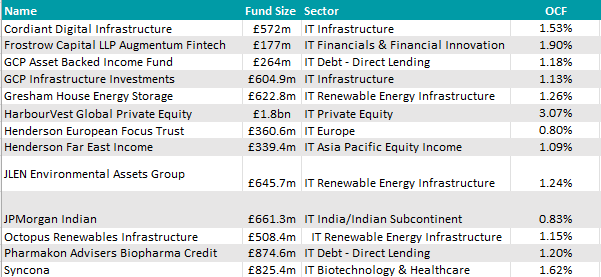

There are still opportunities for fans of investment trusts, despite a tough 2023, according to research company Peel Hunt.

The macro backdrop has improved for many sectors, causing rallies and narrowing discounts across private equity, real estate and renewables; but Anthony Leatham, Markuz Jaffe and Thomas Pocock also saw opportunities in more liquid areas.

Investors can get the most for their money in the alternatives space, which trades on the widest discounts around, but there are also opportunities among more liquid assets too. Below the analysts look at a range of trusts on big discounts, and pick out two that are poised to rebound.

Alternatives

In the renewables and infrastructure space Gresham House Energy Storage’s 26% discount to net asset value (NAV) takes the lead on the researchers’ dashboard.

“While there have been disappointments in terms of portfolio performance, maximising the revenue opportunity and a drop in dividend cover, the recent update from the manager Ben Guest did give us reasons for optimism that might suggest a turning point for the strategy going into 2024,” they said.

Other picks included JLEN Environmental Assets Group (18% discount) and Octopus Renewables Infrastructure (15% discount).

In infrastructure, GCP Infrastructure has the widest discount (37%, on the back of a failed merger), while core-plus strategies and digital specialists have sold off sharply in recent months, despite “very attractive” sector dynamics underpinned by “accelerated demand drivers” such as generative artificial intelligence (AI) and “the growing need for faster connectivity and data storage”. Here, Cordiant Digital Infrastructure (33% discount) and Digital 9 Infrastructure (72%) stood out.

Private equity is also undergoing a rebound and, whilst the direct strategies have seen a broad-based narrowing, Peel Hunt’s analysts continued to see value across the fund-of-funds, with HarbourVest Global Private Equity trading on 43% discount.

The underlying story also “remains intact” for Syncona, despite its discount widening to 31%, while Augmentum Fintech trades on “compelling valuations” (35% discount).

Traditional asset classes

Moving on to equities, following the announcement of manager changes, Henderson European Focus Trust and Henderson Far East Income have resulted in an 11% and 6% discount, respectively.

Other anomalies generated “renewed optimism” for Smithson (13% discount), the Mobius Investment Trust (9%), Polar Capital Global Healthcare (8%) and Impax Environmental Markets (10%).

In fixed income, the team saw “signs of life and pockets of value” and highlighted BioPharma Credit, which is suffering “under the prospect of a discount-triggered continuation vote later this month” but should profit s easy to miss the upside generated by continued takeovers in the healthcare sector

The best rebound opportunities

Finally, two trusts were highlighted for being ready to rebound in the next 12-18 months, with “a number of catalysts that could offer the potential for additional returns” from discount narrowing and provide some support for the rating.

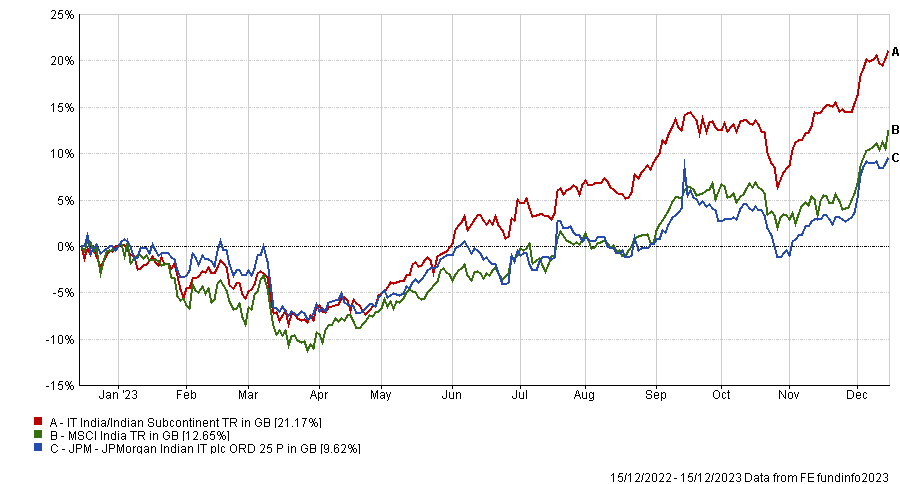

The first was the £650m JPMorgan Indian, whose long-term underperformance has led Ayaz Ebrahim to take over as fund manager following Rajendra Nair’s departure. But the catalyst for the turnaround will be a continuation vote to be held in 2024 and a performance-conditional tender offer scheduled for 2025.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“Ahead of the continuation vote we see a small possibility of the board proactively announcing a more robust solution to the current 18% discount,” the Peel Hunt team said.

“We also believe the tender offer could generate potentially attractive returns, given it should protect shareholders from further underperformance.”

Should the trust fail to outperform the index by more than 50 basis point through to the end of September 2025, shareholders can realise 25% of their holding at NAV less costs.

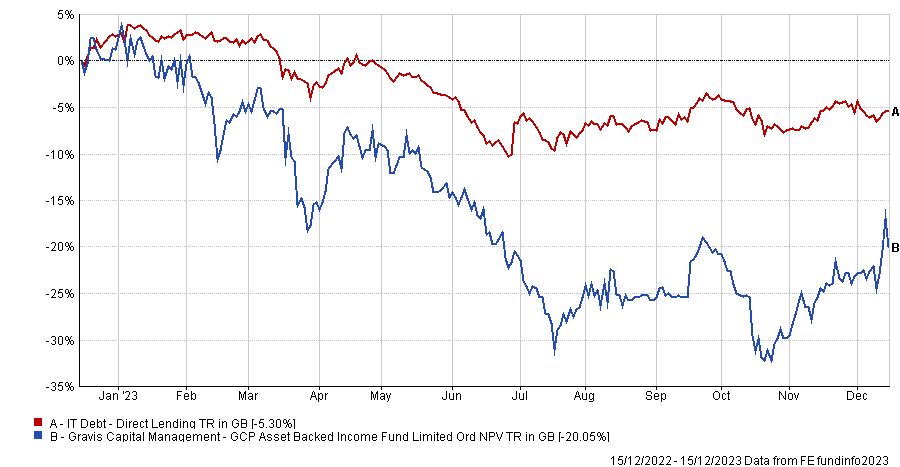

Completing the list, GCP Asset Backed Income introduced a continuation vote after undergoing a failed merger attempt with GCP Infrastructure and the withdrawal of an offer from a US-listed investment company.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“Although the offer was withdrawn, we are encouraged by the approach, which demonstrated third-party interest in the trust’s portfolio,” said Peel Hunt analysts.

“Given the failed M&A, we see an orderly wind-down as the most likely outcome, as it provides shareholders with a return of capital whilst also helping to preserve the value of the portfolio. With the trust trading on a 33% discount, we view any return of capital or complete wind-down as offering potentially attractive upside.”