The market rally that dominated the opening six months of 2023 hit a bump during the third quarter, FE fundinfo data shows, as investors returned to fretting about higher interest rates.

Between the start of 2023 and the end of June, the MSCI AC World index rose 7.8% (in sterling) as investors were heartened by a resilient economy and hype around the artificial intelligence (AI) revolution.

However, as the charts below show progress was harder to come by in the third quarter as many of the investments that worked in the first half failed to deliver.

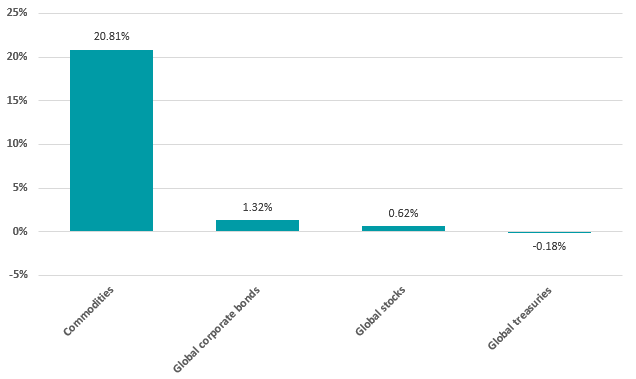

Performance of asset classes in Q3 2023

Source: FinXL. Total return in sterling between 1 Jul and 30 Sep 2023

Global stocks (represented by the MSCI AC World index) only rose 0.6% over the quarter although there were some big ups and downs over the period as investors continue to keep a close eye on economic data while waiting for interest rates to reach their peak.

The index made some strong gains during July only to spend a couple of weeks falling into loss-making territory. It then staged something of a rally but has been on a downward trend since mid-September.

Foreign exchange movements helped UK investors – while the MSCI AC World is up 0.6% in sterling, it posted a 2.5% loss in local currency terms.

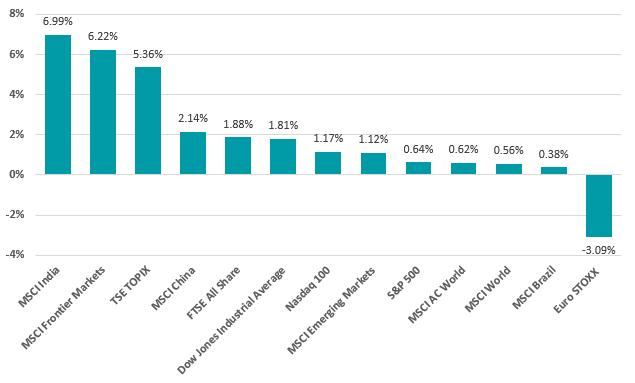

Performance by geography in Q3 2023

Source: FinXL. Total return in sterling between 1 Jul and 30 Sep 2023

Indian stocks were the standout performers of the third quarter, posting a near 7% gain in sterling terms. The country is benefiting from robust economic growth and strong corporate earnings.

Japan had another strong month and Chinese stocks were up after some heavy falls earlier in the year. Closer to home, the FTSE All Share rose 1.9% and outperformed European equities, which had their worst quarter in a year after the economic outlook worsened.

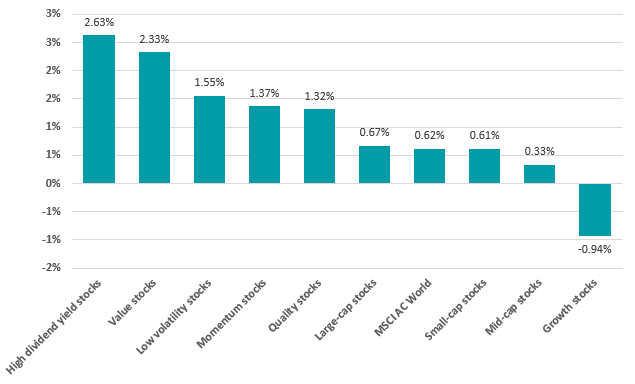

Performance by investment factor in Q3 2023

Source: FinXL. Total return in sterling between 1 Jul and 30 Sep 2023

There was a notable reversal in trends when it comes to the performance of investment factors last quarter.

Growth stocks had been leading the market but value and high-dividend stocks took over in the third quarter. The rise in the oil price will have played a part in this as energy companies tend to fit into investors’ value and income buckets.

At the same time, investors moved out of growth stocks after being worried by central bankers’ ‘higher for longer’ narrative. Growth tends to perform worse than value when interest rates are high.

