Marks & Spencer Group (M&S) was one of the strongest names in the FTSE 100 last year, alongside Rolls-Royce and 3i Group. M&S returned an eye-popping 121.8% in 2023 versus just 7.9% for the FTSE 100.

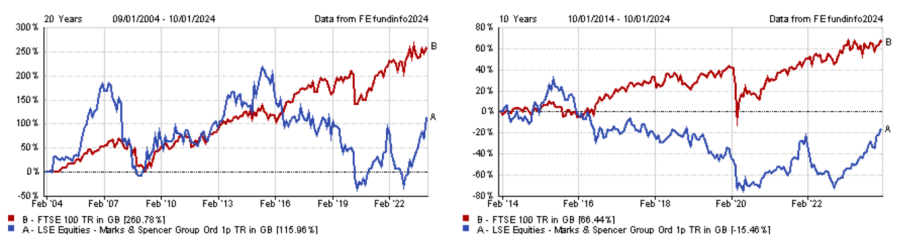

This outperformance may come as a surprise, as the company’s shares have done poorly over the longer term, lagging the FTSE 100 by 145 percentage points over 20 years and losing 15.5% of their value over the past decade.

James Henderson, portfolio manager of the Henderson Opportunities Trust, explained that the company became “complacent” after its early successes in the 1960s and 1970s and failed to keep up with the times and fast-moving competitors.

He added: “This legacy also meant that new management found it difficult to enact change because there was a reluctance to overhaul systems and processes that had worked so well historically.

“It made basic retailing mistakes during this period, losing momentum in terms of moving the brand forward and failing to adapt to changing consumer demands.”

Ian Lance, co-fund manager of Temple Bar Investment Trust, mentioned several strategic errors made by past management, such as over-diversification, wrong locations and neglecting the online business.

Performance of stock in 2023 vs FTSE 100

Source: FE Analytics

However, M&S has been trying to turn the tide and the strategy came to fruition last year. It closed down many underperforming stores, improved its merchandise offering, streamlined product ranges and worked on building the brand. The deal with Ocado also helped to ameliorate M&S’s online business.

Henderson said: “Like many high-street retailers, the pandemic forced M&S to reflect on their offering and consider the longevity of its brand. It moved faster and more effectively during this period than many observers, like myself, expected.”

The macroeconomic environment also helped the stock’s outperformance, as the UK avoided a much anticipated recession. In early 2023, the market expected that the cost-of-living crisis, and the fact wages were not keeping up with inflation, would severely impact consumers and lead retailers to suffer as a result.

Henderson added: “By the end of the year, however, the UK had not gone into recession and there was real wage growth, which meant consumer sentiment, and therefore company performance, were stronger than anticipated.”

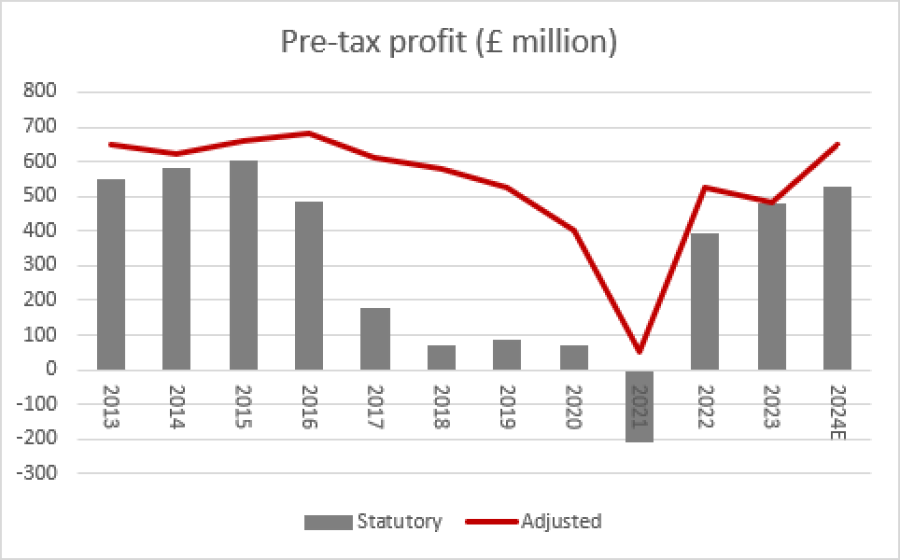

Source: AJ Bell, Company accounts, Marketscreener, analysts' consensus forecasts. Fiscal year to March.

