The ‘Magnificent Seven’ have been the main driver of US and global indices this year as excitement abounds around artificial intelligence (AI). Yet, Craig Baker, global chief investment officer at Alliance Trust’s management firm Willis Towers Watson, is cautious about the excitement around AI.

He said: “We have seen stocks bouncing quite significantly just because someone came out of the company saying the word AI. That doesn't mean there isn't a fundamental attraction to what some of them are doing, but we haven’t put all the chips on AI. ”

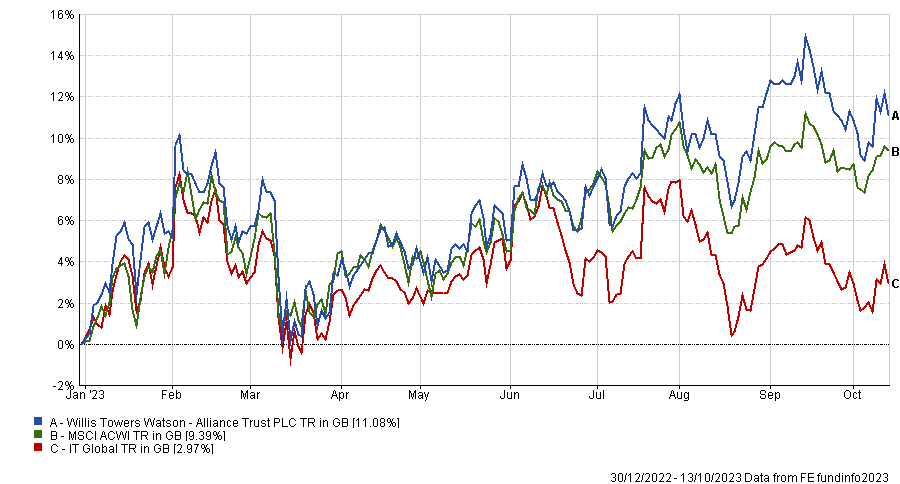

The trust’s portfolio is slightly underweight the Magnificent Seven and US equities in general, which hasn’t hindered it: it has outperformed both peers and benchmark year-to-date.

Performance of trust vs sector and benchmark YTD

Source: FE Analytics

While Baker does not doubt that AI will have a transformative impact on the world, he does not believe that the winners will only be the few companies with a leading edge in this space. He said that other beneficiaries will be companies that can improve the efficiency of their business model thanks to the introduction of AI.

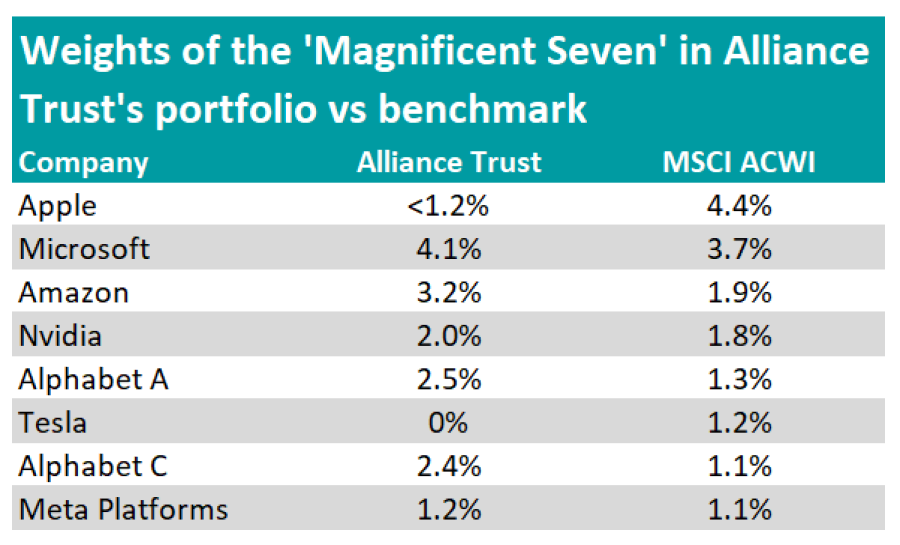

He added that Alliance Trust’s managers are finding ideas in both spaces and that the trust is currently overweight Alphabet, Amazon and Alphabet and Microsoft, while it is neutral on Nvidia and Meta.