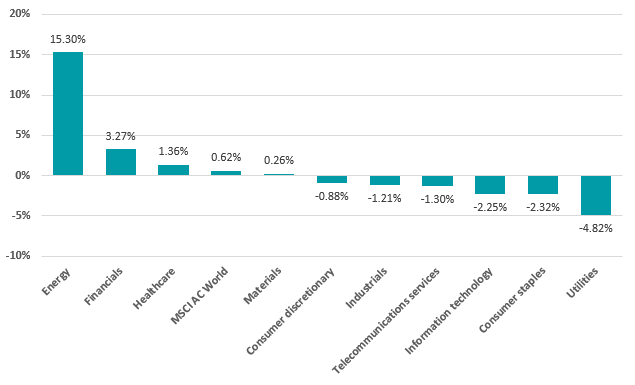

Performance by industry in Q3 2023

Source: FinXL. Total return in sterling between 1 Jul and 30 Sep 2023

This can be seen in the above chart, which shows energy companies were the best performers by a clear margin. The MSCI ACWI Energy index rose more than 15% while the wider MSCI AC World gained just 0.6%.

This is a stark turnaround to the opening half of 2023, when energy stocks were the worst performing industry with a fall of 7.6%. Similarly, information technology stocks lead 2023’s first half with a gain of almost 30% but fell in the third quarter on renewed concerns over rates.

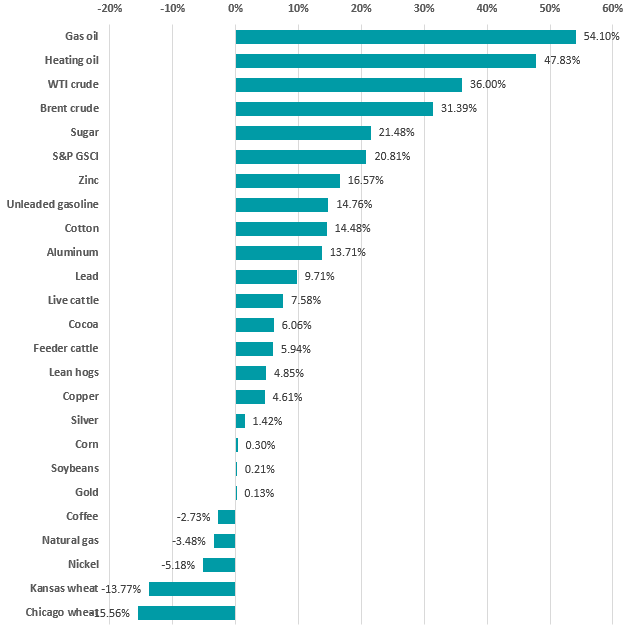

Performance of commodities in Q3 2023

Source: FinXL. Total return in sterling between 1 Jul and 30 Sep 2023

In commodity markets, energy prices jumped during the quarter amid tight global supply because of OPEC+ production cuts. Oil futures ended the quarter close to the $100 a barrel mark.

Sugar was the only other commodity rising more than the S&P GSCI – a broad commodity index – while wheat, nickel and natural gas were among those with the largest price falls.

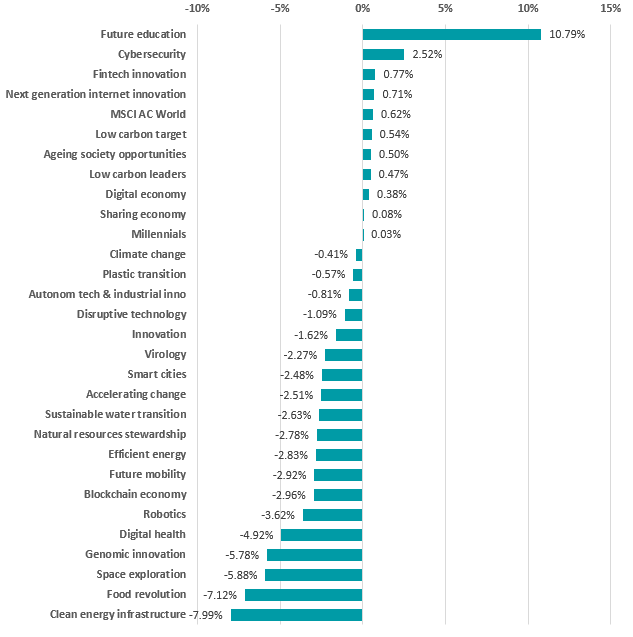

Performance of thematics in Q3 2023

Source: FinXL. Total return in sterling between 1 Jul and 30 Sep 2023

Given the pullback from growth stocks, it should be little surprise that thematic investments struggled in the third quarter.

Future education, cybersecurity, fintech innovation and next generation internet innovation were the only thematic sub-sectors to make a higher return than the MSCI AC World.

Most thematic areas lost money as investors worried what the impact of higher interest rates would be on the valuations of companies where they have wait far into the future for strong earnings.