a key driver of multiple compression.”

However, it’s not all doom and gloom for British businesses when it comes to AI. Technology companies have been the first to feel the excitement from investors, but businesses in other sectors could soon be enhanced by integrating AI, according to Gerlis.

With such strong groundwork in the UK already – whether it be research centres such as the Alan Turing Institute or government investment projects like the National Artificial Intelligence Strategy and AI Sector Deal – there is plenty of opportunity for British businesses to capture some of that AI excitement moving forward.

“Whilst we share concern around the challenge to some business models from AI, we feel that balance to the argument is being missed and, in some cases, that the AI threat to business models may be being overestimated,” Gerlis added.

“Though there are those with deeper pockets – with the US and China, for instance, having launched AI investment programs of greater scale – the UK benefits from an established ecosystem around AI, which reflects a strong base level of capability and talent.”

Multimedia solutions company Future is one example where investors have sold out over fears of AI disruption, dragging the share price down 46.1%, without accounting for the many benefits.

Share price of Future in 2023

Source: Google Finance

“The narrative of AI fuelling a proliferation of digital content and a potential change to the Google search-led world order that has been the foundation of Future’s business model has been an important driver of de-rating, leaving the former stock market favourite trading particularly modestly,” Gerlis explained.

“A positive case for Future, however, is that AI tools supercharge the company’s ability to generate quality content, which can be leveraged across a broad set of well-respected publications across a wide range of verticals.”

Gresham House Multi Cap Income manager Brendan Gulston agreed that there appears to be little room for the UK to benefit from AI on a wider market level, but said there are glimmers of hope when looking at companies individually.

“On an aggregate basis we do not see a clear consensus as to the impact of AI on the UK equity market,” he said. “By contrast [to the US] the UK equity market is not dominated to the same extent by the technology sector, and so the overall impact from AI is less clear cut.”

Gulston noted that companies such as language translation technology company RWS have been integrating AI into their services for years, but markets have yet to appreciate this. This year, its share price has dropped 38.8% as investors focus solely on AI leaders in the US.

However, some UK businesses with a long history of working with AI have already started to get investors’ attention, with shares in Diaceutics – a company that tests medicines – rising 40.3% this year.

Share price of Diaceutics and RWS in 2023

Source: Google Finance

“Diaceutics has been deploying AI for a number of years before the recent growth in thematic interest,” Gulston said. “It announced a hardware collaboration with Lenovo and Intel in order to support its AI deployment in 2017 for example, and in 2019 it presented at the inaugural AICon.”

He highlighted several small-cap technology businesses in the UK such as Access Intelligence, ActiveOps, Craneware and Iomart that he expects to benefit from the rising popularity of AI over the coming years – if they don’t get acquired by larger US firms that is.

There is a risk of that happening, but Gulston said small companies such as these could build a greater presence for technological innovation in the UK as they grow.

“Across the large cap spectrum there is a relative lack of technology companies on the UK market versus the US, which likely reflects the centre of gravity for tech-focussed investment capital being based in the US,” he added.

“As UK small-cap focussed investors we see the UK as an attractive listening venue for technology businesses, which in time should act as feedstock for the large-cap indices as these businesses grow to scale.”