Stock markets bounced back last year against all expectations after a grim 2022. Yet, this rebound mostly benefited a handful of US tech mega-caps.

In spite of this market’s narrowness, a number of funds still delivered good performance without necessarily being exposed to the ‘Magnificent seven’ (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla).

Below, Trustnet asks experts for their favourite funds of 2023.

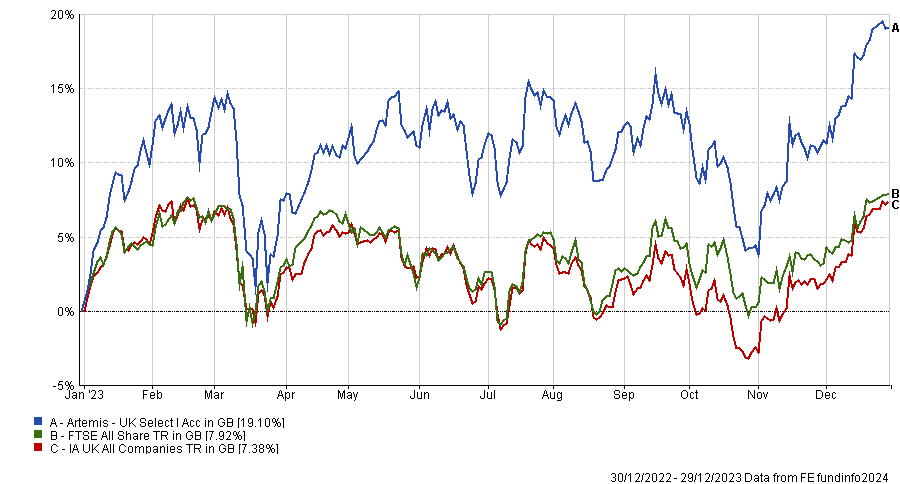

Artemis UK Select

Artemis UK Select is the fund that impressed James Burns, managing partner at Evelyn Partners, the most. This fund, run by FE fundinfo Alpha Manager Ed Legget and Ambrose Faulks, achieved a gain of 19.1% in 2023, outperforming both peers and benchmark by more than 10 percentage points.

Burns said: “The performance of the fund displays the managers’ ability to generate good returns despite the UK market continuing to be one of the least popular globally.”

Performance of fund in 2023 vs sector and benchmark

Source: FE Analytics

Legget and Faulks invest across the whole market-cap spectrum with a slight value bias. The fund also has overweights in the financials, consumer discretionary and industrial sectors.

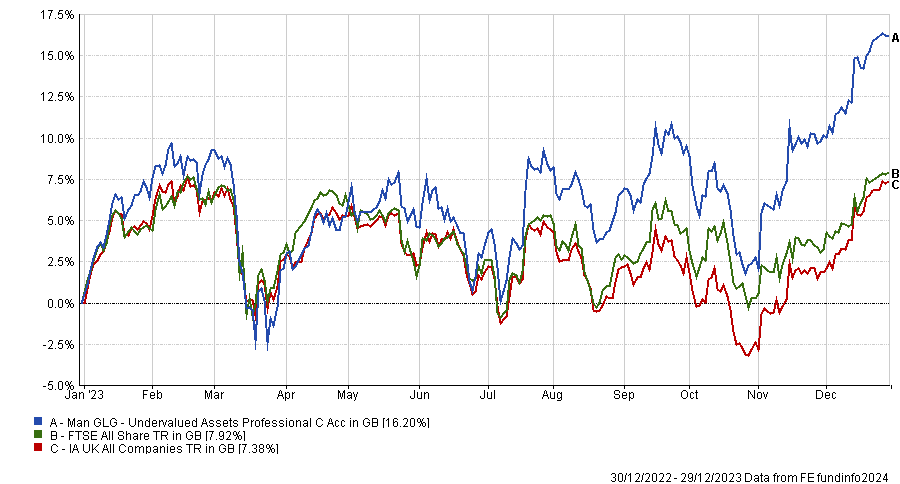

MAN GLG Undervalued Assets

John Monaghan, research director at Square Mile Investment Consulting and Research, also opted for a UK equity fund: MAN GLG Undervalued Assets.

He highlighted the fund’s “clear” and “delineated” investment approach focusing on uncovering out of favour opportunities among UK equities.

Lead manager Henry Dixon, supported by Jack Barrat and Erin Ennis, looks for companies that meet two key criteria. First, they must have their assets undervalued by the market, but have to be cash generative with strong balance sheets. Second, the firms must be trading below the team’s estimation of their intrinsic values as dictated by their returns on invested capital.

The resulting portfolio typically comprises between 60 and 100 stocks with individual position sizes determined by liquidity, upside potential and volatility.

