Currency can sometimes be an afterthought for investors, but its impact has been felt particularly hard by UK investors this year who have missed out on the majority of the gains made by one of the top-performing markets of 2023.

Japan has been on a tear this year, with the Nikkei 225 up 16.8% and the Topix up an impressive 21.6% in yen terms. However, when converting those gains into sterling, the total return drops markedly down to just 2.3% for the Nikkei 225 and 6.2% for the Topix. This huge difference can be explained by the yen’s decline; it has devalued by 12.4% against the pound so far this year to 30 October.

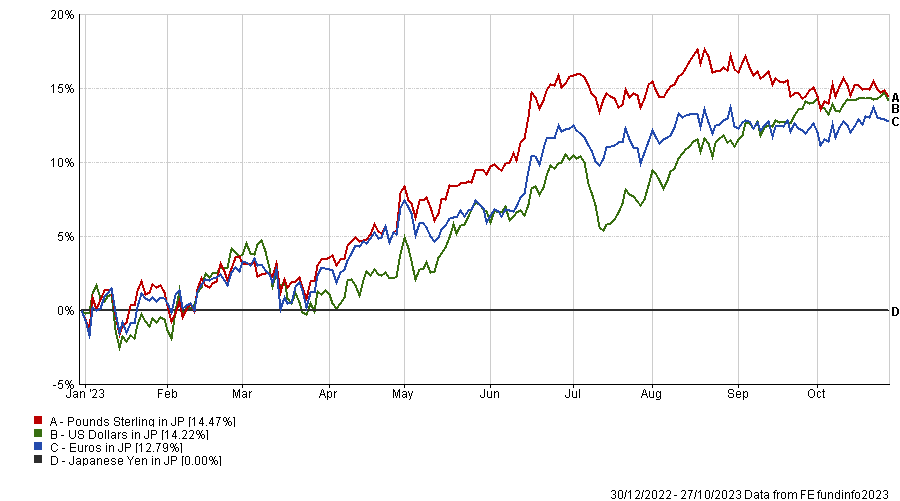

This issue is not confined to sterling investors; the yen has fallen against all the major currencies this year. The below chart shows the reverse of this, with all currencies rising against the yen.

Currencies vs the yen over 1yr

Source: FE Analytics

The yen has come under renewed pressure today with the Bank of Japan (BoJ) increasing the flexibility of its conduct of yield curve control. The target level for 10-year Japanese government bond (JGB) yields remains around 0%, but the bank said it will conduct yield curve control with the upper bound of 1% “as a reference” and it will “control the yields mainly through large-scale JGB purchases and nimble market operations”.

Neil Wilson, chief market analyst at Finalto Trading, described the BoJ announcement an “underwhelming” policy tweak. “The BoJ redefined the 1% cap as a loose ‘upper bound’ rather than an absolute cap,” he said. “They kinda tweaked the yield curve control policy…kinda. More like fiddling whilst the yen burns.”

Stephen Innes, managing partner at SPI Asset Management, said that whenever 10-year JGB yields are at or near a perceived flexible ceiling, the risks to the yen are twofold: “The BoJ prints money to defend the yield cap (tantamount to easing), and because upward pressure on JGB yields tends to coincide with rising Treasury yields, rate differentials will continue to move against the yen (because JGB yields can only rise so far).

“In a nutshell, the absurdity of BoJ policy is they hint at selling the dollar one day to defend the yen while the next they are printing the yen to defend the yield cap.”

So what should investors be doing? With the benefit of hindsight it is easy to suggest that hedging currency risk would have paid off so far this year, so the simple answer is to choose a hedged share class when selecting Japanese equity funds.

A hedged unit class looks to offset currency risks through derivatives, meaning investors would have made higher gains on Japanese stocks, while unhedged unit classes just convert the gains back to sterling, taking any currency fluctuations at the time.

