Investing in growth stocks can be less nerve racking when you have confidence in their long-term prospects. That is why Ted Harlan, manager of the American Century Concentrated Global Growth Equity fund, invests in companies with dominant market positions and sustainable progress.

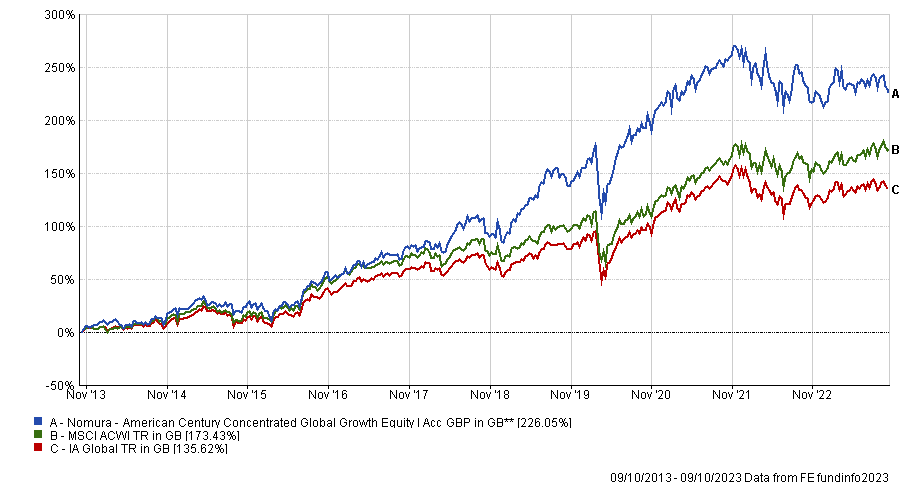

By doing so, his fund is up 226.1% over the past decade whilst it’s the average IA Global portfolio trailed 90.4 percentage points behind, making it the 10th best performer in the sector.

“We want to be early to a fundamental change in a business and we want that positive improvement to be sustainable for at least three years,” Harlan said. “We also want to have a difference of opinion with the street on its earnings power and valuation.”

Here, he shares his top four stocks that are dominating their respective sectors and have the strongest sustainable growth prospects over the coming years.

Total return of fund vs benchmark and sector over the past decade

Source: FE Analytics

Howmet Aerospace

Harlan holds the American jet engine part manufacturer in the portfolio despite operating in the travel sector, which is not usually thought of as growth-oriented.

“When we talk about being able to sustain a fundamental improvement, that typically rules out a lot of cyclical businesses, but I will say that aerospace – particularly civil aerospace – has become a much bigger part of the portfolio since Covid,” he explained.

The aerospace industry ground to a halt in 2020 due to Covid travel restrictions but now the world has reopened and airlines are unable to keep up with high demand. That puts the likes of Howmet Aerospace in a prime position to benefit from this uptick in spending and looking at the “10-year backlogs at Boeing and Airbus” gives the American Century Concentrated Global Growth Equity manager comfort that parts will be needed.

Share price of Howmet Aerospace over the past year

Source: Google Finance

Harlan said: “You essentially can’t build a jet engine without these castings and forgings and a lot of the labour force who had that specialist knowledge retired during Covid. As we're seeing fewer and fewer players in that industry, it is setting up a decade-long improvement cycle for Howmet which is quite profound.”

Canadian Pacific Kansas City

Two of the largest railroad companies in North America merged at the end of 2021 to create Canadian Pacific Kansas City, resulting in a network that spans the whole continent.

With this far reaching railroad that allows the company to transport cargo across most parts of Mexico, the US and Canada, Harlan says its dominance gives it a unique advantage.

“The main reason this is so powerful and timely today is that if you look at Mexico's trend of US imports verses China, they're strangers passing in the night. China's imports are falling and that production will not go back to China – it will be done in Mexico,” he said.

Share price of Canadian Pacific Kansas City over the past year

Source: Google Finance

NVIDIA

Microchip manufacturer NVIDIA has been one of the most talked about companies of 2023, with its share price rising almost 300% over the past year. Its chips are used in all manner of computing needs, but increased investment into artificial intelligence (AI) in particular make it a hot topic among investors today.

“I obviously have to mention NVIDIA,” he said. “Every growth manager owns it today so there's virtually nothing differentiating about it, but the fact of the matter is that nothing is hotter than AI and NVIDIA is a monopolist in that sphere.

“What’s happening in AI is super profound and NVIDIA as a metal-bender in the Midwest is not profound at all, but its place in that story is clearly tremendous and groundbreaking.”

Share price of NVIDIA over the past year

Source: Google Finance

However, Harlan is aware that it might not be able to sustain this high level of growth forever and said he would sell it “if it can no longer sustain improvement.”

“I’m not sure whether we're the best buyers of stock, but we're definitely the better sellers of stock because we won’t hold something that is decelerating or has fundamental challenges.”

Danaher

Danaher is a conglomerate company made up of a lot of businesses across different sectors, but Harlan is most excited about the healthcare division that sits at its core.

He explained that it has shed many of its industrial branches in electronic instrumentation, photographic quality and water, which has “left it with this really high quality healthcare franchise”.

Danaher’s focus on bio production is one of the elements that makes Harlan particularly confident in this name and its ability to maintain a solid market position.

“It’s creating a lot of innovation in large molecule drugs,” Harlan explained. “The bulk of research and development is shifting into biologics and it should have around a 90% market share over time.

“What's appealing about Danaher is two-fold – management is acquiring businesses that are additive to growth and disposing businesses that are detrimental to growth, but what is most exciting today is that that biologics are continuing to just gain share massively year-in, year-out.”

Share price of Danaher over the past five years

Source: Google Finance

Of the stocks mentioned, Danaher is the highest conviction name in the American Century Concentrated Global Growth Equity portfolio, accounting for 2.8% of all assets.