Performance of fund in 2023 vs sector and benchmark

Source: FE Analytics

Monaghan added: “The team’s contrarian approach often leads them to invest in medium and smaller sized companies, meaning the fund may look and act very differently to peers and its FTSE All Share benchmark.

“This can lead to impressive periods of outperformance, but it may also lag when this investment style is out of favour, such as in markets led by growth stocks.

“Overall, this is a differentiated strategy and one which is a good complement to other UK equity funds, worth considering by more benchmark agnostic and long-term investors.”

Amundi Pioneer US Fundamental Growth

Jasper Thornton-Boelman, investment director at Parmenion, was pleased with the performance of the Amundi Pioneer US Fundamental Growth fund.

The fund, managed by David Chamberlain, Yves Raymond and Andrew Acheson, underperformed its benchmark, the Russell 1000 Growth index, but beat S&P 500, the main US index.

Thornton-Boelman said: “In a year where the US market has been somewhat polarised, with the ‘Magnificent Seven’ leading the way and the rest of the index collectively flat (in sterling) until very recently, the strong performance owes much to the stock picking ability of the team and their disciplined process.

“With the team based in the US and the lead manager moving back to the UK in 2022, we had some reservations around the ongoing management practicalities, but pleasingly decided to stick with the fund. Having now held the fund for over nine years, it’s a good story in long-term decision making.”

Performance of fund in 2023 vs sector and indices

Source: FE Analytics

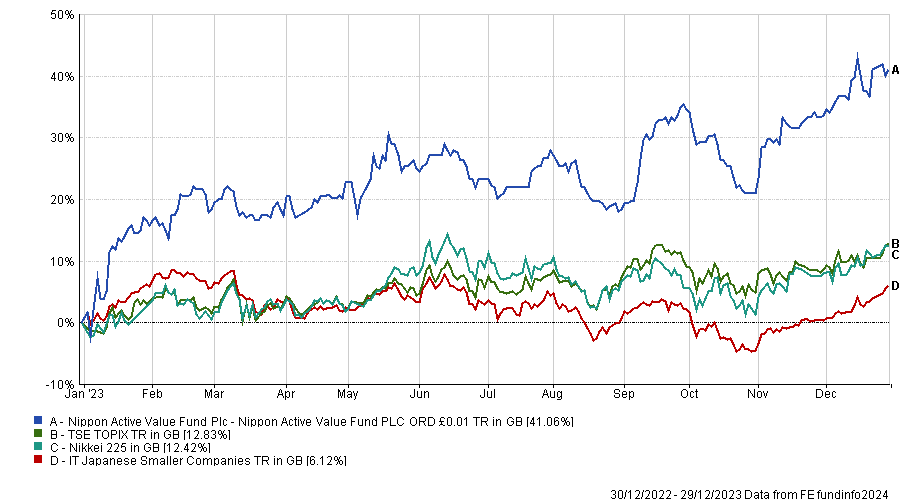

Nippon Active Value

Mick Gilligan, head of managed portfolio services at Killik & Co, highlighted the Nippon Active Value Fund, which takes sizeable stakes in small undervalued Japanese companies and then instigates dialogue with management teams to improve capital allocation and ultimately share price ratings.

It outperformed the main Japanese indices and was one of the best performing investment trusts in 2023.

Gilligan explained: “The trust has seen several bids for its holdings this year. Intage (market research) is a perfect example. It first declared a stake in Intage back in late 2020. The trust argued that Intage’s acquisitive business strategy made it more suited to being a private company, rather than listed.

“In September 2023, NTT Docomo launched a tender offer for 51% of Intage. The bid price was at more than a 100% premium to the price that the trust first invested. So hats off to the managers for a very profitable year.”

Performance of trust in 2023 vs sector and indices

Source: FE Analytics

In addition, the trust absorbed its competitors abrdn Japan and Atlantis Japan last year, bringing its market capitalisation to £306m.

