British companies are having a tough year, battling higher borrowing costs, inflation, speculation about a recession and the ongoing impact of Brexit. But despite the challenging current environment, the UK stock market remains home to a plethora of world class companies, many of which look attractively valued at present. There are bargains on offer for discerning investors, according to wealth manager RBC Brewin Dolphin.

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said: “Several UK companies have bounced back from the lows of October 2022 in a significant way, as investors have reassessed their prospects.”

Risk-averse investors have been moving out of equities and flocking to the relatively attractive yields on offer from cash and bonds, but in so doing, they may have thrown out the baby with the proverbial bathwater.

“UK shares being eschewed for cash and bonds has created interesting opportunities for those willing to do their research and uncover unloved gems,” Burgeman said.

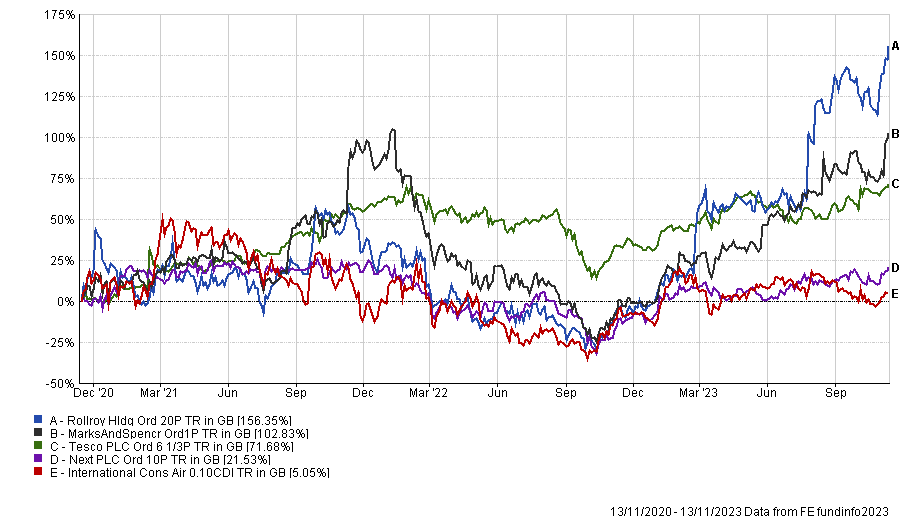

RBC Brewin Dolphin highlighted five British brands which stand out for their prospects: retailers Next, Marks & Spencer and Tesco, along with Rolls-Royce and British Airways owner International Airlines Group (IAG).

High street stalwart Next has made several acquisitions in recent years, snapping up weaker retailers including Made.com, Joules and Reiss. Its shares fell by 46% to a post-pandemic low in October last year but have rallied by more than 65% since then.

Quintessentially British brand M&S' share price has more than doubled since the nadir of October 2022. “M&S has made some big changes to its store footprint, it bolstered its online offering by tying up with Ocado Retail, and it has even managed to boost sales in its previously ailing clothing and homeware divisions,” Burgeman observed.

Tesco shares have been relatively volatile and the supermarket chain has gone through a period of change as it simplified its business, consolidated its operations and recovered from an accounting scandal. Its shares hit a five-year low during October 2022 but have gained more than 38% since then.

“Supermarkets have become a bit of a political football in the past few years, as one of the few businesses to continue operating during the pandemic and have been accused of benefiting from rising inflation in its aftermath. That is part of the reason why they have generally not performed particularly well from a share price perspective, alongside fierce competition in the sector,” Burgeman said.

“Nevertheless, Tesco has emerged from a very tricky period in good shape. It has secured its position as the UK’s top supermarket by market share and is improving customer retention through initiatives like the clubcard scheme.”

Engineering group Rolls-Royce is a recovery story. Its shares fell by 83% during the 2020 pandemic but they have climbed 138% this year as the company has become leaner and more efficient.

“The big worry with Rolls-Royce during the pandemic was that air travel wouldn’t return to previous levels. Rolls-Royce’s revenues are linked to the amount of hours its engines are used and the subsequent maintenance requirements that follow – so fewer planes in the air is bad news for profits,” Burgeman explained.

“But, as the current CEO has pointed out, there were longer-term problems within the business which needed to be addressed. Some tough decisions have been made to remedy them and that is beginning to make its way into the bottom line, and the shares have responded.”

Lastly, IAG along with several other airlines also had a tough pandemic and then struggled to recover. This year however its shares are up 18%.

“Airlines were obviously hit hard by the travel restrictions put in place during the pandemic. What might be more surprising is that many airlines’ share prices remain not far off the levels they were during the worst of it, despite passenger numbers recovering strongly in the last year or so,” Burgeman said.

“There are a number of storm clouds on the horizon – volatile fuel prices, the cost of living crisis’s potential impact on future demand, and the need to transition towards more sustainable travel to name just a few.

“That said, as the performance of Ryanair shows, there are also reasons to be positive. BA is a quality airline and the wider IAG group has other strong brands in the form of Aer Lingus and Iberia, as well as exposure to the budget travel market through Vueling.”

Total return of stocks over 3yrs

Source: FE Analytics