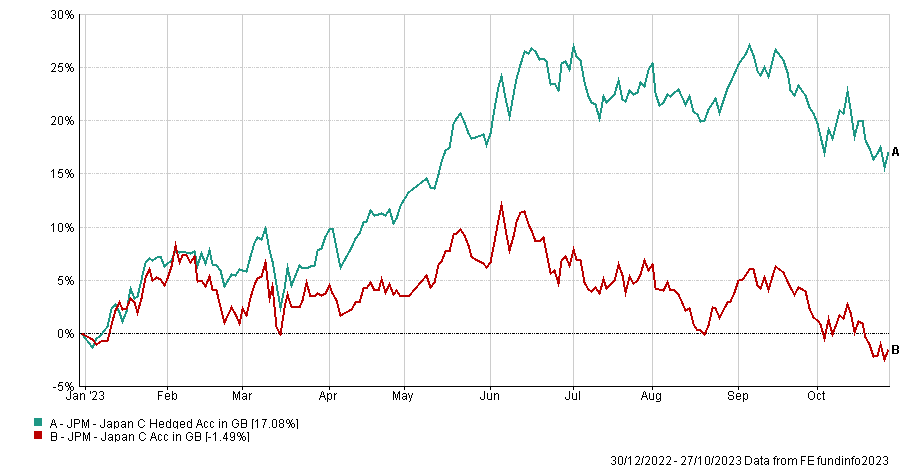

As an example, investors in JPMorgan’s £875.7m Japan fund would have made 17.1% this year in the hedged share class but would have lost 1.5% in the sterling share class, as the below chart shows.

Source: FE Analytics

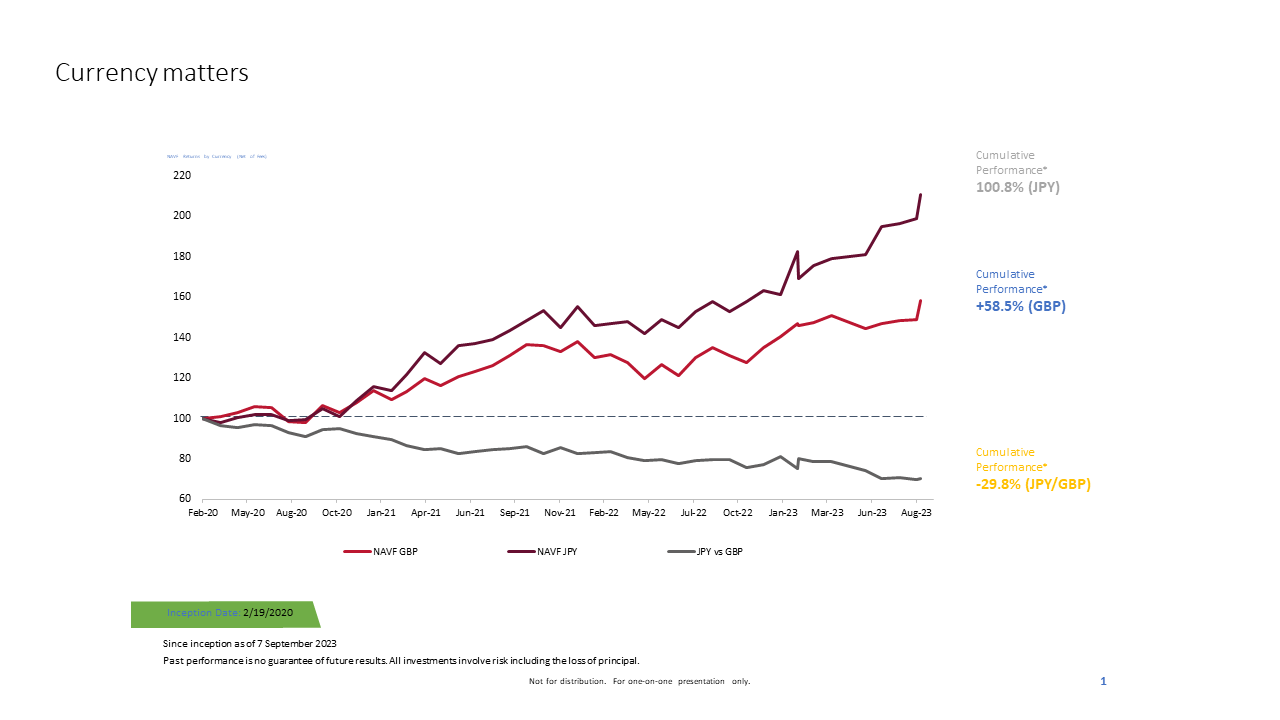

As another case in point, the Nippon Active Value fund would have doubled investors’ money in yen terms since its launch in February 2020. However, the Japanese small-cap trust is a sterling vehicle, so the actual performance experienced by its UK investors since inception was 58.5%.

The yen fell by 30% against the pound during the three and a half years since the trust’s inception, costing investors more than 40% of the gains they could theoretically have enjoyed, as the below chart shows.

Source: Nippon Active Value Fund

Going forward, the question of whether to hedge exposure to the yen becomes more complex. Many commentators expect the yen to recover, so investors might conceivably wish to take on yen exposure and switch out of those hedged share classes.

Steve Russell, an investment director at Ruffer, is among those investment professionals who expect the yen to strengthen. If sterling investors have not hedged their currency exposure already, he believes they should not do so now.