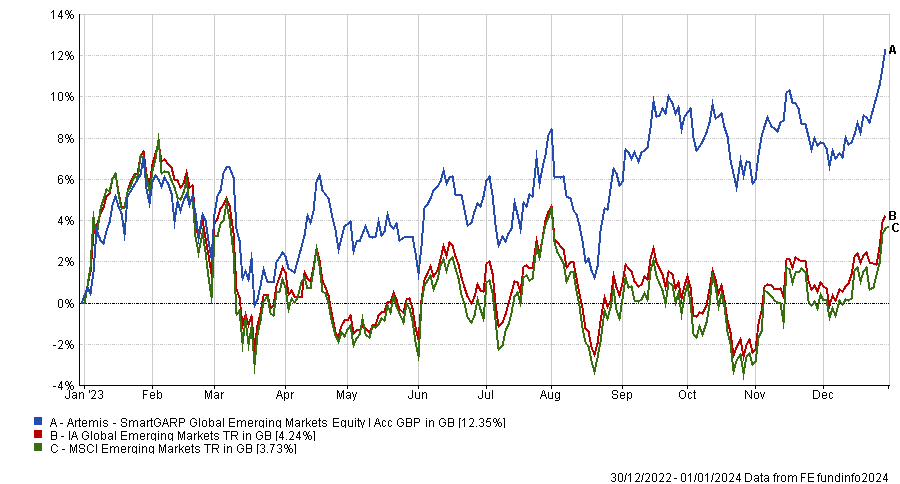

Artemis SmartGARP Global Emerging Markets

Emerging markets did not shine last year, but Artemis SmartGARP Global Emerging Markets has done significantly better than the index.

Managers Raheel Altaf and Peter Saacke use the Artemis SmartGARP (growth at a reasonable price) proprietary tool for stock selection. The outcome of this process is a value style of investment, which has outperformed growth in 2023 in emerging markets.

Sam Buckingham, Investment Manager on abrdn’s MPS team, said: “Whilst the fund has benefitted from this factor exposure, it has also generated meaningful outperformance when compared to a comparable value benchmark.

“We have also liked the fund’s uncorrelated nature to our other emerging market equity funds, which is more growth oriented. Hence, the fund has contributed to portfolios from both diversification and return perspectives.”

Performance of fund in 2023 vs sector and benchmark

Source: FE Analytics

CIM Dividend Income Fund

It was a tough year for Asian equities as well, as they have been impacted by the turmoil in China, which accounts for 27.5% of the MSCI AC Asia Pacific ex Japan index.

In spite of the expectations in early 2023, Chinese equities tanked after the Covid-reopening rebound failed to materialise and the downturn in the country’s property market worsened.

Nonetheless, CIM Dividend Income Fund was able to navigate through those headwinds, despite a significant exposure to China via the H-Share (Hong Kong-listed) market.

Tom Delic, portfolio manager at MGIM, said: “CIM’s value and income approach has proven that a value investing style can often offer downside protection when equity markets become frothy, as was the case across certain countries and sectors in Asia.

“Since the market peaked in February 2021, the fund has returned over 10%, while the index is down 24%.”

Performance of fund in 2023 vs sector and benchmark

Source: FE Analytics

Polar Capital Global Insurance

Finally, Gavin Haynes, co-founder of Fairview Investing, found that Polar Capital Global Insurance was a sensible option for investors preferring predictability over excitement.

He said: “The focus on non-life insurance provides exposure to a largely non-discretionary area of consumer spending, meaning demand is not driven by the economic cycle and it can prove a defensive area of equity markets.

“The fund has been running 25 years and the team at Polar Capital are highly experienced in the specialist sector, which gives them an edge.”

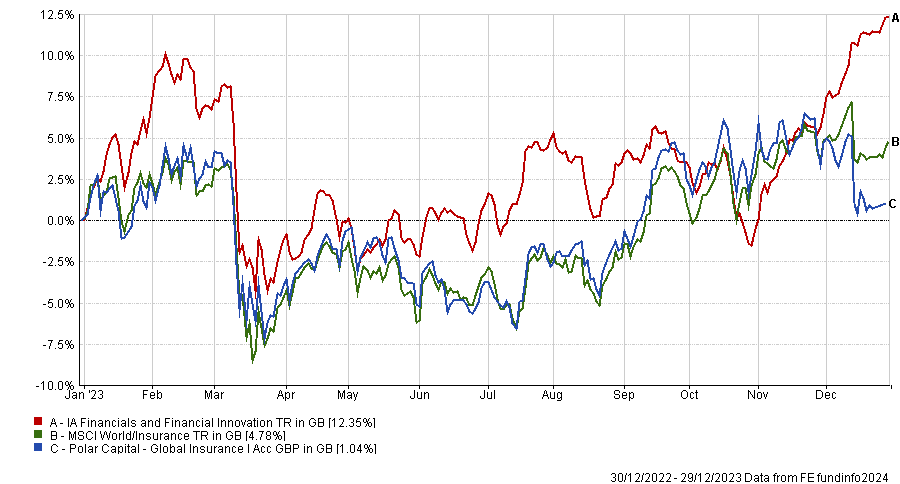

Performance of fund in 2023 vs sector and benchmark

Source: FE Analytics

The portfolio is made of approximately 30 to 35 stocks across a broad range of insurance areas with a focus on quality businesses and a preference for owner managed businesses.