Smaller companies funds have been among the worst performers in the past three years, with average fund in the IA UK Smaller Companies and IA Global European Smaller Companies sectors making negative returns over the period.

The IA North American Smaller Companies sector fared better but the average fund’s returns would not have been enough to protect investors from inflation.

Below, Trustnet looks at the smaller companies funds that have not only delivered positive returns but also beaten UK inflation, meaning domestic investors have made a real return.

In total, nine funds have achieved this feat, with a majority of them specialised in North American small-caps.

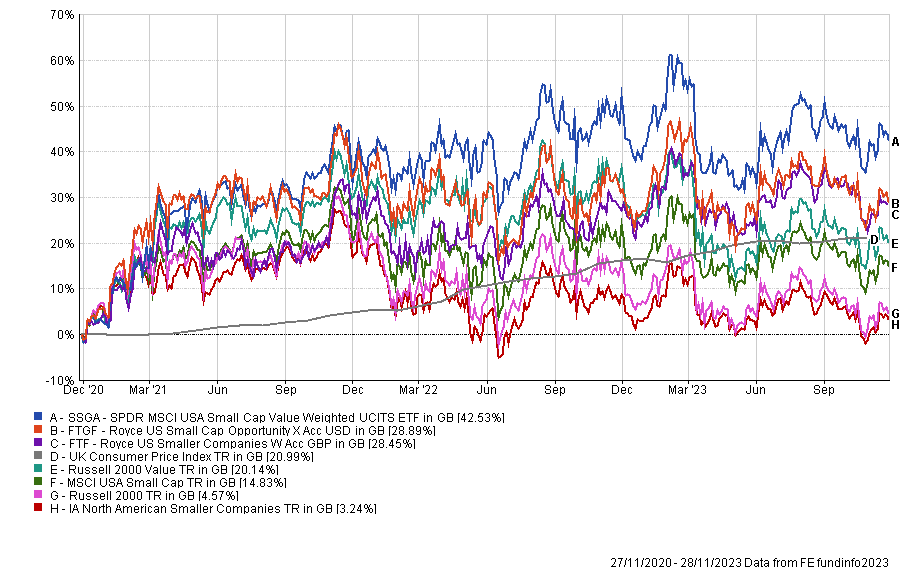

The best performer has been a passive fund, SPDR MSCI USA Small Cap Value Weighted UCITS ETF. This tracker fund’s benchmark is a variation of the MSCI USA Small Cap index with an emphasis on lower valued stocks.

FTF Royce US Smaller Companies is another applying a value bias that has been able to beat UK inflation over three years, but with an active approach.

Manager Lauren Romeo looks for valuation discrepancies among US smaller companies, but also pays attention to downside risk as she considers avoiding losses in down markets to be essential for total returns over the business cycle.

Stablemate FTGF Royce US Small Cap Opportunity, which also has a value tilt, has achieved the same feat. Managers Jim Stoeffel, Brendan Hartman and Jim Harvey look for undervalued companies that they believe have the potential for financial improvement. They typically hold 245 to 320 stocks in the fund and none should be larger than the largest company in the latest Russell 2000 index.

Performance of funds over 3yrs vs sector, benchmark and CPI

Source: FE Analytics

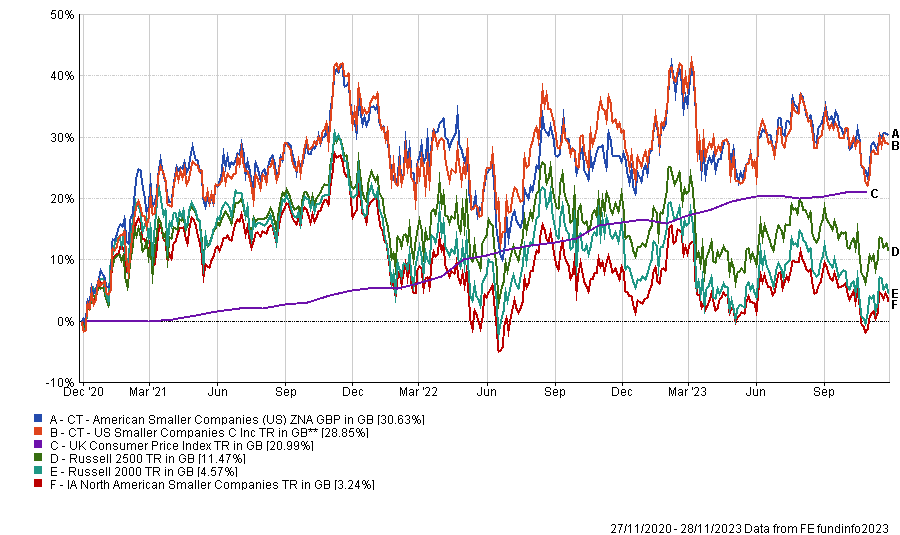

Two US small-cap funds from Columbia Threadneedle, CT American Smaller Companies (US) and CT US Smaller Companies, also generated real growth for UK investors.

