Passive global equity funds have been more adept at consistently beating their benchmarks than active funds during the past decade.

Trustnet has analysed the performance of funds in the IA Global sector and reveals that in the past 10 years, the strategies that beat the most common benchmark – the MSCI World index – more consistently are, perhaps surprisingly, trackers. Passive funds pulled ahead by a few percentage points every year, consistently delivering for their investors.

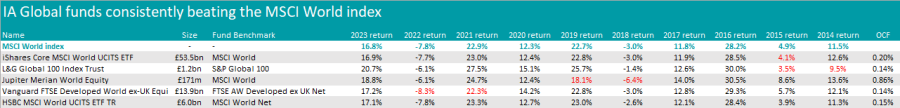

A mere five funds managed to outperform the MSCI World index in eight or more years from the past 10.

Of those, only one is actively managed: Amadeo Alentorn’s Jupiter Merian World Equity fund – although this is unsual as it holds more than 300 stocks. The managers use a systematic approach, tilting the portfolio around themes such as growth, value and momentum, shifting when they believe different parts of the market are going to be in vogue.

As such, they do not make big bets on individual companies, instead aiming to beat the benchmark each year by smaller margins by making these tactical decisions.

Jupiter Merian World Equity has performed strongly for similar reasons to the passive funds in the list. Recently, the portfolio benefited from having all the so-called ‘Magnificent Seven’ stocks among its top 10 holdings – with the other three being Visa, Novo Nordisk and Adobe.

The most consistent performer of the past decade was a passive giant, iShares Core MSCI World UCITS ETF. It beat the bogie in nine years out of 10 (2015 was the outlier).

This £53.5bn behemoth has done slightly better than the index it is trying to replicate almost every year – and has done so whilst charging only 0.2%.

The vehicle is on the radar of FE Investments’ analysts, who like “the focus on transparency and efficiency across iShares’ index funds and ETFs” as well the investment process.

“To supplement fund returns and compensate for the trading costs involved with direct ownership of the securities, the fund manager engages in stock lending. This is a common process in long-term investing, where a select third party borrows a limited amount of the passive fund’s holdings in exchange for a fee,” they explained.

“As a security measure the borrower will place a collateral deposit with an independent intermediary, which is generally of similar or higher-quality. When reinvested, profits from stock lending reduce the effect of management fees, further minimising overall tracking difference to the index.”

Moving down the list to the funds that outperformed the MSCI World index eight years out of 10, L&G Global 100 Index Trust and HSBC MSCI World UCITS ETF were unlucky in 2014 and 2015 – the only two years when they didn’t exceed the most common benchmark for their sector.

L&G’s strategy stands out because it does not lend securities in retail-facing products in order to minimise exposure to additional risks. It also keeps costs down at just 0.14%.

The Vanguard FTSE Developed World ex-UK Equity Index fund does engage in securities lending (although it typically won’t lend more than three percent of its portfolio) and it too convinced the FE Investments team.

“Its structure facilitates Vanguard’s heavy cost-cutting approach, which is ultimately a great benefit to the end investor,” the analysts said.

“The firm applied a new pricing model at the end of 2017 for their index funds, which works by adjusting the price for all investments on a given day up or down according to the inflows or outflows in and out of the fund.”

One explanation for why active managers have struggled to consistently beat the MSCI World is its concentration, with the US market making up the largest chunk. Here, trying to deviate from the index can penalise active managers, because the best performance has come from the 'Magnificent Seven' biggest stocks, without which US growth would look anaemic.