What’s next?

While the turnaround strategy seems to be paying off, the question is now whether M&S’ shares can continue their way upward or whether 2023 was a one-hit wonder.

Performance of stock over 20yrs and 10yrs vs FTSE 100

Source: FE Analytics

For Lance, M&S is just at the start of a recovery as the business is gaining operational momentum.

He said: “It is still one of the most respected UK brands according to some surveys and has now an outstanding management team. The Ocado joint venture is struggling but actions have been taken to improve profitability.”

Henderson also believes that M&S’s prospects are good and continues to hold the stock in his portfolio.

He believes the current macroeconomic environment will remain supportive, as wages are continuing to grow in real terms in the UK, while there are signs that the cost-of-living crisis may be slowing down.

He said: “The next move in interest rates is likely to be downwards and mortgage rates are coming down too. We continue to watch these indicators closely but the evidence suggests that the environment for consumers is slowly improving.”

Henderson also thinks the current share price is reasonable. He explained that M&S’ market capitalisation is half that of its competitor Next, while having a higher sales volume. Therefore, he sees potential for M&S to get a better return on those sales at some point.

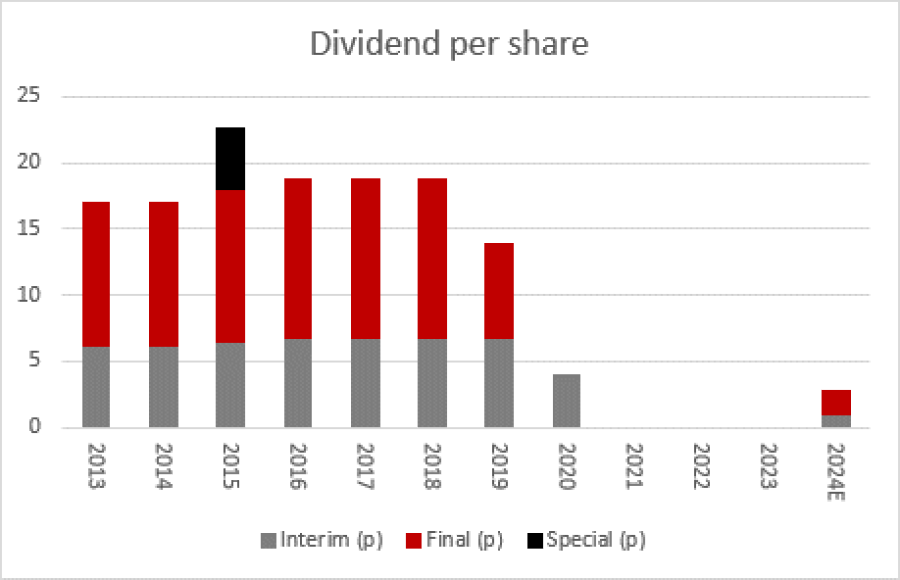

Source: AJ Bell, Company accounts, Marketscreener, analysts' consensus forecasts. Fiscal year to March.

However, FE fundinfo Alpha Manager Alex Wright, portfolio manager of Fidelity Special Values, feels that the stock’s next move is more likely to be downward and sold his holding towards the end of 2023.

He explained: “After such a strong run, we felt the risk/return was more skewed to the downside given a wide range of scenarios in a recession, with the outlook for discretionary spending deteriorating as reflected in commentary from the likes of Next and Boohoo. As a result, it made sense to take profits in strong performers like M&S.”

For the first time since 2020, M&S paid an interim dividend of 1p per share on 12 January 2024. AJ Bell expects that further comments on dividends will be left to the full-year results in May.