The former is managed by Nicolas Janvier who aims to identify US smaller companies that can improve their quality more than the market is forecasting over the medium term.

Janvier and his team consider capital allocation, profitability, margin growth and environmental, social and governance (ESG) integration as four key indicators of quality. They also like to invest in early-stage businesses to benefit from the rapid growth phase of their lifecycle.

Performance of funds over 3yrs vs sector, benchmarks and CPI

Source: FE Analytics

Analysts at FE Investments said: “The focus on stock picking, while limiting sector and factor bets, allows the fund to produce more consistent performance relative to the small- and mid-cap market, regardless of the stylistic and macroeconomic environment.”

Federated Hermes US SMID Equity has also beaten UK inflation over the past three years. The managers invest in quality companies they consider to be attractively priced and aim to hold them for the long term. To make it in the portfolio, companies should have a competitive advantage, sustainable earnings, sensible financial management and ESG-compatible.

Performance of fund over 3yrs vs sector, benchmarks and CPI

Source: FE Analytics

While the majority of small-cap funds that have beaten the UK inflation are investing in US smaller companies, a few funds exploiting the potential of the lower echelons of the home market have also produced real growth.

For instance, Fidelity UK Smaller Companies has outperformed the UK Consumer Price (CPI) Index by 17.3 percentage points in the past three years.

The manager, Jonathan Winton, is a value investor with a contrarian approach, yet he also focuses on downside risk and protection of capital in times of market distress.

Analysts at Square Mile find the overall strategy “extremely sensible” and believe it should reward investors with “impressive returns” over the long term. Yet, they also stressed that there will be periods where this contrarian approach will be out of favour.

The fund is currently open to investors but Fidelity has soft closed it in the past because of the liquidity constraints of the underlying asset class. Square Mile analysts’ warned that this could happen again if the fund goes through a period of strong inflows.

Performance of fund over 3yrs vs sector, benchmarks and CPI

Source: FE Analytics

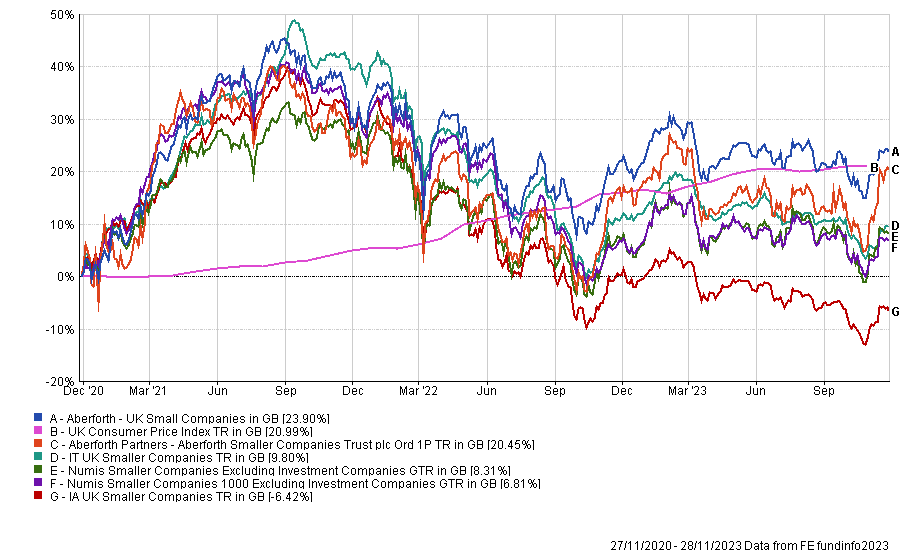

Aberforth UK Small Companies has also beaten UK inflation with a value approach. The managers typically buy stocks when they are unloved, resulting in a portfolio cheaper than the broader UK small-cap market.

The fund has an investment trust version (Aberforth Smaller Companies Trust) currently trading on a circa 10% discount. Yet, unlike the open-ended version, the trust has not generated real growth over the past three years.

Performance of funds over 3yrs vs sectors, benchmarks and CPI

Source: FE Analytics

Finally, Artemis UK Smaller Companies has outperformed the UK CPI by 3.5 percentage points.

Managers Mark Niznik and William Tamworth are bottom-up stockpickers following a ‘growth at reasonable price’ approach. Investee companies should, therefore, be trading on reasonable valuations, have sound financials and preferably be in market leadership positions.

Niznik and Tamworth build their portfolio without reference to the fund’s benchmark. Yet, a single holding will generally not exceed 3% of the fund and not account for less than 0.5%.

Performance of fund over 3yrs vs sector, benchmarks and CPI

Source: FE Analytics

The managers regularly re-balance the portfolio. This can be due to higher conviction stock ideas replacing existing holdings, investee companies hitting higher valuations or to limit exposures to common macro-economic factors.

It should be noted that no fund in the IA European Smaller Companies sector has managed to beat UK inflation over the past three years.