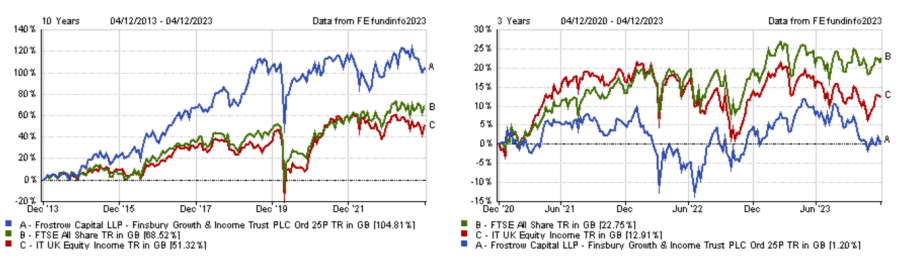

“Frustrating” is the word that Nick Train, manager of Finsbury Growth & Income, has used to qualify the performance of his investment trust in recent years.

While the trust has comfortably outperformed the FTSE All-Share over the past decade, it has lagged its benchmark over three years. The trust’s results, published yesterday, showed its net asset value continued to underperform the index in the year to 30 September.

The lack of exposure to cyclical sectors such as energy, basic materials and financials has been one of the main reasons for this underperformance as Train prefers branded consumer goods, software and data analytics companies. One of Finsbury Growth & Income’s key holdings, Diageo, has also disappointed in recent years, which has been detrimental to performance.

In addition, UK equities have fallen out of favour with both global and domestic investors and are left with no obvious buyers.

Yet, Train believes that fundamentals will eventually reassert themselves and is hopeful he will be able to continue to deliver the same level of returns that he has since he took over the management of Finsbury Growth & Income in 2000.

Below, he discusses the trust’s performance, explains why UK equities deserve a place in growth investors’ portfolios and implores active managers to take risks.

Performance of trust over 10yrs and 3yrs vs sector and benchmark

Source: FE Analytics

What is your investment philosophy?

We run a concentrated portfolio of excellent businesses situated in advantaged industries and then hold them for very long periods of time.

The aspiration is to participate in the superior economics of these businesses and allow the wealth that they create over time to create wealth for our shareholders. It's a highly distinctive investment approach and the result of that is a highly distinctive portfolio.

Why should investors have the trust in their portfolio?

The trust offers the potential, but sadly never the certainty, for really differentiated and excellent performance. I would argue that the historic returns of the strategy give an indication of the sort of returns that, we hope, are achievable in the future.

If you look at the very long-term returns, Finsbury Growth & Income has outperformed not only the FTSE All-Share index, but also the S&P 500 in the United States.

Performance of trust over 20yrs vs indices

Source: FE Analytics

UK equities have been out of favour with investors for a long period of time. Is it a good moment to buy growth companies in the UK rather than globally?

There have been times, particularly over the past seven or eight years, when I've looked with envy and chagrin at the growth opportunities being captured in markets outside of the UK.

But notwithstanding the UK stock market’s reputation of being a ‘Jurassic Park’ made up of dinosaur businesses, there are in fact a measurable number of genuinely globally significant growth companies listed on the London Stock Exchange.

I don't want to exaggerate the opportunity, but perhaps there is an undervaluation of UK equities, including the obvious global growth businesses that are listed in London.

The portfolio is quite concentrated (85% in the top 10 holdings). What would you say to investors concerned with this level of concentration?

Every active fund manager must take some risks to credibly propose to beat an index. There are many low-cost products available to investors if they simply want to perform in line with the benchmark.

But if they want to achieve a higher rate of return, then they need to identify the risks that are being inevitably taken by a fund manager to try to generate returns greater than the benchmark.

I believe the businesses we have chosen to concentrate the portfolio on are inherently low-risk companies. They tend to be major, substantive, long established companies with very strong business franchises.

The trust has lagged the benchmark in recent years. How do you explain it?

Sometimes, you just can't make the whole portfolio work all at the same time. We've had some absolutely fantastic returns from big holdings this year, but also some deeply disappointing performance from other big holdings. It's amounted over the course of 2023 to another year of mediocre, slightly worse than benchmark performance. It is frustrating.

But we must stick to the strategy because if we don't our investors will lose all certainty about what it is that we do. We must stay extremely patient and own businesses that have demonstrated, and we believe can continue to generate, attractive returns over time.

What have been the main contributor and detractor to performance over the past 12 months?

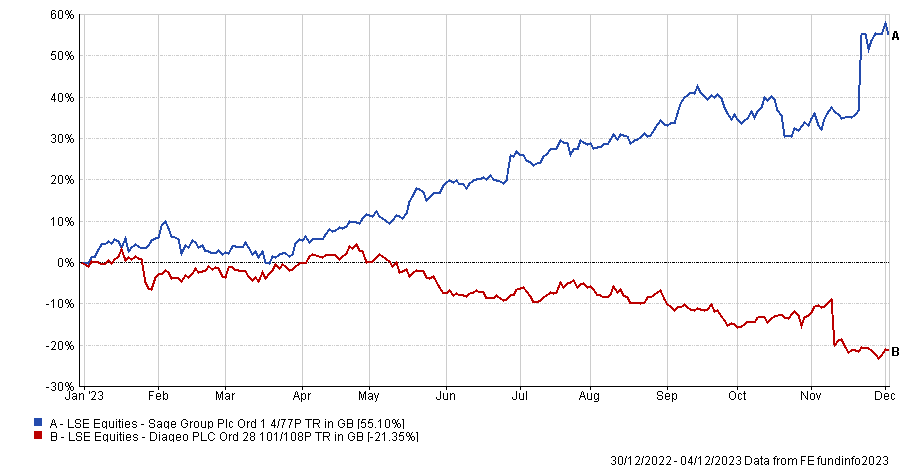

I would assume that the biggest contributor has been Sage, which is arguably the biggest pure technology company listed on the London Stock Market.

The shares are up over 50% in 2023. I think it has been a combination of the announcement of a share buyback and the reassuringly strong double-digit growth of this software company.

Performance of stocks YTD

Source: FE Analytics

The biggest detractor is Diageo. The share price year-to-date is down over 20%. I did not expect that, and I don't like it, but it's understandable in hindsight. Interest rates have stayed higher for longer in 2023, so there's been a slight trading down of consumers, because their purses are feeling a bit pinched. That's been an unhelpful backdrop for Diageo.

The other thing is that the company got its physical stock wrong in Latin America. Diageo has over supplied the Latin American market. As a result, there's a sharp contraction in new shipments to Latin America until that excess stock gets mopped up.

We have been adding to Diageo again after this recent fall in its share price. Let's hope that's the right thing to do, but I have to admit I didn't expect to have the opportunity to buy it again at a share price below £30.

Several UK companies have chosen to relist in the US (or are considering to), while others have been the targets of M&A activities. As a UK investor, is it a concern to you?

At an abstract level, yes. It is conceivable that all the businesses that we might aspire to invest in would no longer be listed on the London Stock Market. In that case, the mandate that we've been given would be impossible to execute on.

I guess if that happened, we would need to consult with the board of the investment trust and say: ‘look, we simply cannot deliver the effects that we're trying to capture, because these companies have been taken over or they're no longer listed in London’. But to date, we're still able to find the type of companies that we're looking for.

What do you do outside of fund management?

I both practice and teach yoga. It's the most wonderful practice and discipline: it makes you a better investor and a better human being.

If your readers take nothing else from what I've said today, it is that they should take up yoga. It's never too late to start and the best time to start is tomorrow.