Japanese equities had a good run in 2023, as the Tokyo Stock Exchange’s corporate reforms gained more attention from investors.

While it was mostly large-caps that rallied last year, small-cap specialist and activist investor Nippon Active Value Fund outshone its peers across the IT Japan and IT Japanese Smaller Companies sectors placing it among the 10 best performing investment trusts of 2023.

Nippon Active Value Fund also acquired both Atlantis Japan Growth Fund and abrdn Japan Investment Trust last year, enabling it to grow its assets under management to £307.4m.

Below, Paul ffolkes Davis, chairman of Nippon Active Value Fund’s investment advisor Rising Sun Management, explains the investment strategy, discusses last year’s acquisitions and tells why you do not need to buy stellar businesses to make money in Japan.

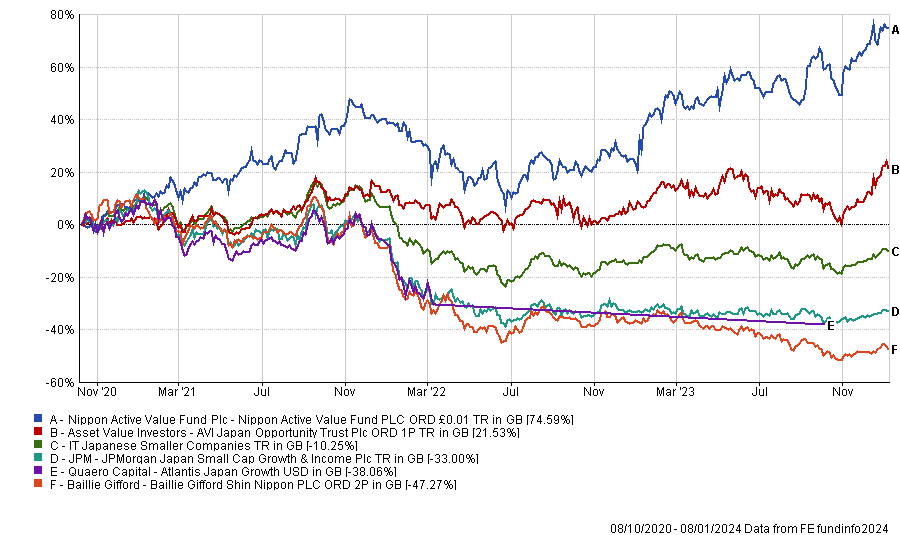

Performance of trust since launch vs sector and sector peers

Source: FE Analytics

What is your investment strategy?

When we launched the trust, we wanted to go after companies that have a weak share register, aren't followed by third party analysts and have a decent business. It doesn't have to be stellar, but it has to be good because we want to invest in companies that we think can do better.

Our holding companies tend to have poor allocation of capital issues: they make bad acquisitions, they don't spend their money or they don't increase their dividends. Some of them are listed on the prime section when it's not obvious that they should be listed at all.

One additional criteria is that we want a high margin of safety. It means that we want companies that won’t go bust even if we haven’t had time yet to engage with them.

What have been the main contributor to performance since the launch of the fund?

The top performer over the life of the fund has been Mitsuboshi Belting, which is a smallish manufacturer of rubber timing belts and also make conveyors for car engines.

We said we would send four proposals to the annual general meeting (AGM): we thought it should increase the dividend, do a share buyback, award the management with restricted stocks because they had no financial interest in the company and make the board more diverse by adding women and experts.

Japanese companies hate it when people send suggestions to their AGM. Their invariable response is to formally say no to everything, because they do not want to be seen as being influenced by their shareholders.

When we went to see the management team, they said they had been thinking about our proposals. They had worked out that they have so much money on the balance sheet that they could actually increase their payout to 100% of earnings for the next three years and could do a 10% buyback. They also instituted a restricted stock programme and added people to the board. They then asked us whether we would withdraw our proposals if they comply, which we accepted. They did all those things and the stock rallied immediately 85% that week.

They've kept on doing the right things, but they've run out of things that they can do now. We have come to the conclusion that the company is probably fully valued now, so we don't need to hold as much of it. Over the holding period, we’ve made 151.1%.

What has been the main detractor?

Over the fund's lifetime, Seven & I (the owner of the Seven11 stores) is the only stock still in the portfolio currently showing a loss. It is down 0.1%.

Atlantis Japan Growth Fund and abrdn Japan Investment Trust were rolled into Nippon Active Value Fund in 2023. What does it mean for the trust? And are there other mergers in the pipeline?

The only thing that we have retained is a member of each of their boards on our board. We've disposed of their assets and reinvested in our names.

What I think is interesting about those two acquisitions is that neither was in any way an activist fund. It took quite some imagination on the part of both boards to think the Nippon Active Value Fund would be a good place to put their shareholders’ money in.

Will there be more acquisitions? I would love to, but it's going to be hard, because the remaining trusts in our sector are not having a very bad time. Both abrdn Japan Investment Trust and Atlantis Japan Growth Fund were in trouble, because they were facing continuation votes, which they were expecting to lose. If we find somebody in a similar position, we would be up for at least bidding for.

Japanese equities had a good run in 2023. Are the corporate reforms finally kicking in or is it a new false dawn?

One of my partners is always circumspect on this. He says that change happens very slowly in Japan. It does, but the pace of change is accelerating and the effect of these corporate reforms is going to continue to drive it.

The undervaluation of Japanese large-cap stocks has started to unwind in 2023. They're not expensive, but they're becoming more reasonably valued. They're less out of line than they were at the beginning of the year with international standards.

On the other hand, small- and mid-caps are still very cheap. They're also improving, because, increasingly, we and other activists are going after the stocks that are clearly wrongly valued. Over time, that will have the effect of bringing that market up as well.

Are there other markets where you think your strategy could also work?

We are actually thinking about where else we could do this. We have been looking at other markets that you would consider as perhaps less sophisticated, but funnily enough, most of them are not cheap.

India is an obvious market that you can see expanding a great deal over the next few years. There are going to be a lot of opportunities, but when you look at the valuations, they're actually in line with the US. People who buy the right stocks in India will make a lot of money, but in Japan, you can buy the wrong stocks and still make a lot of money.

We are looking at other places like Vietnam, but it has been thoroughly invested in for decades and it's not cheap either.

The wonderful thing about Japan is that it's one of the most mature, sophisticated and deepest stock markets in the world, yet it is enormously cheap. There isn’t another one like it.

What do you do outside of fund management?

I have a slightly complicated life. I move about between Italy, the UK and the Caribbean constantly. The greatest constant is music. I listen to classical music.