The portfolio is, however, underweight Apple and has never held Tesla.

Baker explained: “They're great companies and have been among the best performing stocks on the planet, but are they priced to perfection? Our managers have an investable universe made of a few thousands companies and pick 20 stocks they think have the biggest upside potential. They have to make the distinction between what the market is pricing in today for the growth and prospects of a company versus what they think is likely.”

Not all agreed, however, and for some, those stocks have become no-brainers due to the transformational potential of AI.

Mark Baribeau, manager of PGIM Jennison Global Equity Opportunities, told Trustnet last month how he does not understand how one could choose to forego Nvidia and considers that Apple and Tesla are among the few companies that can make a big difference and thus deliver most of the markets return over time.

Weights of the ‘Magnificent Seven’ in Alliance Trust's portfolio vs benchmark

Source: FE Analytics, AIC

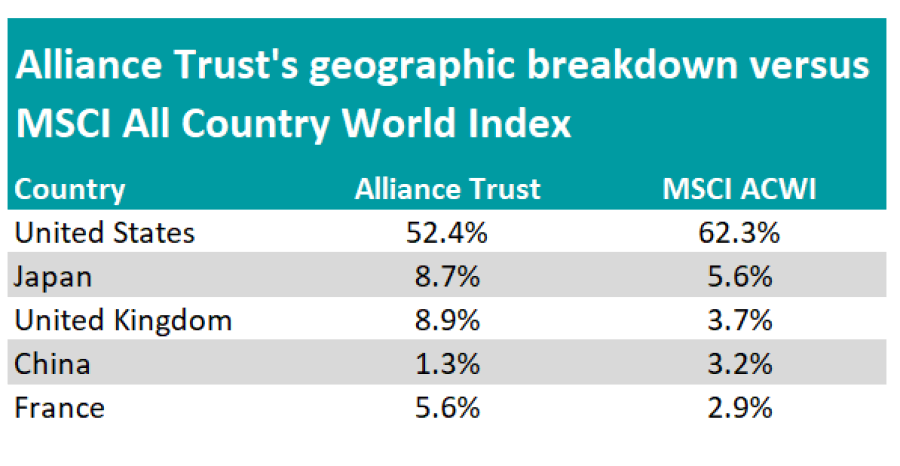

Instead of the Magnificent Seven, Baker said the trust’s managers have been turning closer to home, with the portfolio currently overweight the UK, accounting for 9% of assets. There is, however, no UK company currently in the portfolio’s top 10 holdings.

While it is not a consensus among the stockpickers, a number of them believe the sell-off of UK equities has been overdone.

Baker said: “There are structural issues in the UK but a number of the companies are global in nature, where UK earnings only account for a small portion.”

Another market Alliance Trust is overweight is Japan, which makes up 8.7% of the portfolio. The trust introduced a Japan specialist, Dalton Investment, in its manager line-up in July to take advantage of the country’s corporate governance reforms.

Baker said: “We think there's a particularly good bottom-up stock selection case for outperformance in Japan over the next three to five years. A lot of that has come out from reforms initiated by previous prime minister Shinzo Abe, but also changes in the stock exchange at the beginning of this year.

“Companies with a price-to-book ratio of less than one now have to explain themselves and what they're going to do to address that. As a result, a number of companies are starting to do shareholder friendly actions, like not piling up massive amounts of cash by either paying some of that out, investing in the business, etc.”

Baker added that Dalton Investments aims to invest in shareholder-friendly companies and focuses more on the small-cap area where some of these reforms are expected to have the biggest impact.

Alliance Trust's geographic breakdown versus MSCI All Country World Index

Source: FE Analytics

An additional benefit is that the country is in a different part of the economic cycle compared to the US, UK and Europe. While interest rates have surged dramatically since 2022 in the US, UK and Europe, they are negative in Japan, with the Bank of Japan targeting short-term interest rates of -0.1%.

Baker concluded: “Japan has been an underperforming market for a number of years but things are starting to look more attractive. We have seen better performance in recent months, but that's following more than a decade of underperformance relative to global equities and we think there's a long way for that to go.”